Forums

Answers (7)

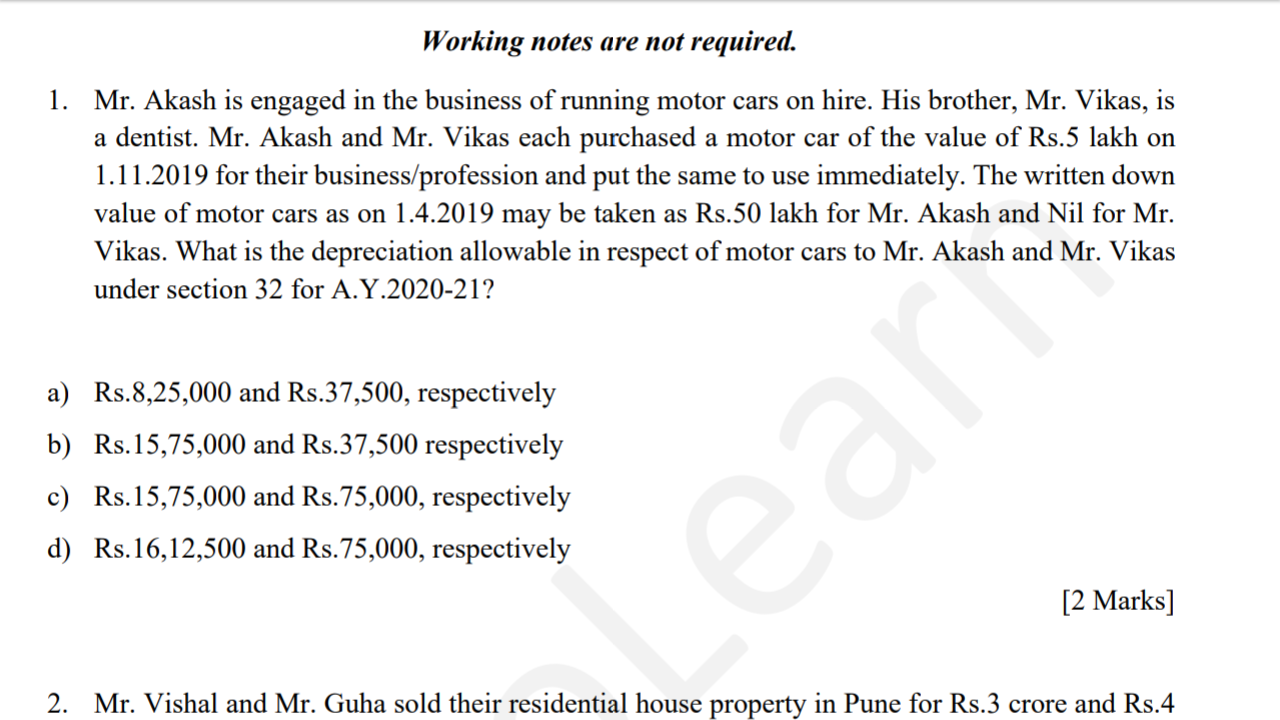

Depreciation rate if car used in business of hire is 30% Depreciation rate if car used other than business of hire is 15% Depreciation rate if asset purchased is put to use for less than180 days in the previous year than depreciation rate is 50% of actual rate. That is 15% in case of car used in business of hire and 7.5% in case of car used other than business of hire

Depreciation for akash who runs cars on business of hire is as follows For the block of assets that is cars on 1/4/2019 value 50,00,000 depreciation is 50, 00,000*30%=1, 50,000 For car purchased on 1/11/2019 value 5,00,000. This car has been put to use for less than 180 days, that is from 1/11/2019 to 31/3/2020. So depreciation rate is 15%

anil vagvala

For vikas who has put to use his car for less than180 days, (1/11/2019 to 31/3/2020), for purpose other than business on hire, depreciation is 5,00,000*7.5%=37, 500

Increased rate of depreciation in respect of motor vehicles acquired and put to use during the period from 23.8.2019 to 31.3.2020 [Notification 69/2019 dated 20.9.2019] Motor buses, motor lorries and motor taxis used in a business of running them on hire, acquired during the period from 23.8.2019 to 31.3.2020 and put to use on or before 31.3.2020 - 45%