Forums

AS 25 Interim Financial Reporting

Accountancy

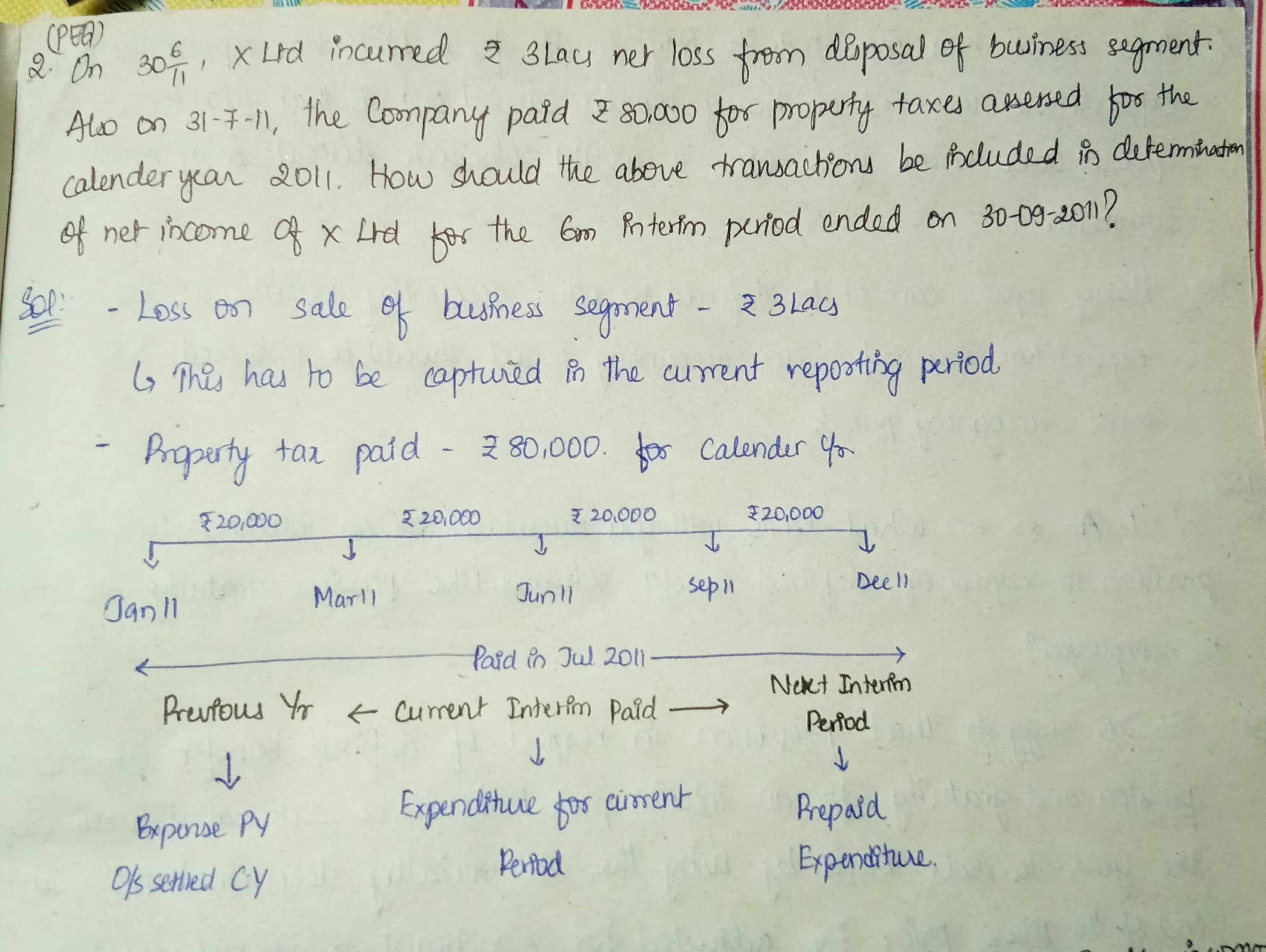

In the annexed illustration, expenditure incurred towards property tax for calender year for Q1 was treated as outstanding or prior period expense? If it is treated as prior period expense, then additional disclosures are required to be made, right? If not, then what will be the treatment and disclosure w.r.t. same?

Answers (1)