Forums

Composition scheme

Indirect Taxation

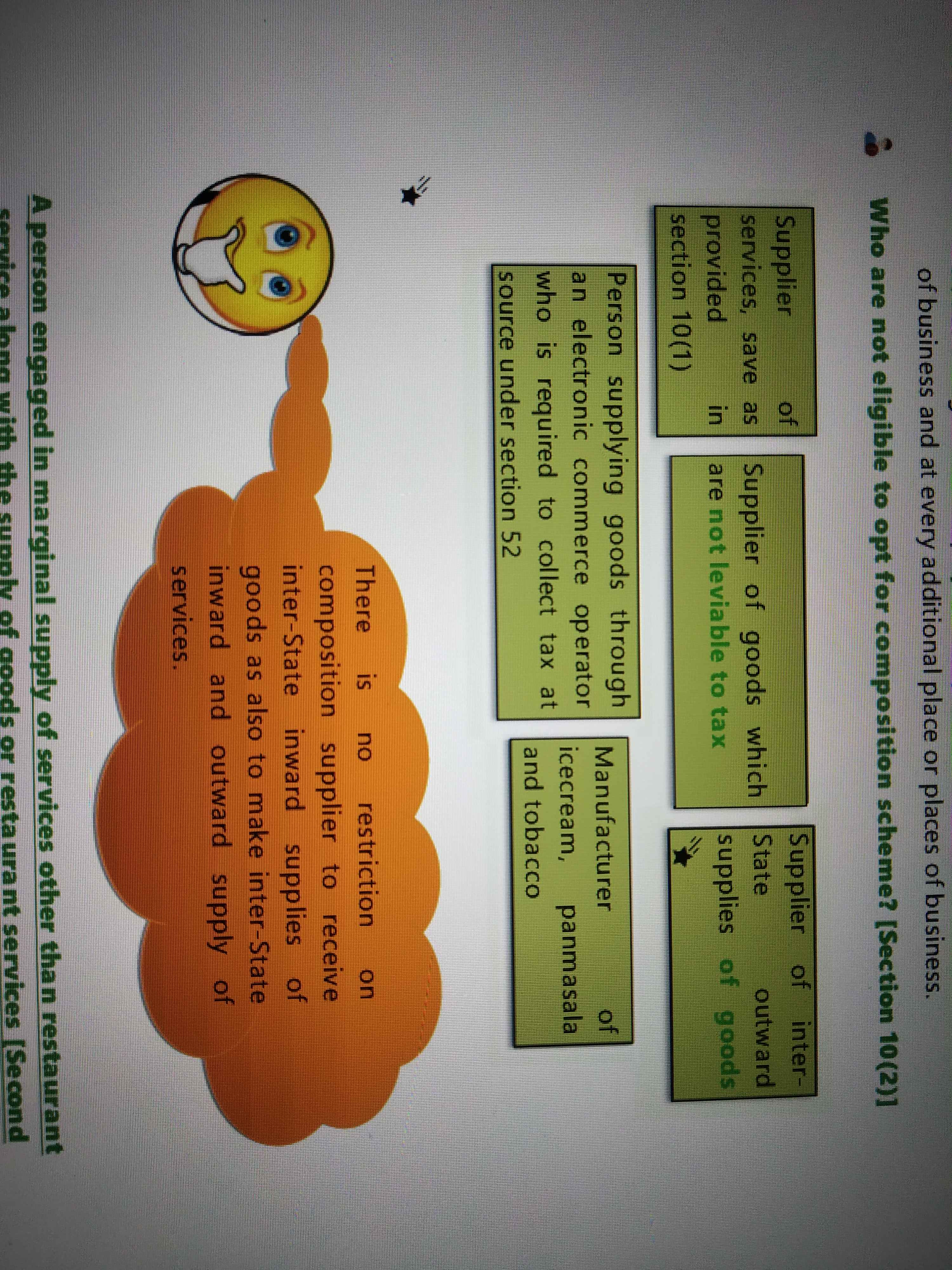

In composition scheme , inter state supply of goods is not allowed , but is inter state supply of "SERVICES" allowed which is less than 10% aggregate turnover of preceding FY or 5 lackhs which ever is higher..?

Answers (4)

CA Suraj Lakhotia Admin

There was an error in my earlier answer. Please ignore. As per the latest provisions - supply of services up to 10% threshold can be made interstate as well. The restriction is only for the interstate supply of goods.

Yes sir , 10% of aggregate turnover of previous year , can be used for supply of services