Forums

Bonus Issue : Authorised Cap

Accountancy

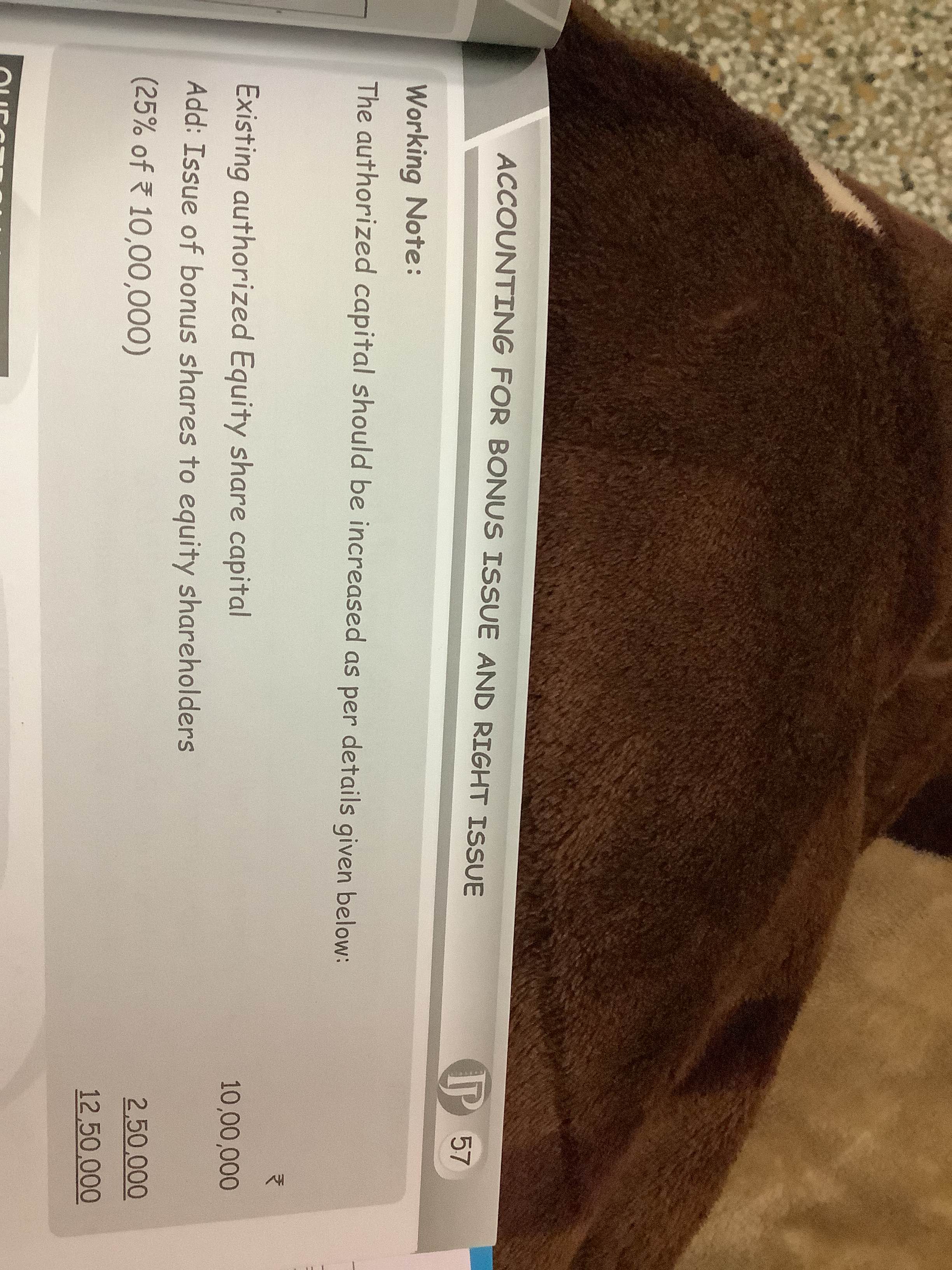

Authorised Capital. = â?¹ 10,00,000 Issued & subs Capital = â?¹ 9,00,000 Now, issued Bonus Share 1:4 i.e. 25% (i.e. â?¹ 2,25,000) Authorised capital will have to be increased by how much? a) 10,00,000 + (25% of 10,00,000) b) 10,00,000 + (25% of 9,00,000) c) or something else..?? Please clarify.

Answers (3)