Forums

Capital structure

Financial Management

How to do this problem

Answers (4)

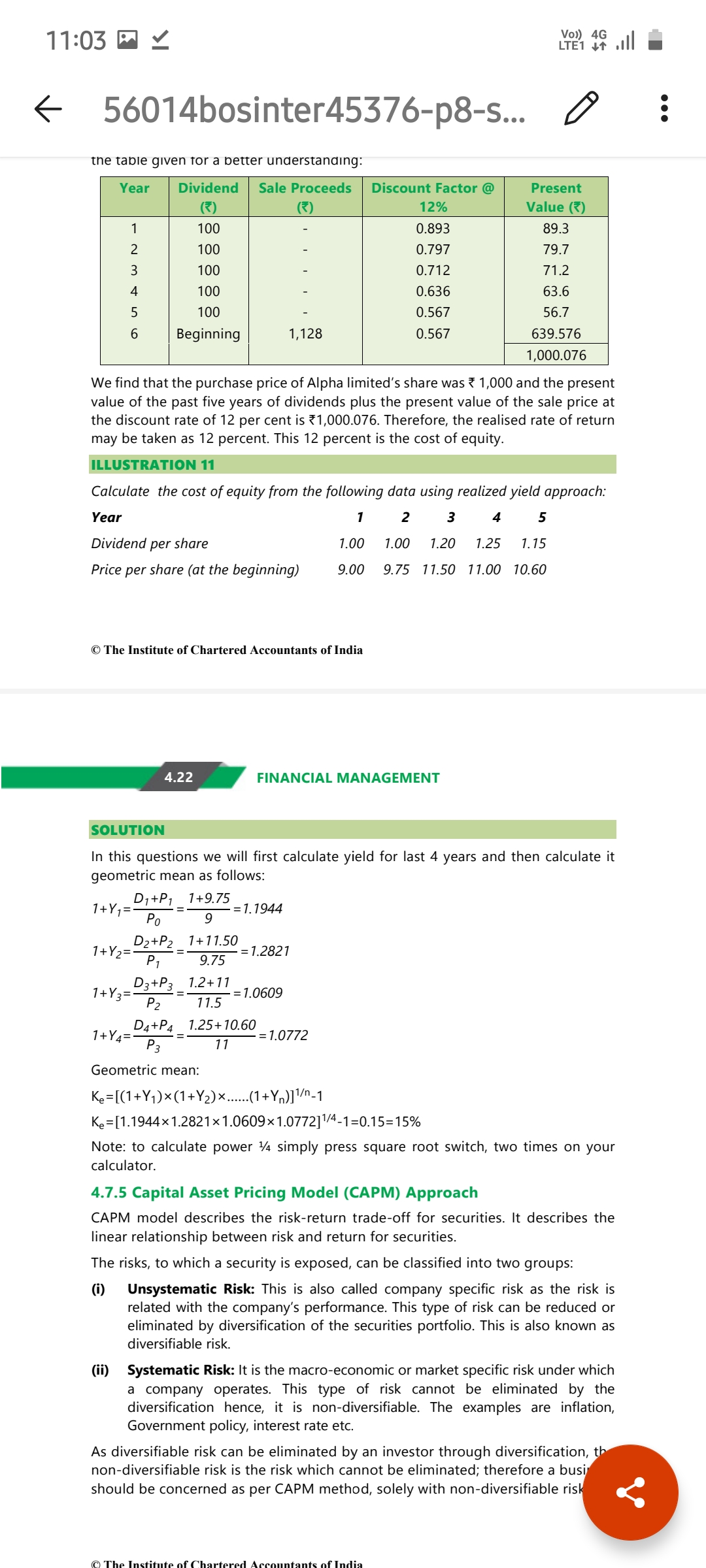

Here realised yield approach has been used for calculating cost of equity. Firstly we should calculate yield for each year. Then mean should be calculated in respect of yields of different years. Yield or cost of equity in realized yield approach Is = {(Dividend + closing market price of share)/(opening market price of share)} Mean may be arithmetic mean(simple average) or Geometric mean = nth root of product of n terms. It shows the average yield of an equity share or cost of equity( that is expectation of shareholder). Hope it helps!!!

VIJAYA SARADHI MAGANTI

Here realised yield approach has been used for calculating cost of equity. Firstly we should calculate yield for each year. Then mean should be calculated in respect of yields of different years. Yield or cost of equity in realized yield approach Is = {(Dividend + closing market price of share)/(opening market price of share)} Mean may be arithmetic mean(simple average) or Geometric mean = nth root of product of n terms. It shows the average yield of an equity share or cost of equity( that is expectation of shareholder). Hope it helps!!!

In the above formula subtract with 1 on right hand side of equation to get yield.