Back

Indian Institutes of Accounting - a threat to the CA Profession? Reading in between the lines

A lot of dust has been kicked up over the last few days and several students have reached out to me and Suraj Lakhotia, worried, if Indian Institutes of Accounting (IIAs) will be established soon and if the CA qualification, which they are currently pursuing, will lose its sheen. Students and young professionals have several concerns on how they will be impacted with the possible end of Monopoly of ICAI, reservations in IIAs, how will the 3-year articleship (internship) a key feature of CA course be accommodated for someone graduating from IIA, etc. Unfortunately, the issue of IIA has caught popular social media attention, but the reality of the issue at hand is far more nuanced and as usual, the devil lies in details - Do read till the end on why I think that is the case.

Let us understand the exact nature of what is happening and what all this hue & cry is about. The Lok Sabha Secretariat has released a document pertaining to the Standing Committee on Finance. The said committee constituted under the chairmanship of Shri Jayant Sinha, MP has proposed certain amendments to the Institute of Chartered Accountants of India (ICAI), the Institute of Company Secretaries of India (ICSI) & the Institute of Cost Accountants of India (ICoAI) Acts and has also made certain observations on the accounting profession in India. The committee has several MPs from Lok Sabha and the Rajya Sabha and is assisted by the MCA as well as Mr. R Narayanaswamy, retired professor of Finance & Accounting at IIM Bangalore

I am not sure if a lot of the commentary by Chartered Accountants, students, and others on social media is based on a reading of the actual document of the Finance Committee or a general reading of the press articles. So, I am sharing herewith a link to the said document. Budget a good one hour if you intend to go through all of its 121 pages. The document consists of 3 parts.

1. Actual report of the committee

2. Minutes of the meeting of the committee &

3. Proposed amendments to various acts.

The report of the committee (Part 1 mentioned above) is from pages 6 to 34 of the PDF file, and it deals with issues concerning the 3 professional bodies over aspects given below. It is pertinent to note that ICSI and ICoAI are ok with several amendments and comments of the Committee – The ICAI has objected to every single suggestion of the committee. The report is professionally researched and has compared several aspects of the functioning of accounting bodies across the world, including the US, UK, Australia, South Africa, and several others with those in India.

Contents of the report (Part 1 mentioned above)

A. Re-organization of the Co-ordination Committee of all 3 institutes through Statute in order to improve its functional effectiveness– ICAI wants status quo and fears loss of autonomy. But the MCA and the committee felt that better coordination is the need of the hour and have suggested several changes through statute to make this committee an effective functional body. The changes so suggested are a part of the amendment bill (Part 3 referred above).

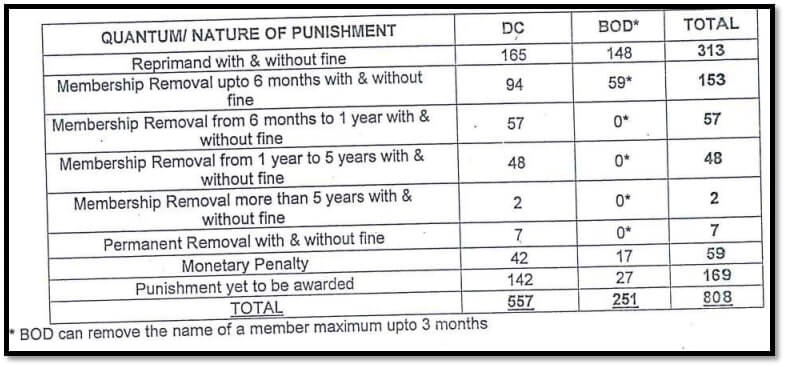

B. Composition of Board of Discipline and Disciplinary committee of ICAI (please note the focus of the report and the Lok Sabha Committee here is only on ICAI and not on ICSI or ICoAI). Ministry of Corporate Affairs (MCA) has suggested several changes to the constitution of the Disciplinary Committee, its independence from the council, ICAI’s poor history thus far, an urgent need to dispose of cases quickly, and the impact of scams and frauds in large corporates (not red-flagged by Auditors on a timely basis) on the Indian economy. This clearly is a self-created problem by the ICAI – its inaction on erring members over decades, the all-out effort it takes to protect its existence, protect its members, over what is right for all stakeholders, has led to this day. ICAI’s constant chest-thumping about it being a partner in nation-building rings hollow when several major frauds in the country (especially in this government's pet project - GST) over the last few years have a connection with someone who has a CA background, either as a perpetrator or an accomplice or an auditor – Just like so many aspects in life, it is the errant few who make life unfair and difficult for the honest many - It is a telling comment on the sorry situation.

ICAI has provided to the committee an extract of disciplinary action by the ICAI over 15 years from Dec 2007 to Dec 2022:

Table 1

ICAI has two levels of Disciplinary process, the Board of Discipline (BoD) & the Disciplinary Committee (DC).

The MCA and Parliamentary standing committee on finance's focus are on removing the conflict of interest inherent in ICAI's current disciplinary process and making the process more timebound and assigning more independent (non-CA) members as part of the disciplinary process. The changes suggested by them are a part of the amendment bill

C. Role of President & Secretary – bifurcation of roles like those of chairman and CEO in a corporate – This is a welcome move and is in line with international practices. Also, there is a proposal to increase the term of council members to 4 years from 3 years and no re-election after 2 terms (this was 3 terms earlier) - This proposal is part of the amendment bill. This is a good step, but I wonder why such rules cannot be framed for our beloved MPs & MLAs!!

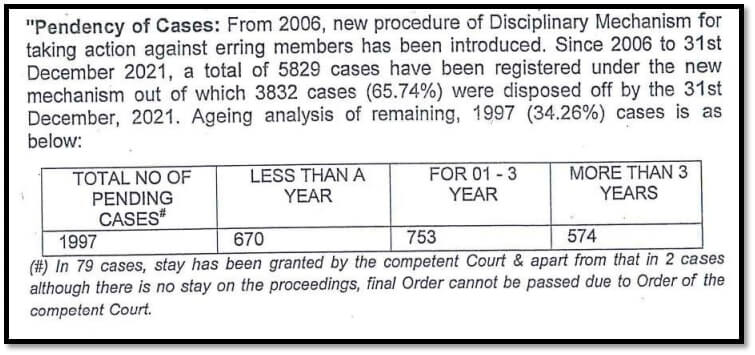

D. Timelines for disciplinary action: Statutory emphasis on resolving all cases within 365 days from the date of the complaint, compared to no timeline as per the existing process. The data submitted by the ICAI is given below in Table 2. 574 disciplinary cases are pending for over 3 years out of a total of 5829 cases.

Table 2

A reconciliation of Tables 1 & 2 is warranted, or a better explanation is required as one table talks of overall and pending cases and the other talks of actions taken

The committee has proposed several clauses in the amendment bill which incorporate their point of view.

E. Liability of misconduct by a partner in a CA firm to impact the entire firm – this amendment is framed following several frauds, scams, shell companies that have been unearthed over the last few years. ICAI has rightly raised the issue of the impact of debarring such firms on Article clerks, paid assistants, etc. But the committee felt that provisions will apply only when a partner commits multiple offenses. This proposal is part of the amendment bill.

F. The one aspect that has got most of the students upset – Increasing competition – comparison with international institutes and establishment of IIAs. Fairly elaborate processes and procedures have been outlined for the establishment of IIAs. IIAs if and when established, will offer a Certified Professional Accountant (CPA) degree and compete with the ICAI. CPAs would obviously have a right to practice and sign the audit reports.

Please note that as of now, no new statute has been proposed through which these IIAs will be established. It appears that several of these suggestions on IIAs, comparison of the ICAIs practices with international practices were made by Professor R. Narayanaswamy as the independent witness.

The committee has unequivocally stated that ICAI is a Statutory monopoly that operates on its own terms as per its own whims and fancies and hence needs competition to perform better.

However, please do note that the committee has only made a recommendation to the GOI to establish IIAs. If these IIAs are eventually formed, it will be a serious blow to the ICAI. I do not think that the government will immediately embark on establishing IIAs. It appears to be more of a veiled threat and an arm-twisting tactic to get ICAI to fall in line w.r.t separation of duties, elimination of conflict of interest, better disciplinary action on errant members, etc., NFRA too came into existence for very similar reasons - this time, ICAI should not be myopic but rather change the way it functions to meet the genuine stakeholder demands of the day.

One should note that the creation of a parallel professional body with infrastructure and market acceptance is easier said than done. The GOI has several other priorities and building IIAs may not necessarily be the topmost priority for them now. However, if push comes to shove, I think they will go ahead and end ICAI’s monopoly.

From a student & a young professional's perspective, do note that, if and when IIAs are launched, the value of a professional (CA / CS / CMA) degree will not decrease overnight. Consider today's realities :

- Most CAs (about 80%) opt for a job (instead of practice) where one is already competing with MBAs in Finance and Other International Accounting Courses.

- All IIMs & IITs are not the same and in the same way if and when IIAs do come up, it will take a long while for them to come up to the standard of ICAI w.r.t the course syllabi, student acceptance, employer acceptance, etc.

- A wide range of job opportunities exists for CAs - largely dependent on skills and not necessarily the qualification - point in case being several organizations including Big 4s now hiring Non-CA candidates ( ACCA, CPA, CMA, etc) based on their skills rather than qualifications alone - will be covering this aspect in greater depth in upcoming articles/posts.

Shedding more light on what was stated in the report w.r.t competition – the report has made a comparison of ICAI with CPA- US. In the US, each state issues its own licenses. AICPA (the governing body of CPA), as rightly pointed out in the committee report is a seminar conducting organization :) and a broad syllabus defining body. Exams are conducted by the National Association of State Boards of Accountancy (NASBA) – Examination, licensing, disciplinary oversight, all three are conducted by different agencies in the US. Similar is the case with ACCA in the UK, and accounting bodies in South Africa and Australia. While examination and disciplinary oversight can and should be separated from the ICAI, state-wise licensing is not feasible in India especially due to a lack of regulatory, legislative, and management capability as well as bandwidth with states to establish and supervise such bodies. Secondly, the current dispensation is a fan of centralization and standardization – no way will they devolve such powers to states.

G. Acts of Commission also now fall under the definition of professional misconduct – prior to this amendment, only acts of omission were included in professional misconduct under Section 22 of the ICAI act.

H. Change in the nomenclature of cost and works accountants to Cost Accountants. ICoAI wanted their name to be changed to Cost and Management Accountants – MCA is evaluating if such a change can be made – However the amendment bill only has the name change to Cost Accountants.

Conclusion:

The GOI can and will do what it considers appropriate, despite all opposition - we have seen this in the past as well. PM Modi had publicly admonished ICAI on its poor track record of disciplining and penalizing its errant members, in his public address on July 1, 2017 (CA Day) on the occasion of the launch of GST – the public rebuke should have given enough indication to the ICAI to mend its ways. Close to 5 years from that day, no major changes have been made by ICAI and if they have been made, they are not yet are visible to an outsider. The amendment bill still needs to be debated and passed in the parliament. ICAI will use its network and lobby for changes to the bill - but going by the tone and tenor of the Standing Committee Report, the GOI appears to be keen on bringing about a change in the way things are being run. The proposed changes are for the good of all the stakeholders and it is time for ICAI to embrace the change, else it runs the risk of becoming irrelevant. It is anybody’s guess how things will play out in the coming few weeks/months.

(The Author cleared his CA Final exams in 2003 but has never been a member of the ICAI. The Author is a CFA (USA) charter holder, a graduate of ISB Hyderabad, and is the Co-Founder & CEO of IndigoLearn.com an Ed-tech Startup focussed on Accounting and Finance Education (CA / CMA / CS / CFA / ACCA, etc) in India and abroad)

Share

Course Guides

Popular Courses

CA Foundation

CA Inter

CA Final

Upskilling

CMA Inter

News & Updates

Launching CA Courses for Sep'24 & Jan'25

27-Mar-24 16:34

Time to Shine! Mark April 5th on your calendars! We are going Live and answering all your questions!

27-Mar-24 14:57

Correction Window - ICAI May-24 Examination

24-Mar-24 17:51

Openings (BLR & KOL) for Undergrads, Semi Qualified Professionals & CPAs

22-Mar-24 10:00

Revised Schdeule of ICAI May 2024 Exams

19-Mar-24 18:39

Cash & iCash awards for Nov / Dec-23 Students

09-Mar-24 17:18

CA Final & Inter Subscription Courses Live 🥰🥰

07-Mar-24 17:07

Launch: CA Final Paper 6 - Integrated Business Solutions Classes! Yay! 🤩🙈

02-Mar-24 11:38

Can't Miss this Session! IBS Live Class ll | 27th Feb@7PM

26-Feb-24 17:41

May-24 Exams - Important Points to Keep in Mind

22-Feb-24 14:30

More