Forums

Capital gains

Direct Taxation

In first q under b , why is there no indexation for cost of acquisition

Answers (9)

Anirudh gupta

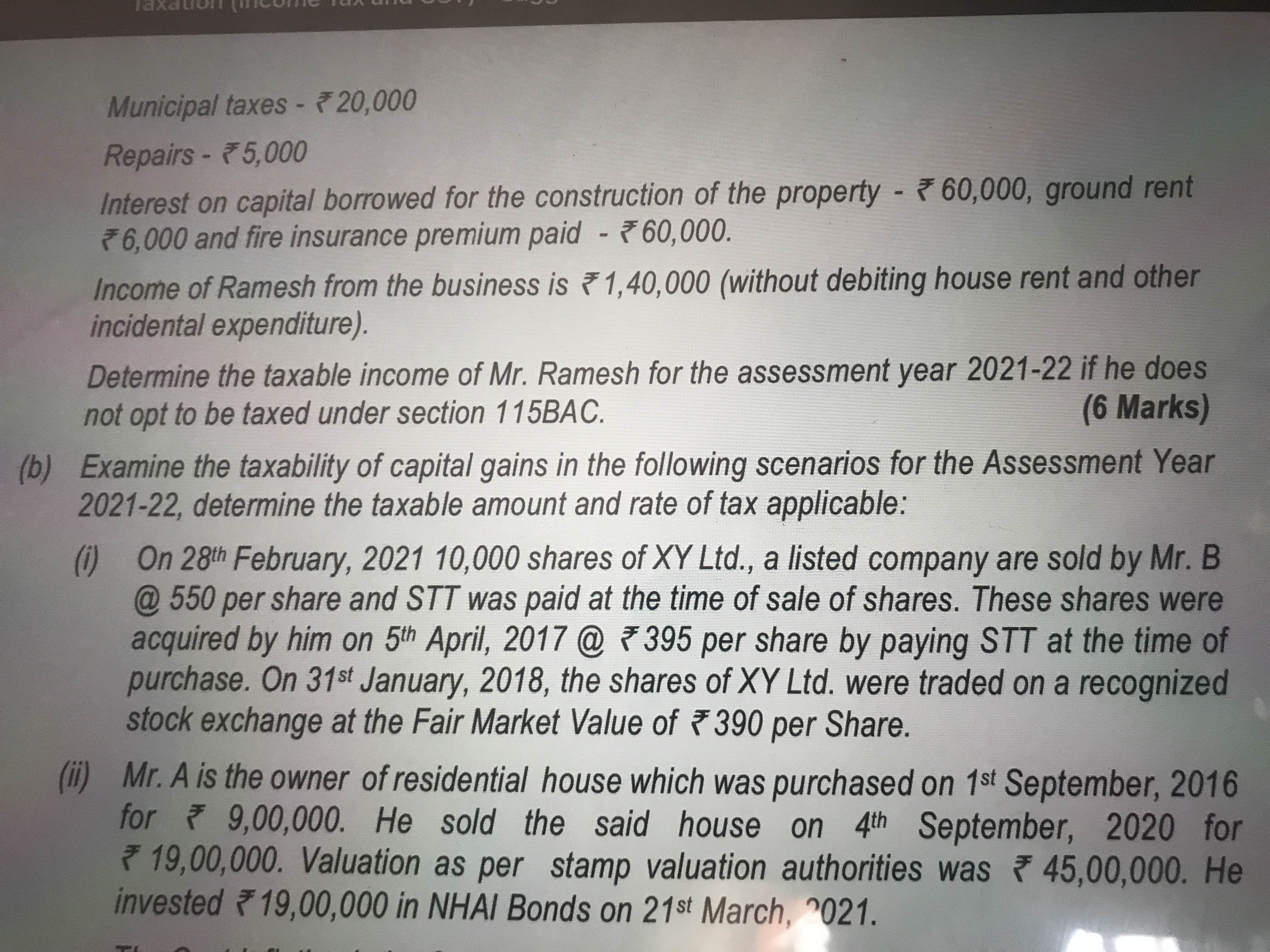

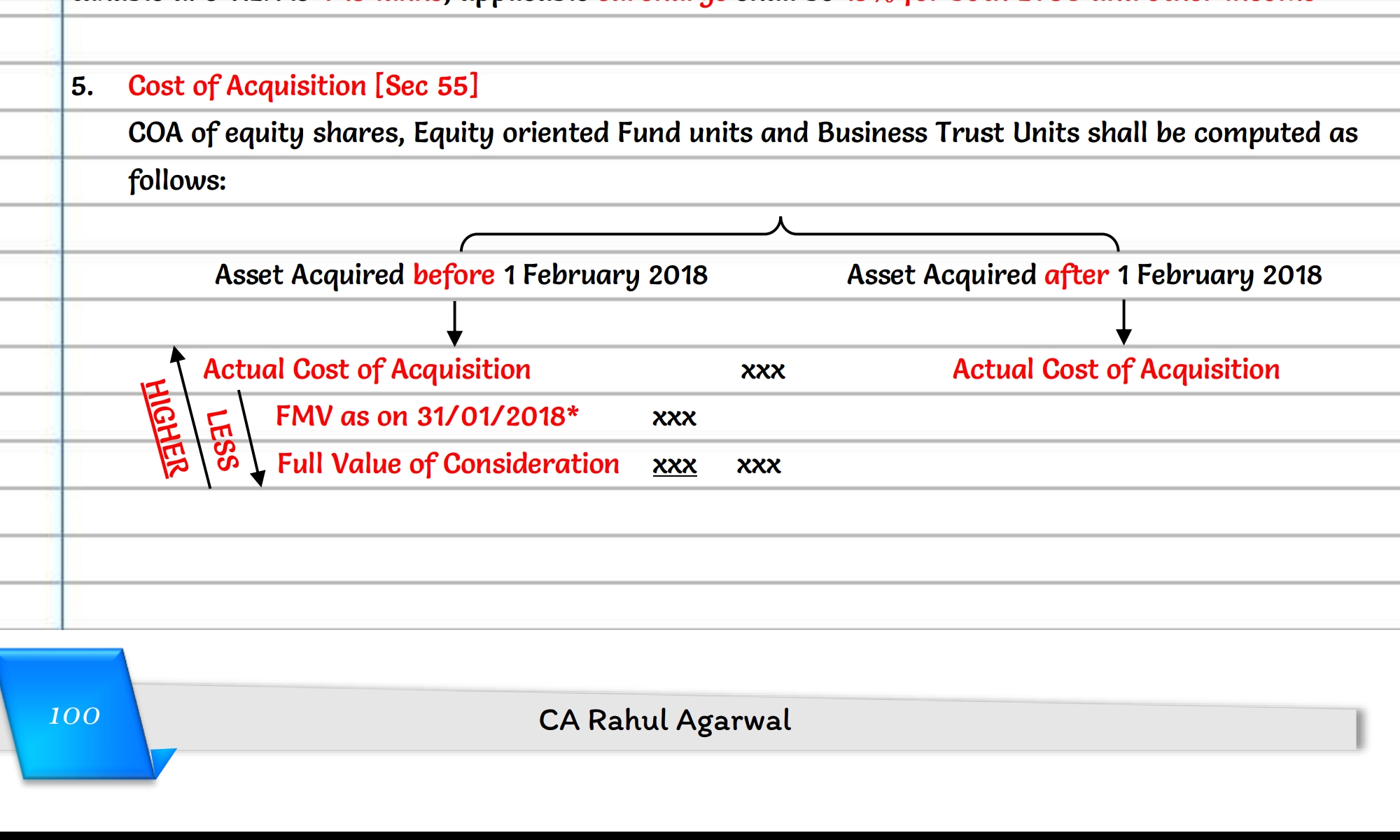

For the (i ) question you need to follow this to find the taxability

But after finding this why don’t we take indexation

Thread Starter

SANSKRITI BADRI 2111339But after finding this why don’t we take indexation

Remember one thing....if there is purpose to jse index...then icai will compulsorily gives you those indices

Anirudh gupta

Remember one thing....if there is purpose to jse index...then icai will compulsorily gives you those indices

I understand what ur saying … however the indexes given in the second part can be applicable as the years are the same

Thread Starter

SANSKRITI BADRI 2111339I understand what ur saying … however the indexes given in the second part can be applicable as the years are the same

May be for the second part they missed to include the indices...no worries but for the first part...u dont need to care about indices...apply the specific provision and you are good to go.