Forums

CAPITAL GAINS

Direct Taxation

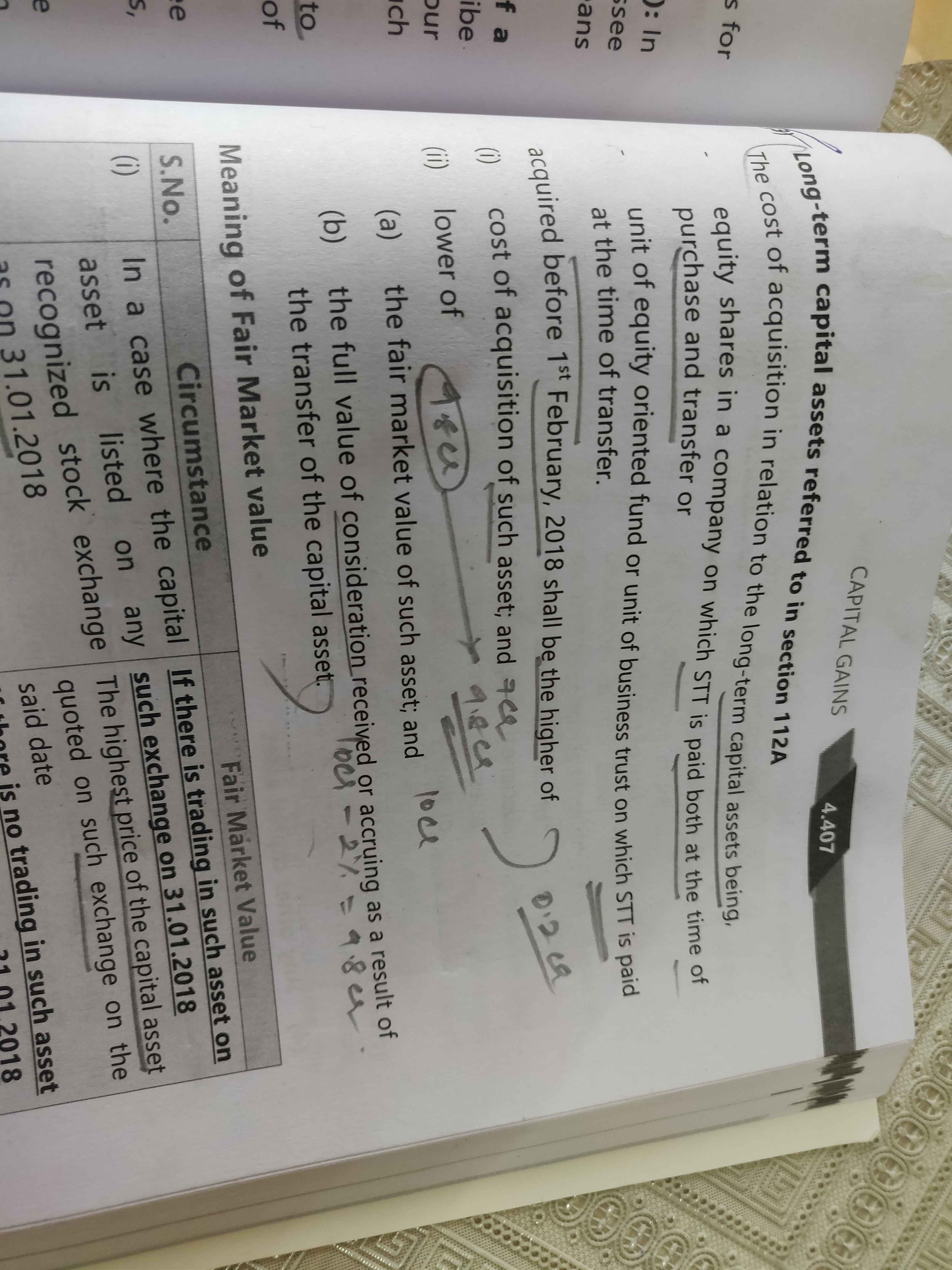

No deduction of STT on capital gains is given in notes But as per the reader the STT is considered indirectly see in the image

Answers (4)

Section 112A does not mension anywhere about the deductibility of STT paid on such transfer, payment of STT is just procedural compliance to apply the concessional rate of 10%, otherwise normal slab rates will be applicable to that assessee. Hence we should not consider STT paid as a deduction for calculating LTCG.

Thread Starter

aman kawadSir then can we say that for all transactions which involve STT ars not allowed as deductions and the assessee must pay again a portion of tax on that

No deduction will be given capital gain will be levied without considering STT.