Forums

Esop accounts

Accountancy

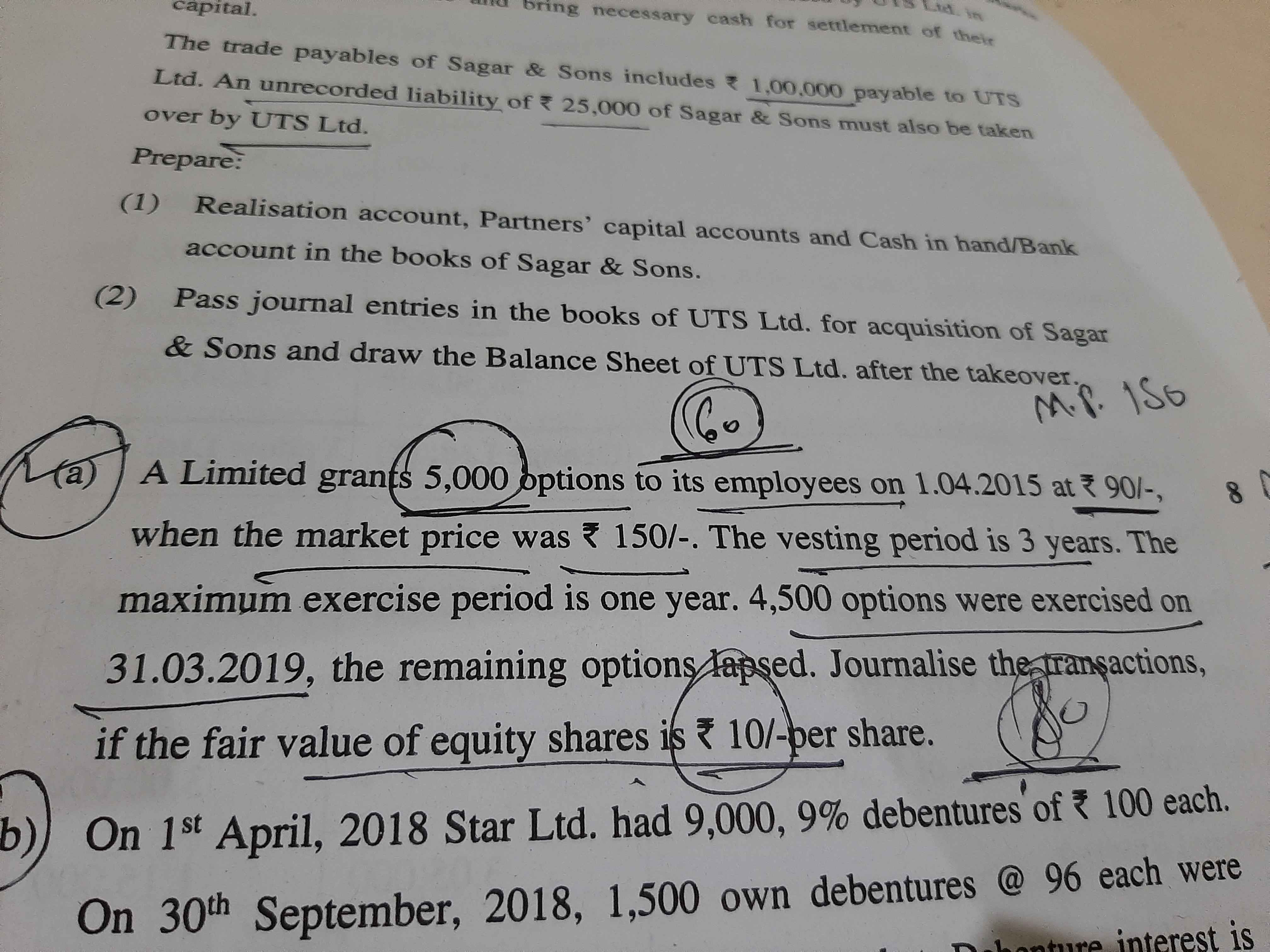

In this question please tell the use of fair value and market value. This is nov 19 question.

Answers (8)

The enterprise should measure the fair value of shares or stock options on the grant date, based on Market value , if available. In the absence of Market value the fair value of the grant is estimated based on a valuation technique. Fair value is generally used when there are post vesting restrictions when the shareholder cannot sell his shares in the open market and hence he has to use the fair value of shares to measure the grant or option

Thread Starter

Amit VermaWhy didn't we considered fair value given in the question?????

As i already mentioned. In this question there is no mention about the vesting restrictions. Hence the shareholder can sell in open market and that is why we have considered Market value. Fair value would be taken if there were any restrictions imposed and shareholder and he could not sell his shares in open market