Forums

Cash flow statement

Accountancy

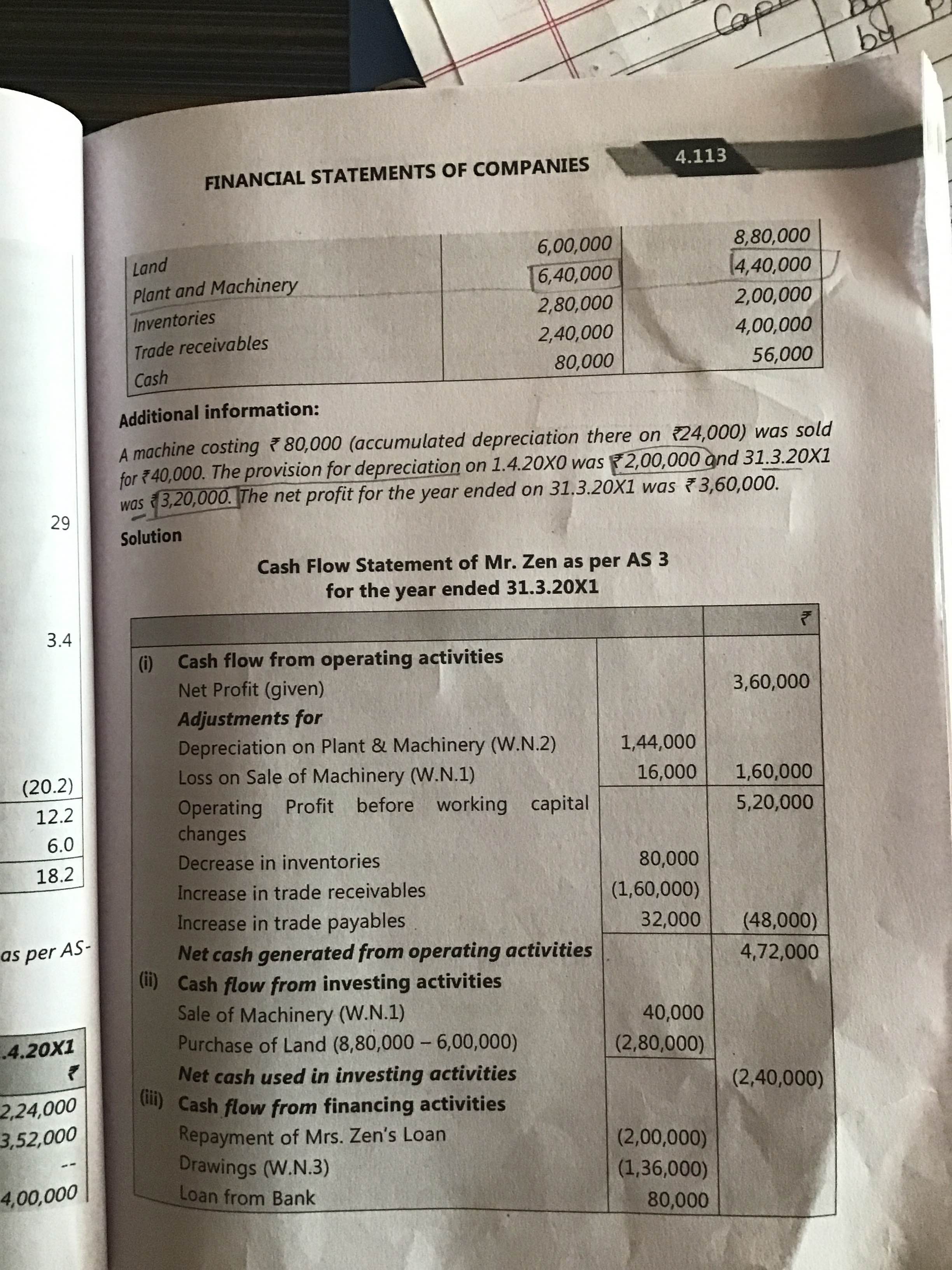

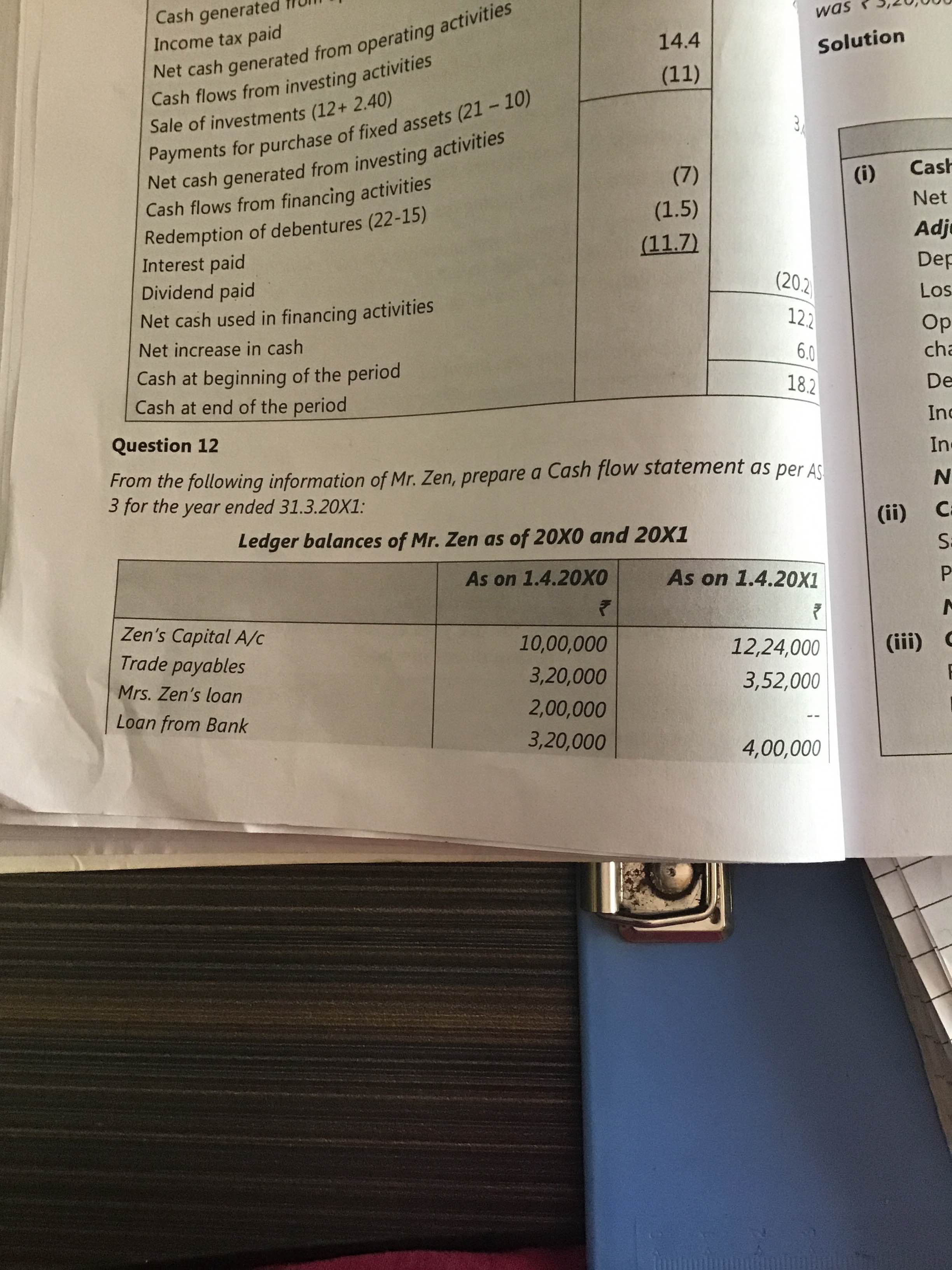

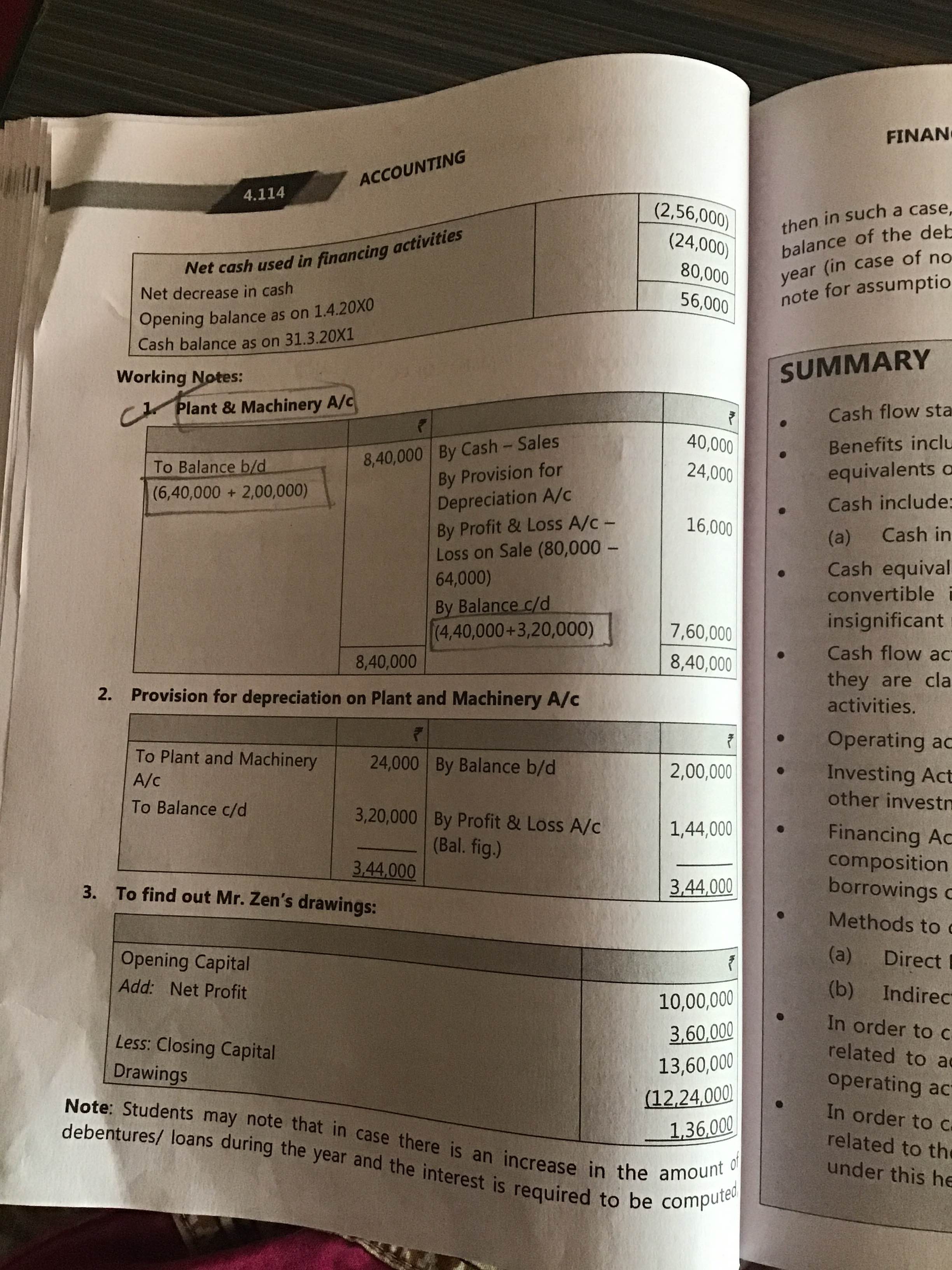

Why provision for depreciation is added to balance brought down and carried down

Answers (4)

Best Answer

Sahibdeep Singh

If it was there in ledger balances, then we would have assumed plant and machinery is at cost. But now since, provision is given as addtional info only, it means plant and machinery ledger balance is net (written down value). I agree, it is little confusing. If we see ICAI May 19 Material, it was mentioned Balance Sheet instead of Ledger Balance. There Provision that did not appear in Balance sheet, so it was very clear that P&M balance is after adjusting provision. But now they modified the question to ledger balance, so the fact that Plant & machinery is net of provision is not very intuitive. Don't worry - you now know what to do.

Thank you very much sir,. The answer was very clear and in understandable... thank you sir

Sahibdeep Singh

This is because we don't find provision account in ledger balance which means Plant & Machinery balances as given in ledger are after deducting provision amount from them.

Thank you sir! But how to identify that the figure given is in cost or written down value . Because, the provision for depreciation is given . I thought the value of asset is in cost

Thread Starter

Susai YappanThank you sir! But how to identify that the figure given is in cost or written down value . Because, the provision for depreciation is given . I thought the value of asset is in cost

If it was there in ledger balances, then we would have assumed plant and machinery is at cost. But now since, provision is given as addtional info only, it means plant and machinery ledger balance is net (written down value). I agree, it is little confusing. If we see ICAI May 19 Material, it was mentioned Balance Sheet instead of Ledger Balance. There Provision that did not appear in Balance sheet, so it was very clear that P&M balance is after adjusting provision. But now they modified the question to ledger balance, so the fact that Plant & machinery is net of provision is not very intuitive. Don't worry - you now know what to do.