Forums

Chapter 4 heads of income, unit 1 salaries

Direct Taxation

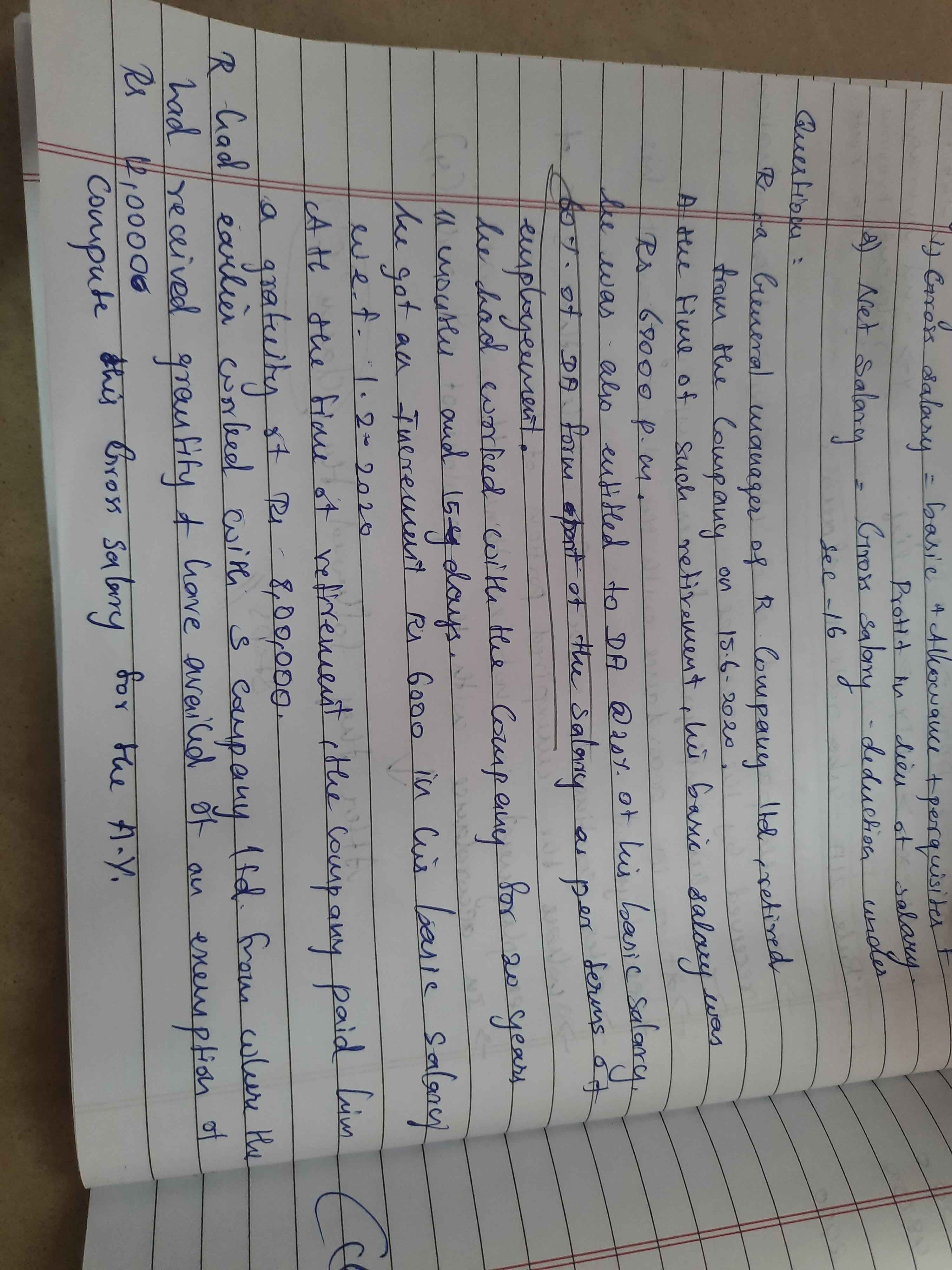

Sir, in this question, actually they what that mentioned , he had worked with the company for 20 years 11 month and 15 days but in your video classes you've take only for 20 years ,why you have been taken only for 20 years , sir can you please your answer

Answers (6)

From that question ,They have completed nearly 21 years ( only 15 days is left to complete the last one year) you have already said that at the time of teaching the gratuity topic( 6 month are more of service considered as completed year). But you have been calculated twenty years for the gratuity exempt

Thread Starter

Subash ChandraboseFrom that question ,They have completed nearly 21 years ( only 15 days is left to complete the last one year) you have already said that at the time of teaching the gratuity topic( 6 month are more of service considered as completed year). But you have been calculated twenty years for the gratuity exempt

Please watch video 40 for clarity on the concept..... If covered by Payment of Gratuity Act then > 6 months in the year is considered but if not coverdcd by the Act, year has to be complete... 15days less also is not considered as year