Forums

As-10, Property,plant and equipment.

Accountancy

please explain about commercial substance in as-10 And how should an asset should be valued when asset is acquired by exchange

Answers (5)

Best Answer

A] COMMERCIAL SUBSTANCE is defined as the event or transaction causing the cash flows of the entity to change. The economic reality that underlies a transaction or arrangement, regardless of its legal or technical denomination. A business transaction is said to have commercial substance when it is expected that the future cash flows of a business will change as a result of the transaction. A change in cash flows is considered to be when there is a significant change in any one of the following (not including tax considerations): Risk- Such as experiencing an increase in the risk that inbound cash flows will not occur as the result of a transaction; for example, a business accepts junior secured status on a debt in exchange for a larger repayment amount. Timing- Such as a change in the timing of cash inflows received as the result of a transaction; for example, a business agrees to a delayed payment in exchange for a larger amount. Amount- Such as a change in the amount paid as the result of a transaction; for example, a business receives cash sooner in exchange for receiving a smaller amount. B] When a fixed asset is acquired in exchange for another asset, its cost is usually determined by reference to the fair market value of the consideration given. It may be appropriate to consider also the fair market value of the asset acquired if this is more clearly evident. An alternative accounting treatment that is sometimes used for an exchange of assets, particularly when the assets exchanged are similar, is to record the asset acquired at the net book value of the asset given up; in each case an adjustment is made for any balancing receipt or payment of cash or other consideration. When a fixed asset is acquired in exchange for shares or other securities in the enterprise, it is usually recorded at its fair market value, or the fair market value of the securities issued, whichever is more clearly evident.

Book value of asset to be exchanged: Rs 100 Fair value of this asset: Rs 80 Fair value of asset acquired: Rs 100 Here we acquired new asset by paying Rs 20 + old asset(fair value). Is there any commercial substance here? If No, here we can see the cash flow( payment of cash) of Rs 20 how can it be justified??

Thread Starter

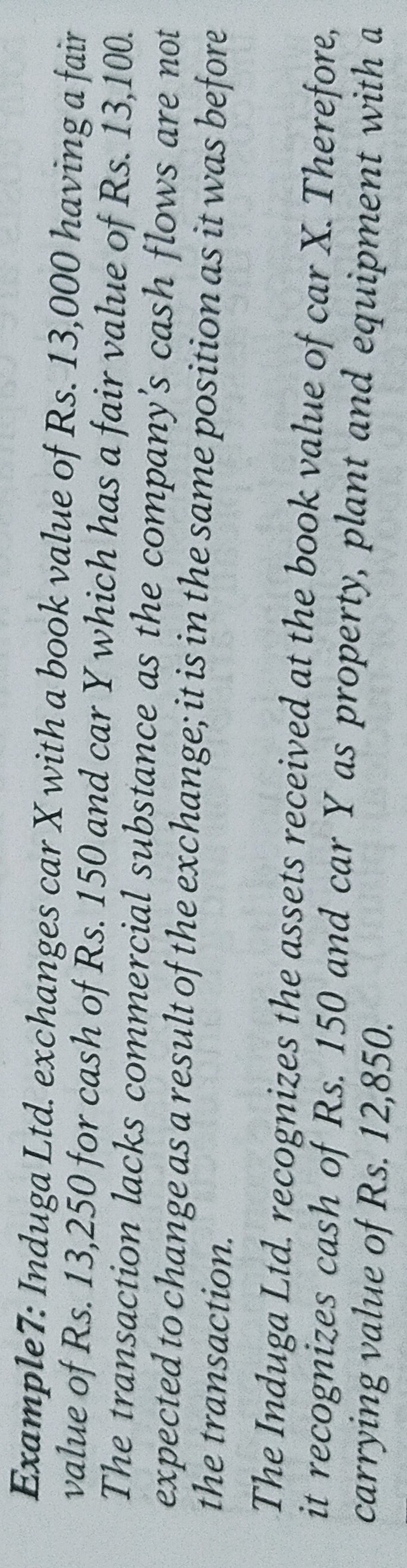

VIJAYA SARADHI MAGANTIMqm, can you please explain the problem in the image

What is your specific doubt. Please solve and share the solution. we can share specific explanations where you have an issue. We cannot solve full length problems for you