Forums

Doubt

Accountancy

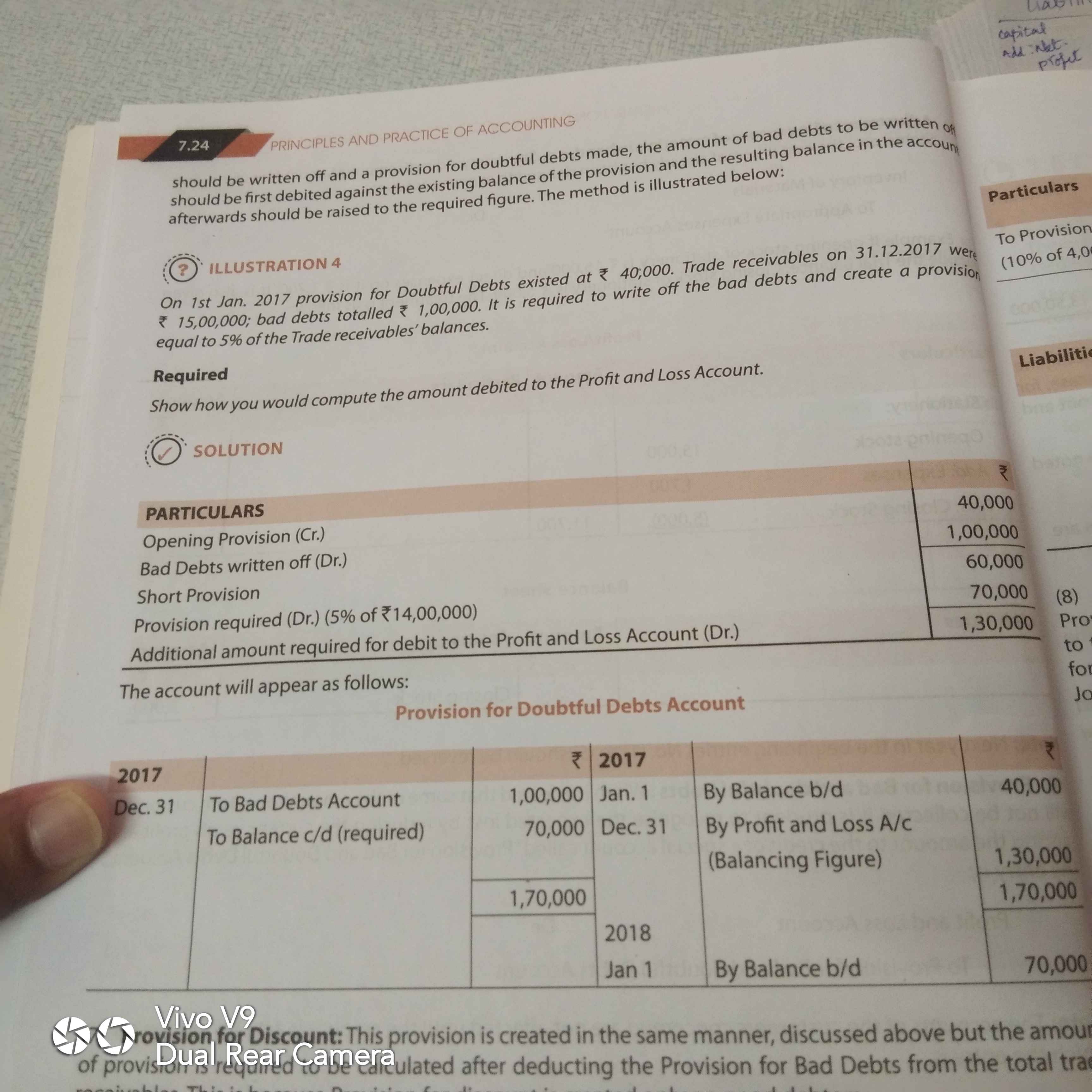

On 1st jan provision for doubtful debts existed at 40,000.Trade receivables on 31-12-17 were 15,00,000;bad debts totalled 1,00,0000.it is required to write off the bad debts and create a provision equal to 5% of trade receivables balances. In the above problem when we create provision for bad debts account why we enter open balance of provision for doubtful debts in credit side of provision account. Can any one suggest me so that it would be helpful

Answers (16)

But in question they was mentioned the word existed means provision was already created last year I think So basically provision for doubtful debts is debit balance Ie we enter the amount in asset in trade receivables So next year the amount will be credited to the provision for doubtful debts a/c as opening balance I think.

Provison for doubtful debts has a credit balance. Asses side of balance sheet shows debit balance and provision is a liability created against debtors.And liability has credit balance so instead of showing provision as a liability it is shown on the asset side by deducting the amount from debtors. it is just a presentation to show in balance sheet

Gaurav ojha

For creation of provision journal entry is Bad debts A/c dr. To provision for doubtful debts A/c

Sorry this entry is wrong correct entry is Profit and loss A/c Dr. To provision for doubtful debts

Now you have to create a new provision for 60000 and also another provision @5% of the amount of trade receivables after deducting 100000 from trade receivables. So now you have to create a new fresh provision for 130000(60000+70000) by debiting profit and loss account

Gaurav ojha

Sorry this entry is wrong correct entry is Profit and loss A/c Dr. To provision for doubtful debts

This is the correct journal entry for creating new provision

When the amount is not recoverable we call it bad debt and reduce it from debtors. Bad Debts A/c Dr. [This is ultimately transferred to P&L] To Trade Receivables/Sundry Debtors [Here actual balance in debtor is being reduced] What is a provision for bad debt? Basically , the business is keeping aside some amount to take care of bad debts which might arise in future. Say Current debtors are 1,00,000 and the company expects 5% will not pay (based on past experience). For this the company would make a provision of Rs.5,000. Here the company would not credit the debtors by 5,000 (as we do in case of actual bad debt) because the debtors is not yet bad. So for this we create a provision (set aside amount from profits). Profit & Loss Dr. To Provision for bad debt (This will always be a credit balance) Now in next year say 0,000 of debtors became bad. Bad Debts Dr. 9,000 To Debtors 9,000 Now the bad debt is an expense which has to be transferred to P&L. Out of 9,000 , 5,000 was already provided last year. So we will use that provision now. Dr. Provision for bad debt 5,000 Dr. Profit & Loss 4,000 (for balance ) Cr. Bad debts 9,000. For any new provision to be created, similar entries as passed earlier. [These are actual entries - In exams we can combine and pass entries]