Forums

Final accounts

Accountancy

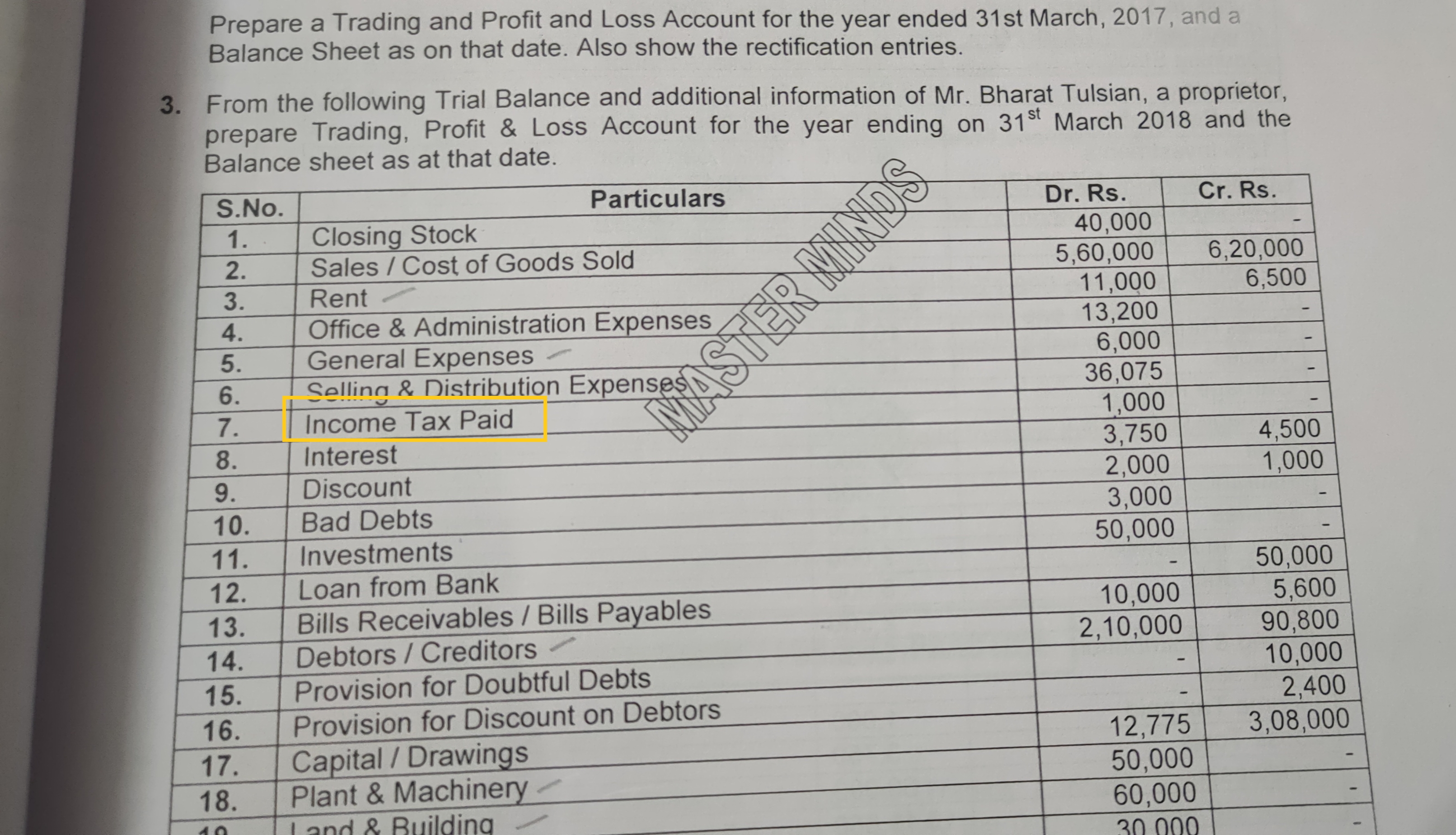

when income tax paid is given inside trial balance Then we should deduct from drawings know sir?

Answers (8)

Thread Starter

siva chaitanyaMam, can you explain

Any other information given on income tax paid under additional information

Thread Starter

siva chaitanyaCan you please explain mam

It will be deducted from capital in the balance sheet. It will be treated similar to drawings as income tax in case of propreitor is personal liability