Forums

Composition scheme

Indirect Taxation

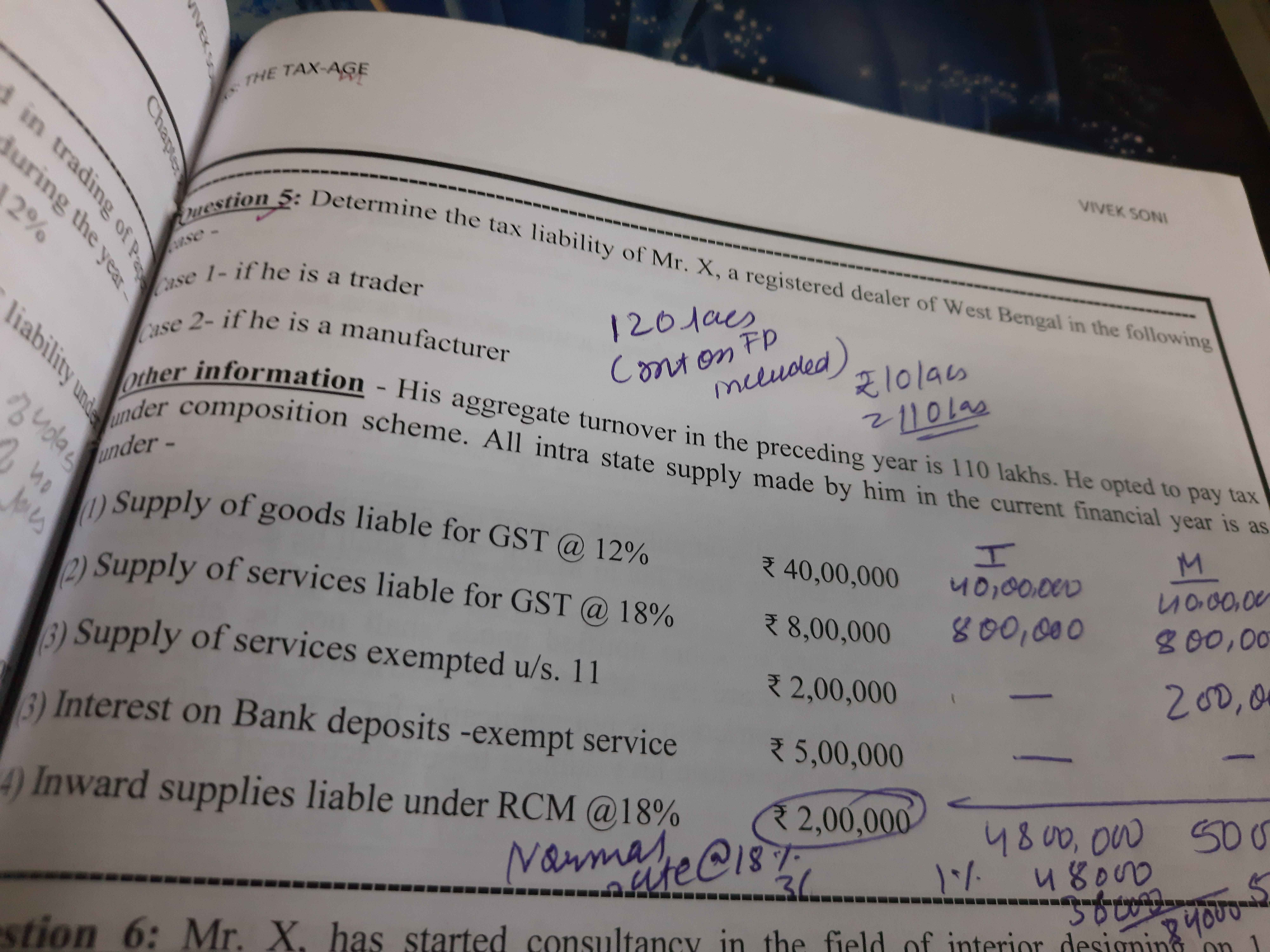

Can anyone tell how will treat supply of service liable for gst @18% given in point (2)

Answers (4)

Generally they can't engage in providing services . However they can provide subject to limits. First check the limit 5,00,000 or 10 % turnover of preceeding financial year . It comes to 11,00,000 means within the limit as he is providing the service. Therefore he is eligible to continue u/sec 10(1) . Accordingly consider service in aggregate turnover and provide 3% or 1% as the case may be...