Forums

Gift to employee

Direct Taxation

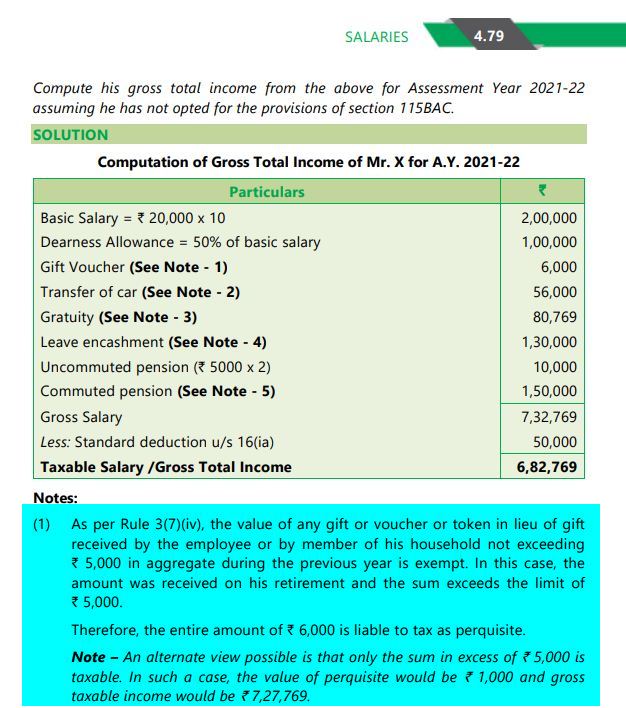

Gift to employee is exempt upto 5000. If the gift is above 5000, under which head will it be taxable?

Answers (9)

Venkateshwara Prabhu

Under the head "salary" and whole amount is taxable as gift value is more than 5000rs

Excess over 5000 is taxable, not the whole amount in case of gift in kind. Check.

Deepak Gupta

Taxable as perquisite under the head 'Income from Salary'.

Gifts up to Rs. 5,000 in the aggregate per financial year would be tax exempt in the hands of the employees. The excess value of gift over and above Rs. 5000/- would be taxed as a perquisite in the hands of the employees.

In study material, ICAI has given both the approaches: Approach-1: If above 5k, then entire amount taxable Approach-2: Amount above 5k will be taxable Dr. Girish Ahuja book says: Amount above 5k will be taxable In exam: Solve as per ICAI Approach-1 and give note for Approach-2