Forums

Cost accounting

Accountancy

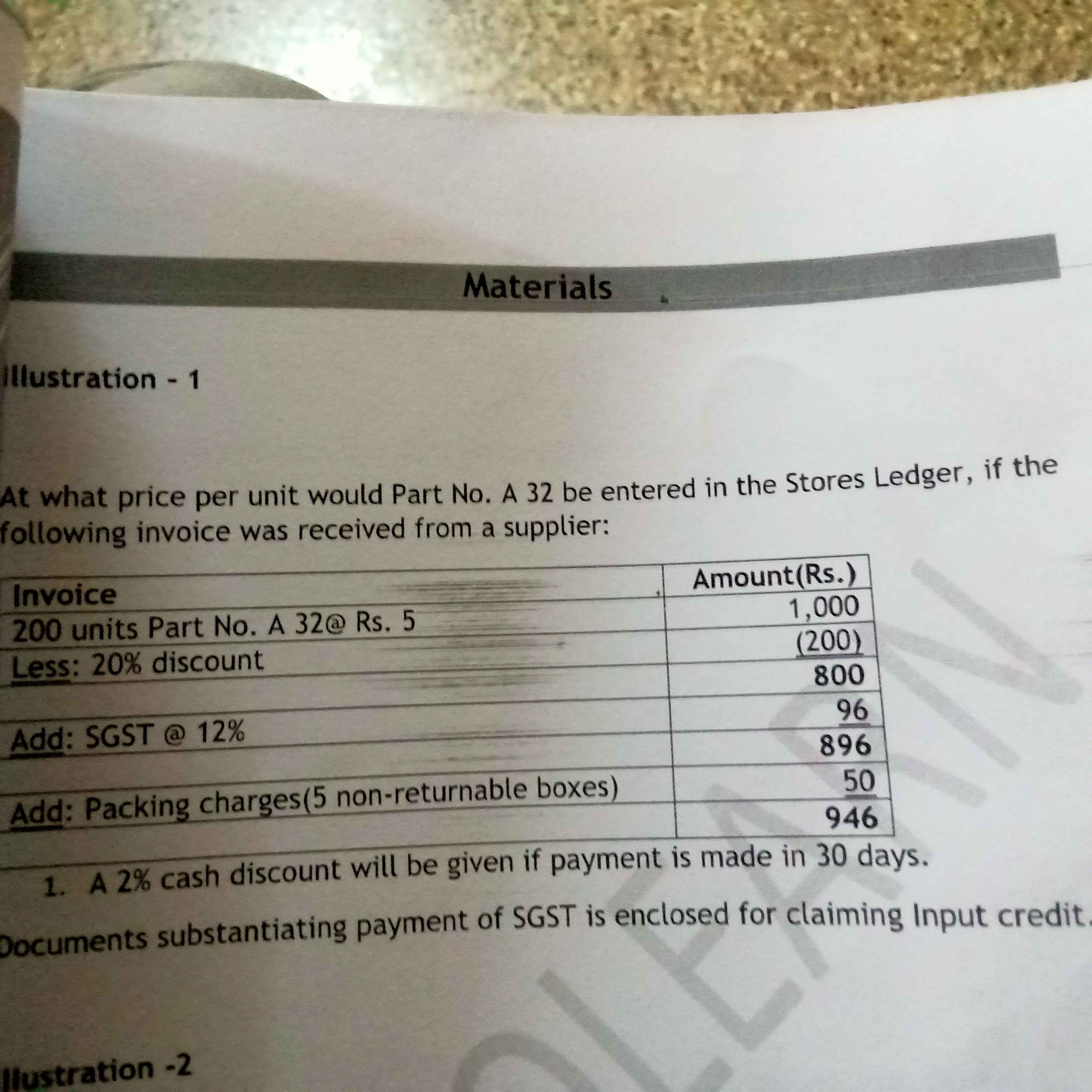

Materials chapter problem please explain problem sir

Answers (4)

CA Suraj Lakhotia Admin

This is covered in class. WHat is your doubt?

Sir how to solve the problems can't understand ing sir

First of all you should know the costs that are to be included and excluded while valuing cost of stock or stores. Trade discount should be excluded because it is trade benefit(this is the margin given by whole saler to trader so that he can earn profit by selling even to that extent of discount given to him) Any taxes paid can be claimed as refund or set off from output tax should be excluded. Here in the given question trade discount should be deducted(1000-200= 800) SGST paid will get credit in output tax given in question so it will not be included in cost. Non returnable boxes for packing will form part of cost for the seller so it will be charged from us (800+50=850) . Cash discount is the benefit which will be received for prompt payment of amount due to creditor but not for what we purchase as in the case of trade discount. As it is a financial item it will not be included in costing a product/inventory. It's our wish to avail cash discount or not. It will be clearly understood in the chapter of Debtors management in financial management. Finally the cost of the inventory/stores of A32 is Rs 850. Hope it helps!!!