Forums

Depreciation

Accountancy

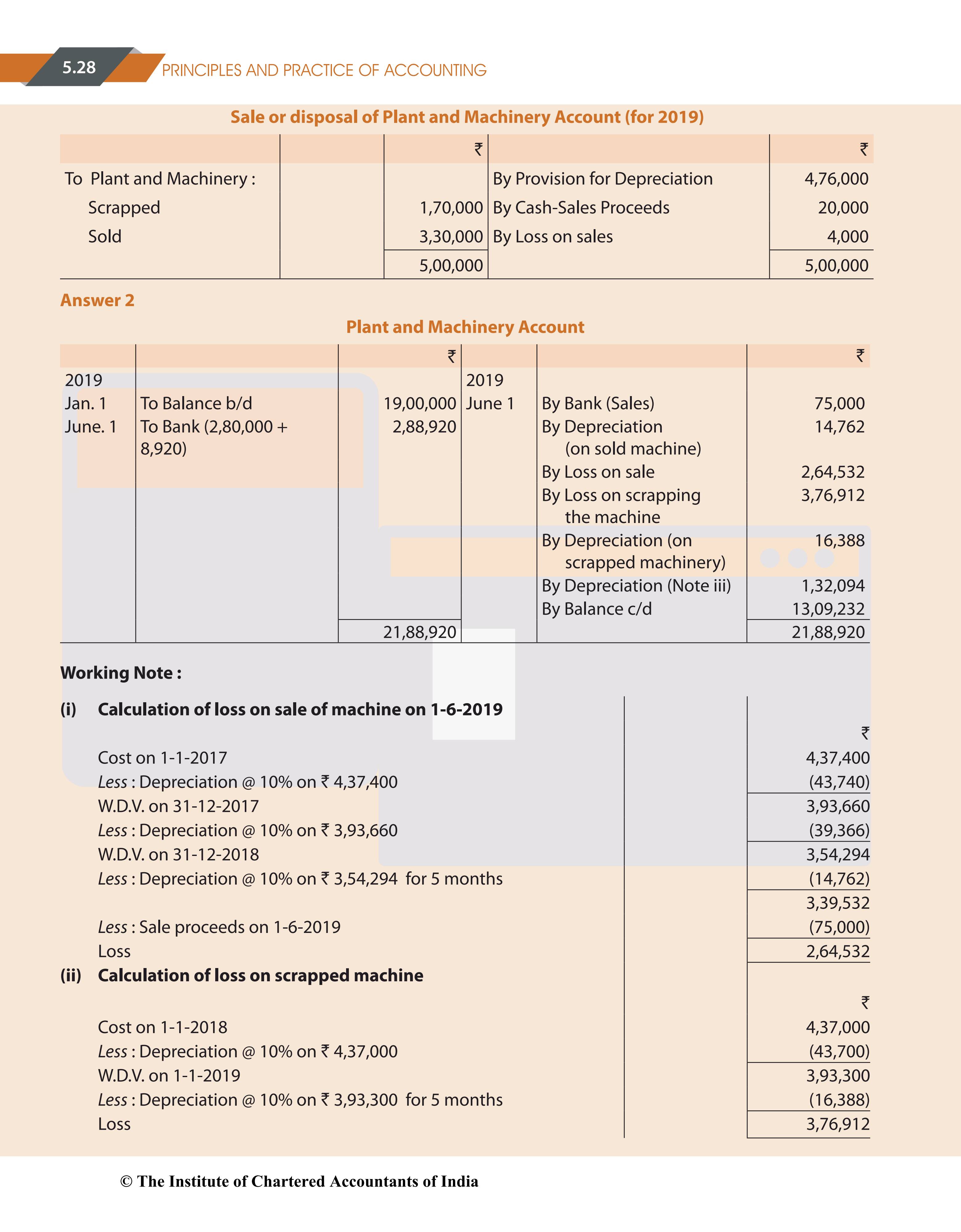

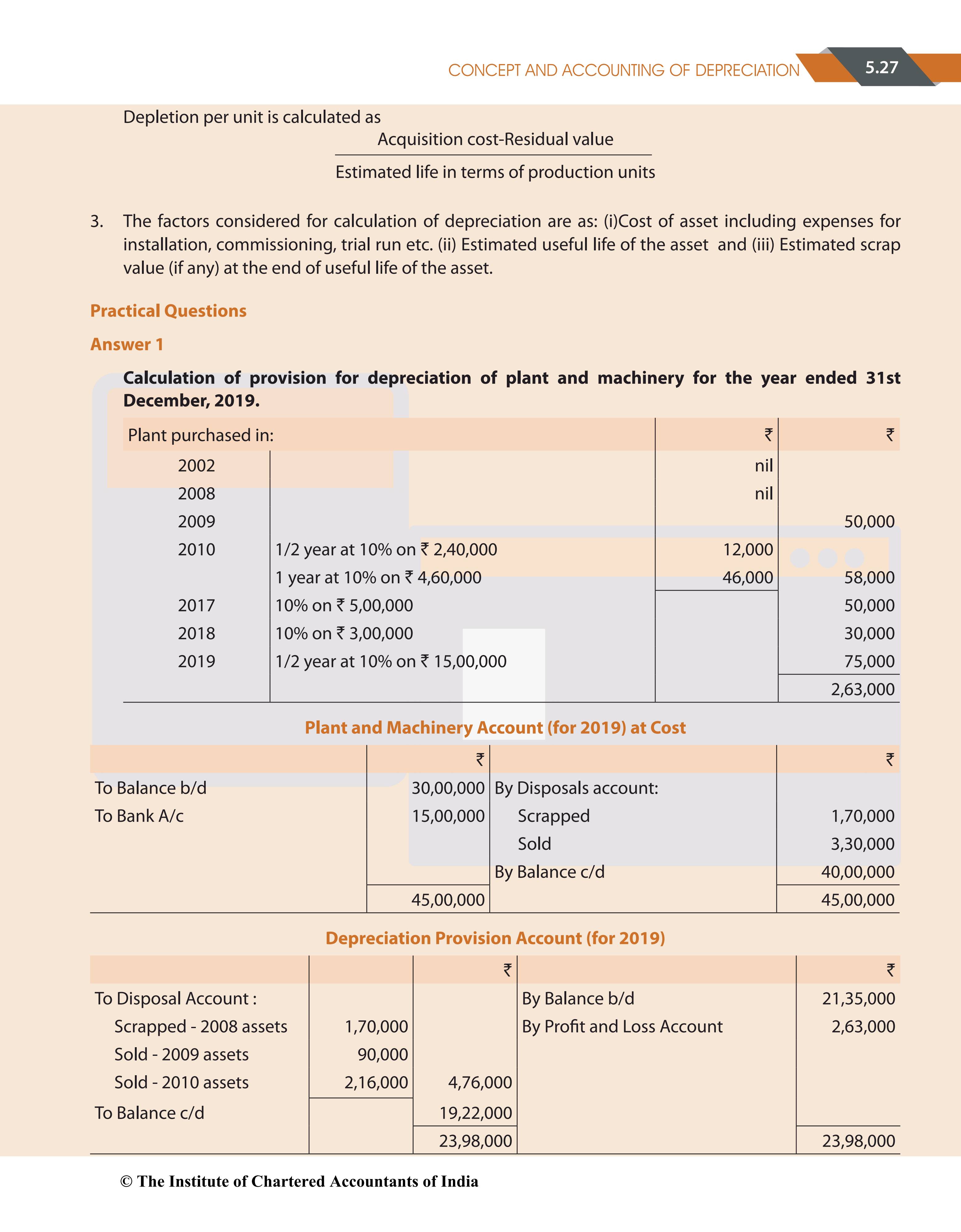

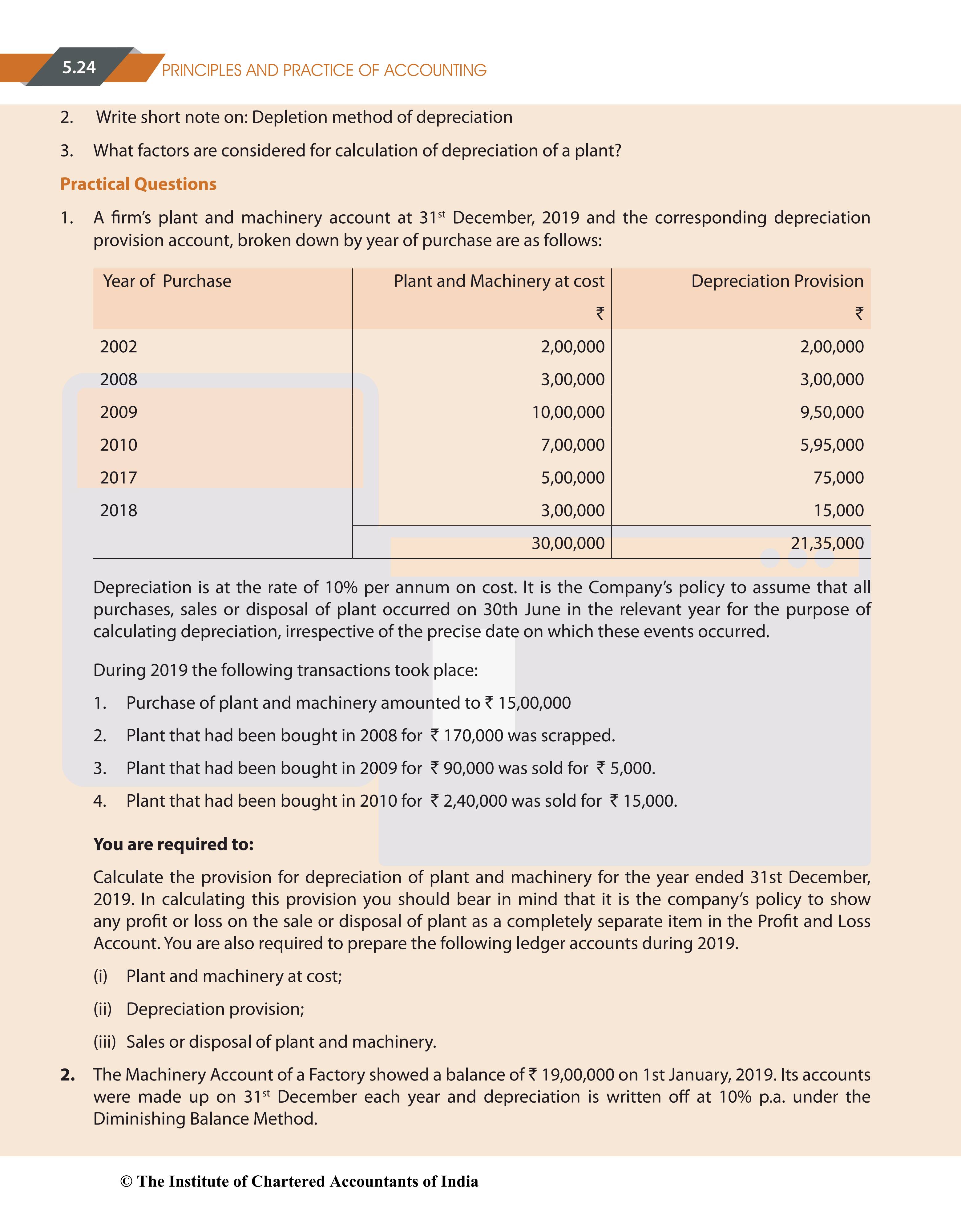

1st question in practical question 1) In the anwer I understood the plant & machinery account, but why we debiting the depreciation provision account and crediting the sale/disposal of plant and machinery account? 2) In the debit side of depreciation provision account, how the value of sold-2010 asset became 2,16,000?

Answers (4)

Depreciation provision account has the accumulated depreciation of the asset....... when you dispose the asset, the corresponding values - gross value and depreciation provision has to be removed from the balances Hence they are transferred to the Sale of Asset A/c ...... after transfer of such balances, the balance figure is the net value of the asset

(2) 2,16,000 As at 31st Dec 2019 , provision for depreciation balance for assets sold = 2,40,000 x 595000/700000 = 2,04,000 Depreciation provision for the same asset for 2020 till sale time = 2,40,000x10%x1/2 = 12,000 So total provision for depreciation as on 30/6/20 is 2,16,000

Thread Starter

Vijay KWhat is accumulated depreciation?

Total depreciation charged on the asset till date from the purchase date