Forums

Advance paid in advance

Accountancy

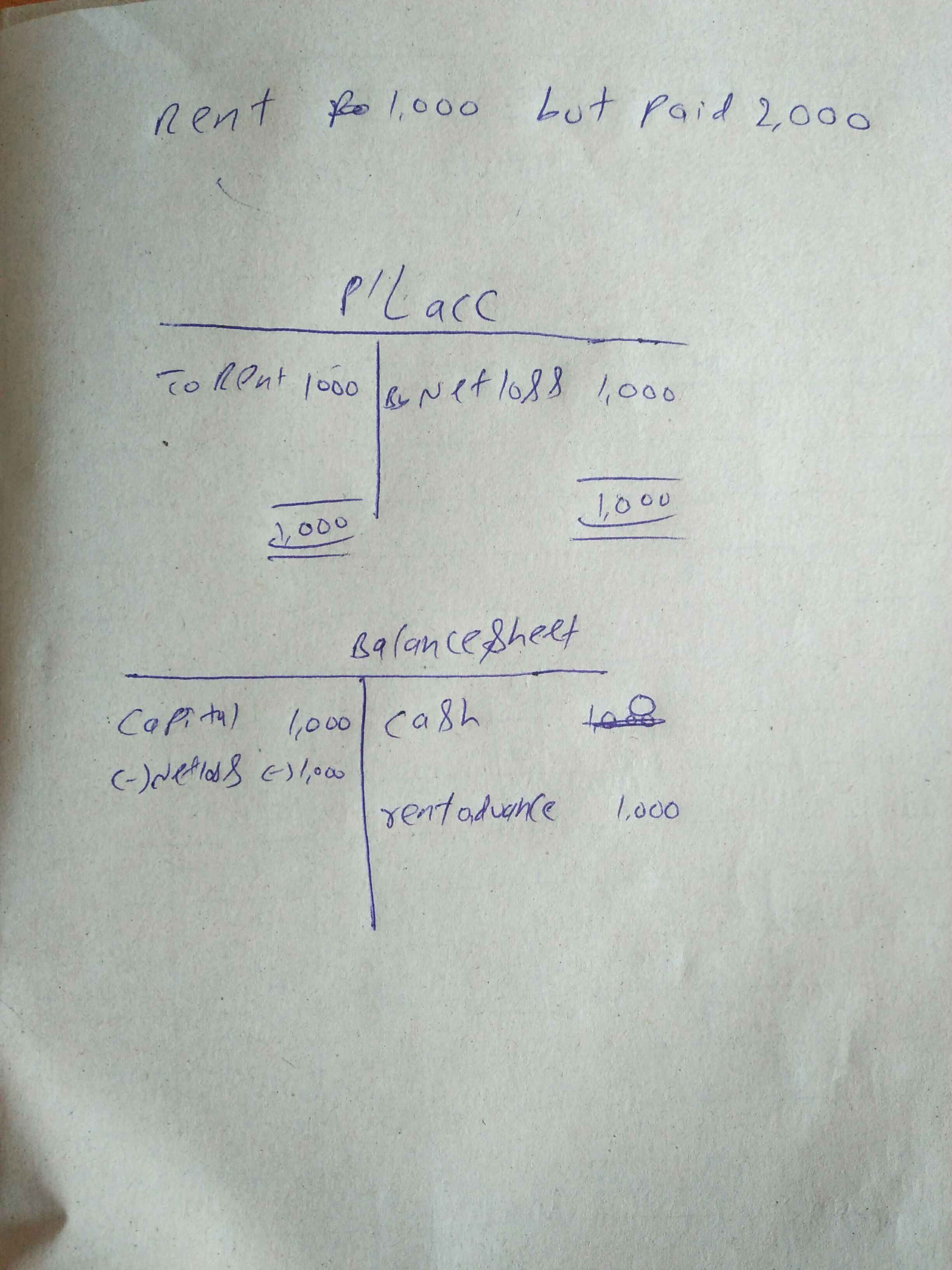

Sir when we pay rent or other expense 1000 in advance it going to dr of p/l acc so it is a net loss it will be transfer to balance sheet capital-net loss then asset side becomes rent advance and cash then how it will be tally sir its not tallying

Answers (5)

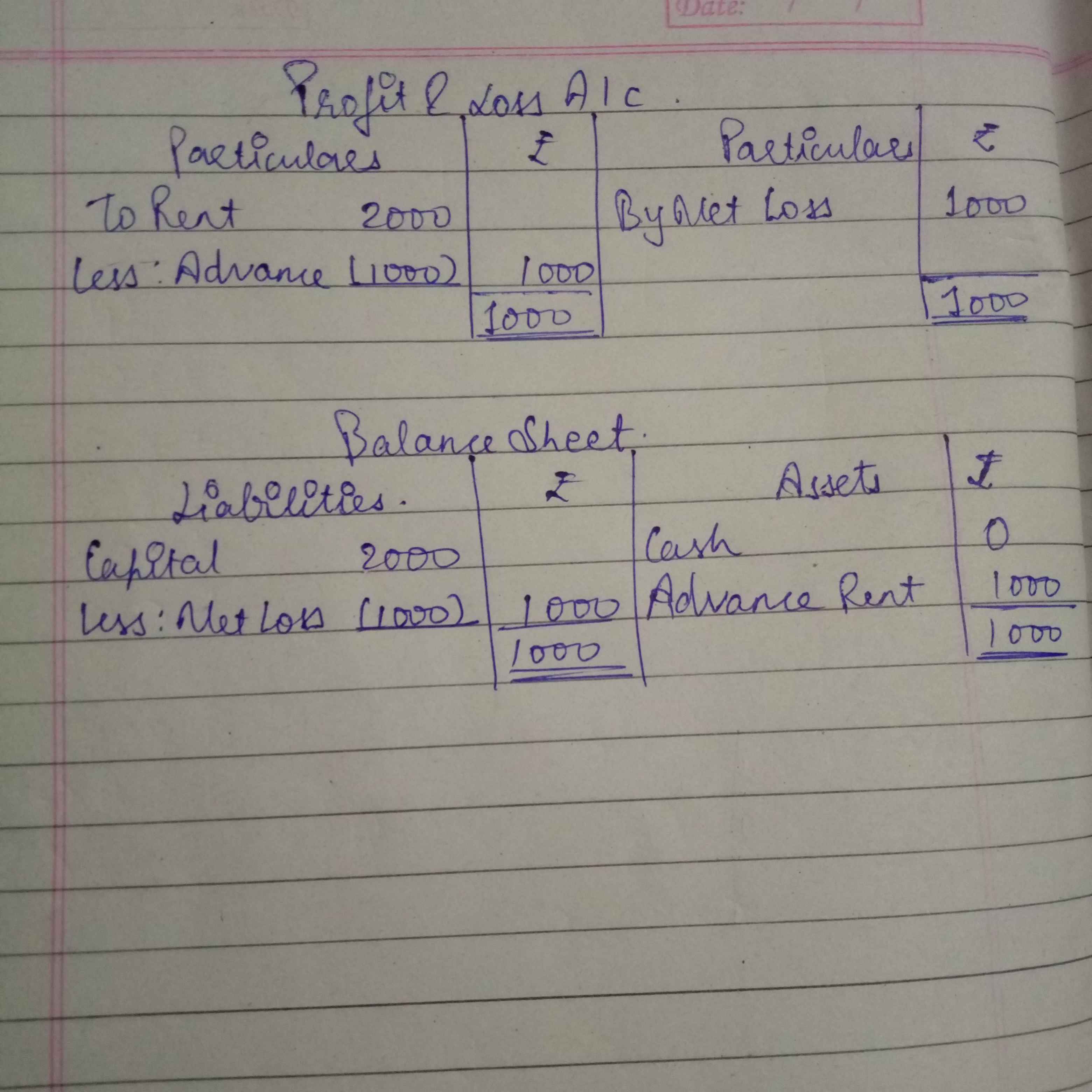

For instance, let's assume that Mr.X started a business with cash in hand of Rs.2,000, and as there is no liability at the beginning then according to accounting equation, Assets = Liabilities + Capital. So, Capital = Rs.2,000. When rent is paid of Rs.2,000, then cash in hand would be zero, then we will get it as shown in this attachment:

Thread Starter

Jashwanth SIts tallying on capital and liabilities side sir

In your example, if you had taken cash Rs.2,000 then you need to take capital too Rs.2,000 only then your answer would be right.