Forums

Gst

Indirect Taxation

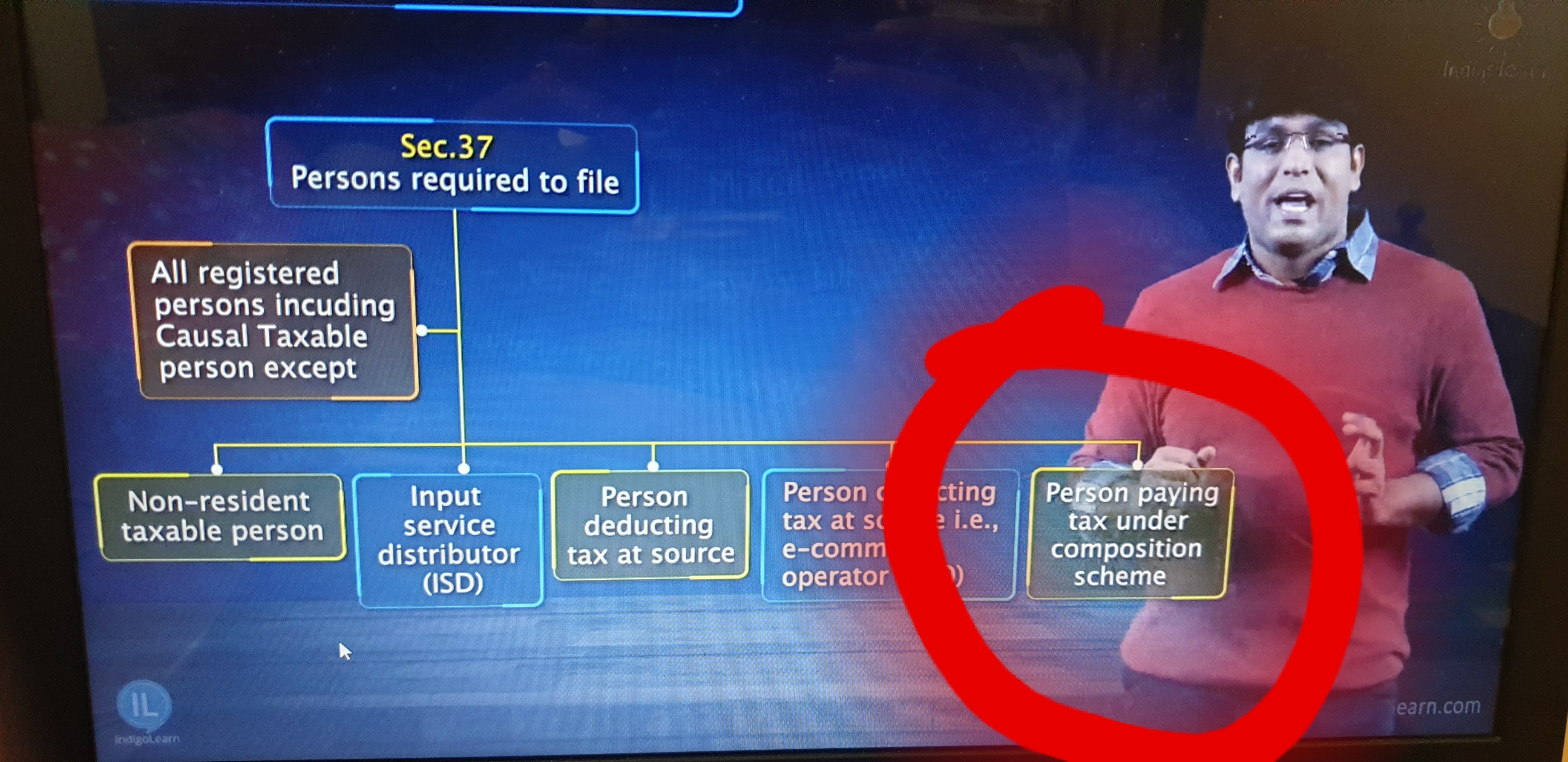

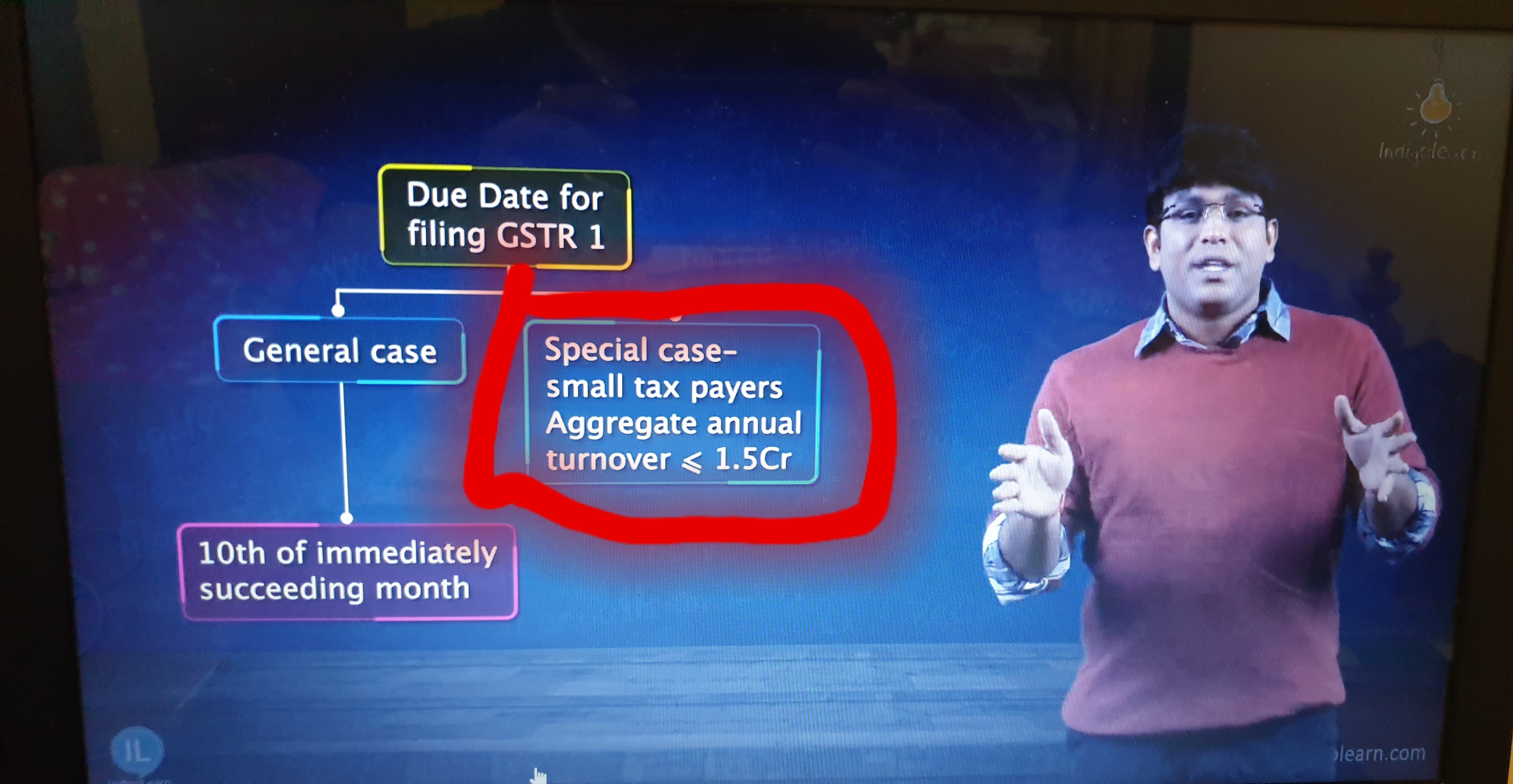

In GSTR-1 it is said that the composition scheme registrated person is not required to file this return but also it is special case of filing this return for small tax payers So won't this make registrated person under scheme to file return?

Answers (7)

Best Answer

Thread Starter

Swathi KrishnaK that but the above one small taxpayers means ?

Person who are register in regular scheme and they turnover over is less than 1.5 crores can opt to File GSTR-1 quarterly instead of monthly