Forums

Capital Budgeting (old syllabus)

Financial Management

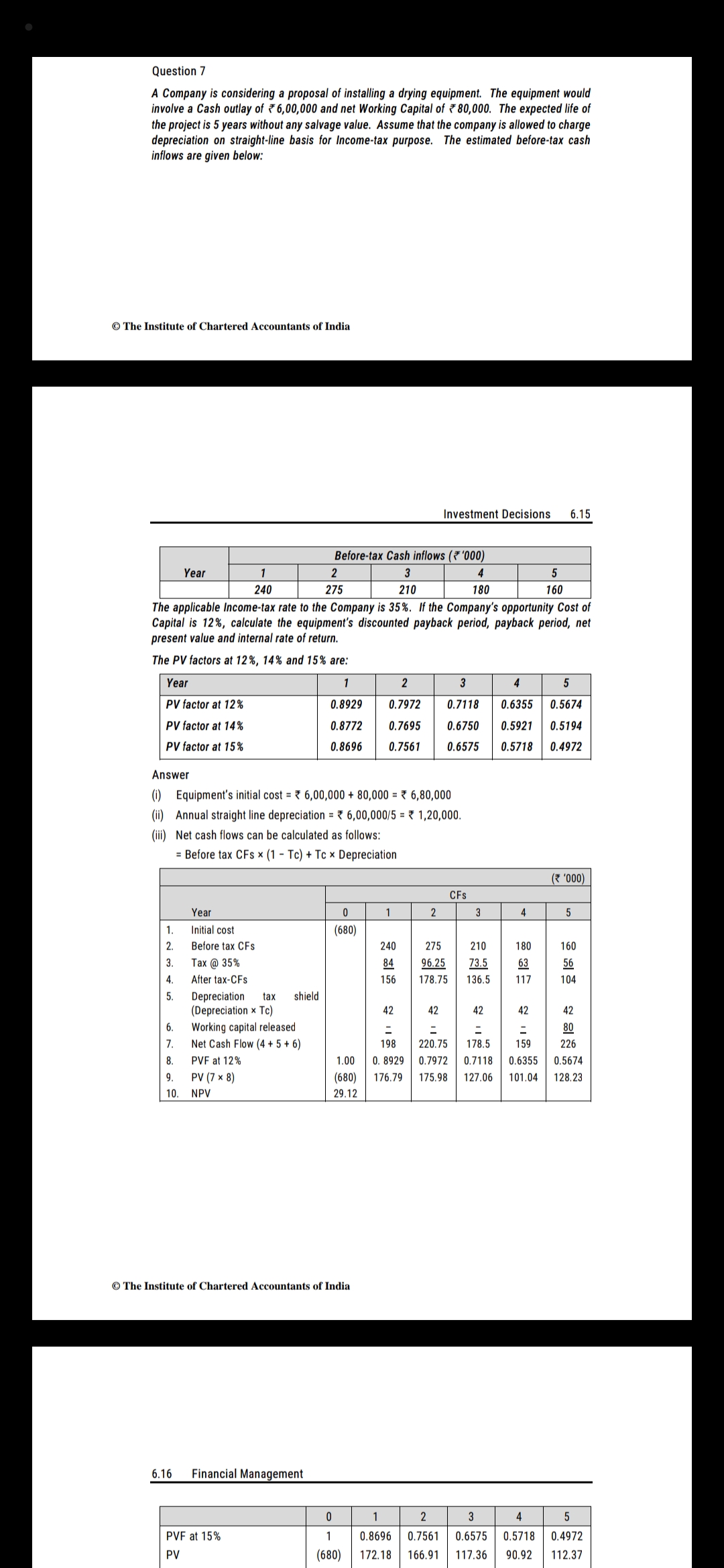

In this problem, depreciation is multiplied by tax percentage and added back to PAT. . Is it correct to do it the other way, that is, add back the entire depreciation of â?¹1,20,000 (assuming that the given cash flow before tax excludes entire depreciation) and give a note at the end? Or does the question particularly demand the method it has opted for in the solution? If so, can you say why?

Answers (10)

Best Answer

Thread Starter

Raja RamanBy assuming it has been excluded, I meant that, the cash flow before tax was arrived at after adjusting the entire depreciation instead of the tax part of it . Because the solution adds back only the tax part of the depreciation to the PAT. By exclusion I did not mean the calculation of PBT did not include depreciation at all. So is it correct to do like I mentioned in this reply?

Depreciation is not a cashflow. The tax you save on depreciation is considered as implied inflow.

The cash flow before tax always means that the amount is derived after all the adjustments made and the tax to be deducted from it. You can not assume that depreciation is not included when the question specifically mentions it as before tax cash inflows.

Lavanya Chitturi

The cash flow before tax always means that the amount is derived after all the adjustments made and the tax to be deducted from it. You can not assume that depreciation is not included when the question specifically mentions it as before tax cash inflows.

By assuming it has been excluded, I meant that, the cash flow before tax was arrived at after adjusting the entire depreciation instead of the tax part of it . Because the solution adds back only the tax part of the depreciation to the PAT. By exclusion I did not mean the calculation of PBT did not include depreciation at all. So is it correct to do like I mentioned in this reply?

CA Suraj Lakhotia Admin

Depreciation is not a cashflow. The tax you save on depreciation is considered as implied inflow.

Here's the format: Profit Before Depreciation And Tax Less: Depreciation PBT (this is given in the question and is the starting point of the problem) Less: Tax PAT Less: Depreciation CFAT Now depreciation appears twice. In this problem it appears only once. So it is assumed that, the amount given, before tax cash flows, has already subtracted it. Also whatever depreciation subtracted is also added back to get the correct calculation or CFAT would be understated or overstated. Now my question is, what amount of depreciation was subtracted? It is obviously the same figure added back. So if I add back the entire depreciation, why is it wrong?

Thread Starter

Raja RamanSorry. PAT Add: Depreciation CFAT Typing mistake.

Since CFAT is after adding entire depreciation, why would you add again?

CA Suraj Lakhotia Admin

Since CFAT is after adding entire depreciation, why would you add again?

I added entire depreciation to PAT to arrive at CFAT. But the problem adds back only tax part of the depreciation.

Thread Starter

Raja RamanI added entire depreciation to PAT to arrive at CFAT. But the problem adds back only tax part of the depreciation.

The question has given cash flows before tax.

CA Suraj Lakhotia Admin

The question has given cash flows before tax.

Sorry for so much pestering. Finally got it. Since tax saving (Depreciation * Tax percent) is an implied inflow, only that portion is added back. Thanks.