Forums

Advanced Accounting- ESOP

Accountancy

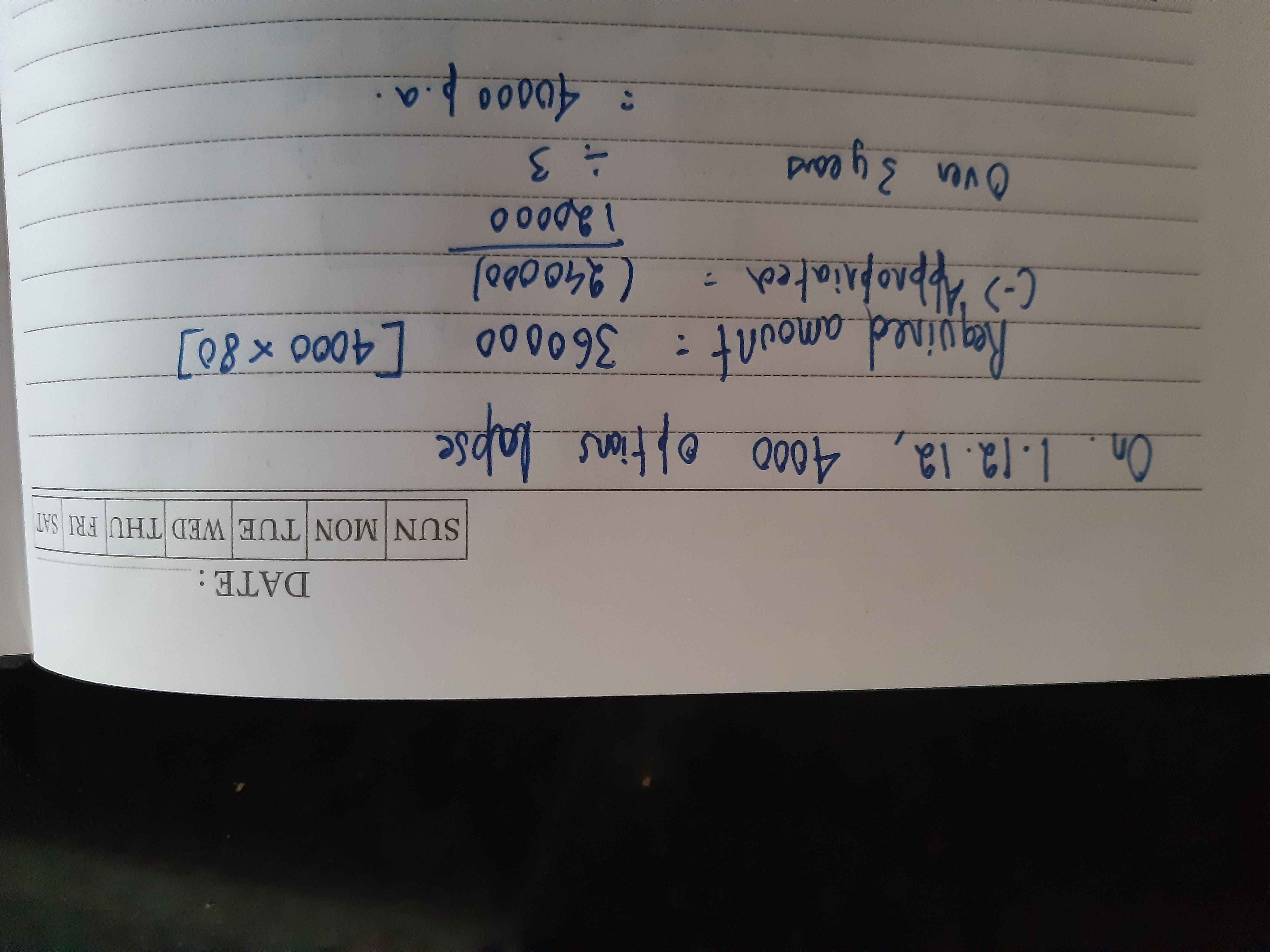

In Illustration 5 of Employee Stock Option Plan (pertaining to P Ltd), when the options lapsed, we immediately transfered the amount that was already credited in ESOP Account for the options lapsed on 1.12.12 to the General Reserve. Instead of that, can we internally adjust the amount to be transferred in the subsequent years (I have done that working in the attached working note) just like how we solved the following problem i.e. Illustration 6 (pertaining to Choice Ltd)?

Answers (7)

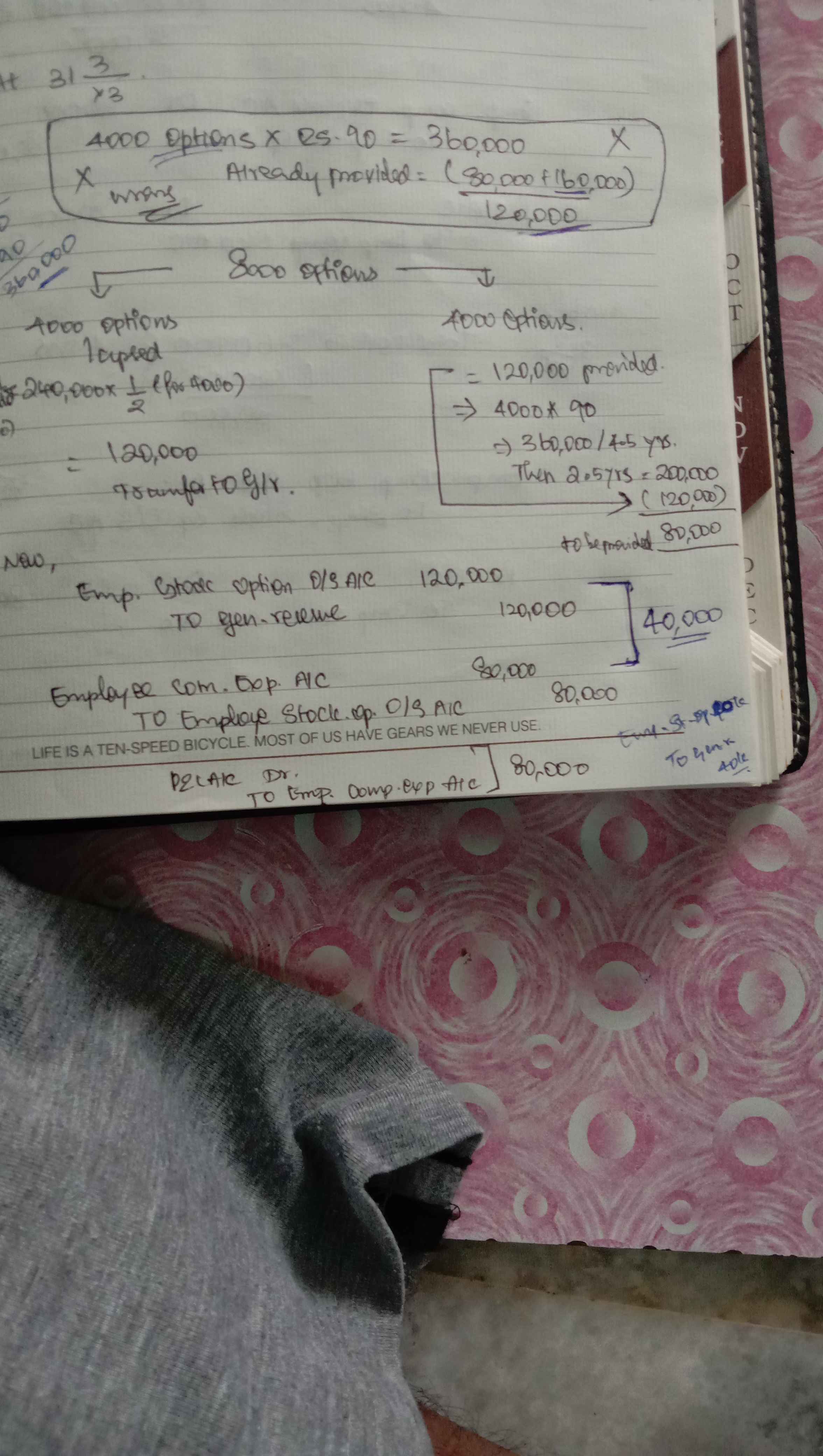

No bro! I think it wont be right! At the end of 3rd year expenses that should have been charged is â?¹2L for 4000options! We have already provided 240000! So we must bring that down by 40000 by cr. it to Gen.Res! And the next two years 80k and 80k!! What we must keep in mind is for each yr how much must be charged and did we charge it!! Hope this clarifies

Saran Vadivel

No bro! I think it wont be right! At the end of 3rd year expenses that should have been charged is â?¹2L for 4000options! We have already provided 240000! So we must bring that down by 40000 by cr. it to Gen.Res! And the next two years 80k and 80k!! What we must keep in mind is for each yr how much must be charged and did we charge it!! Hope this clarifies

What my logic is (and the same was what happened in the following question) is that we require 360000 in the ESOP Outstanding Account at year end. We have already credited 240000. Instead of making an adjustment that brings the balance down to 120000 and then makes us add 80000 per annum for 3 years which gives 360000, why can't we retain the same 240000 and subsequently add 40000 per annum for 3 years which will also give us 360000