Forums

AS 10 PPE

Accountancy

Please provide solutions for following question.

Answers (3)

Best Answer

Thread Starter

Hiren GhadiyaIn the solution, 5 crores Depreciated in 5 years that is okay, but why they deduct it from Cost of ship 20 crores. That is my question.

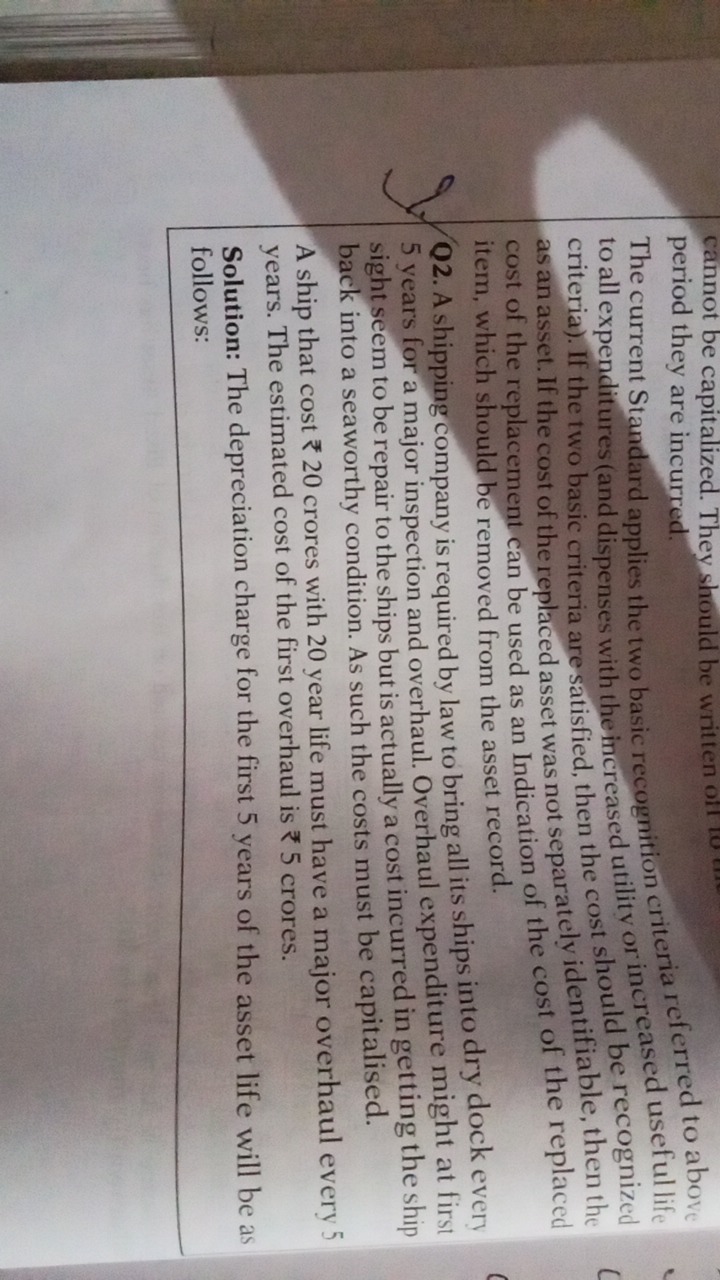

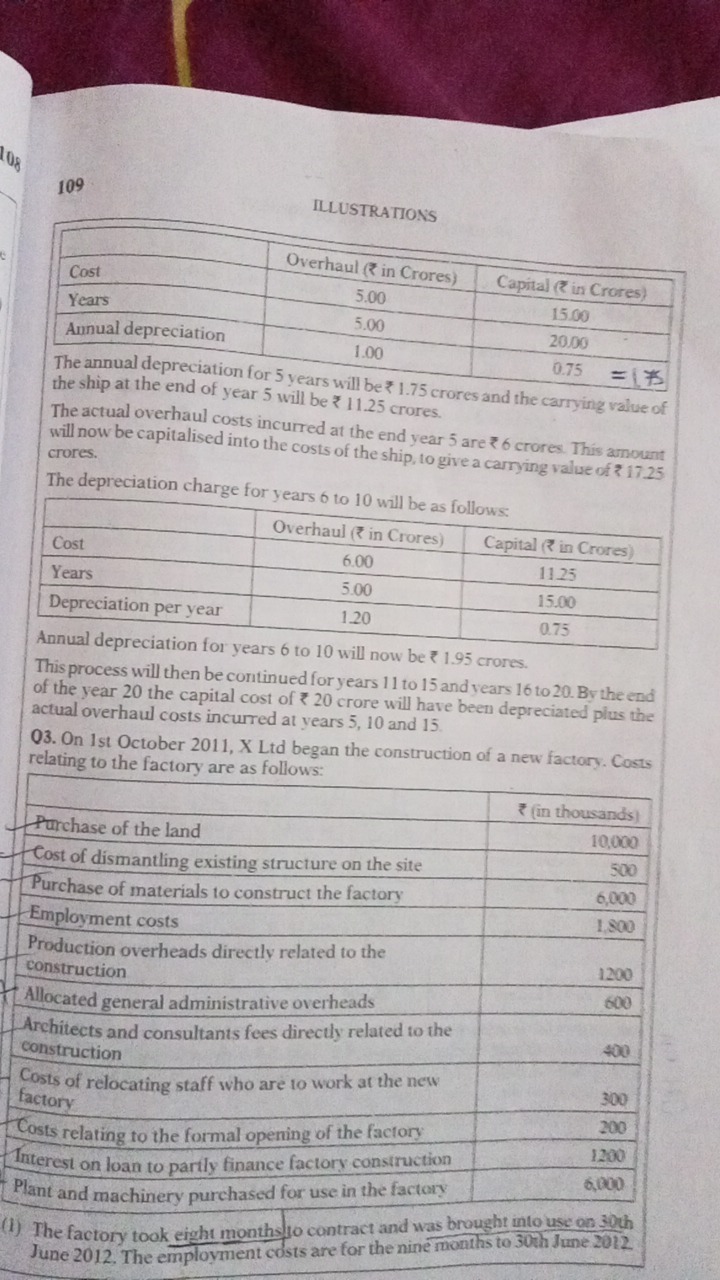

The cost is seggregated into two parts. Equipment & Overhaul (15 crores & 5 Crores) A new ship does not need overhaul so notionally 5 crores of the cost is attributed to that overhaul. Equipment - 20 years useful life Overhaul - 5 years useful life.

Overhaul expenditure should be recognise as this expenditure would be leads to future economic benefits thus to comply with the provision of accounting standard 10 should be recognise and depreciation provides on the remaining estimated life of value of the(although this is a new type of question which I would ever seen if you get the solution please share with me also, I would answered on the basis logical point of view of mine)

Sima Shaw

Overhaul expenditure should be recognise as this expenditure would be leads to future economic benefits thus to comply with the provision of accounting standard 10 should be recognise and depreciation provides on the remaining estimated life of value of the(although this is a new type of question which I would ever seen if you get the solution please share with me also, I would answered on the basis logical point of view of mine)

In the solution, 5 crores Depreciated in 5 years that is okay, but why they deduct it from Cost of ship 20 crores. That is my question.