Forums

Holding period of asset acquired without consideration

Direct Taxation

When 'asset acquired without consideration' is transferred,does the period of holding of previous owner is includable or not??

Answers (9)

Best Answer

Thread Starter

Nagesh S Hegde???????

Yes. Many court verdicts and tax tribunals have held that for gifted or inherited property (capital asset), the period of holding should be considered from the time the previous owner acquired it. Based on such period of holding, an asset would be classified as short term or long term.

Yes. where an asset is acquired by gift or inheritance, the period of long term capital asset shall be reckoned from the date when the previous owner acquired such asset and the indexation shall be allowed accordingly from the year of acquisition by the previous owner.

Sudha Reddy

Yes. where an asset is acquired by gift or inheritance, the period of long term capital asset shall be reckoned from the date when the previous owner acquired such asset and the indexation shall be allowed accordingly from the year of acquisition by the previous owner.

Ok..thank you What if asset acquired not as gift or through inheritance but just without consideration??

Sudha Reddy

Yes. where an asset is acquired by gift or inheritance, the period of long term capital asset shall be reckoned from the date when the previous owner acquired such asset and the indexation shall be allowed accordingly from the year of acquisition by the previous owner.

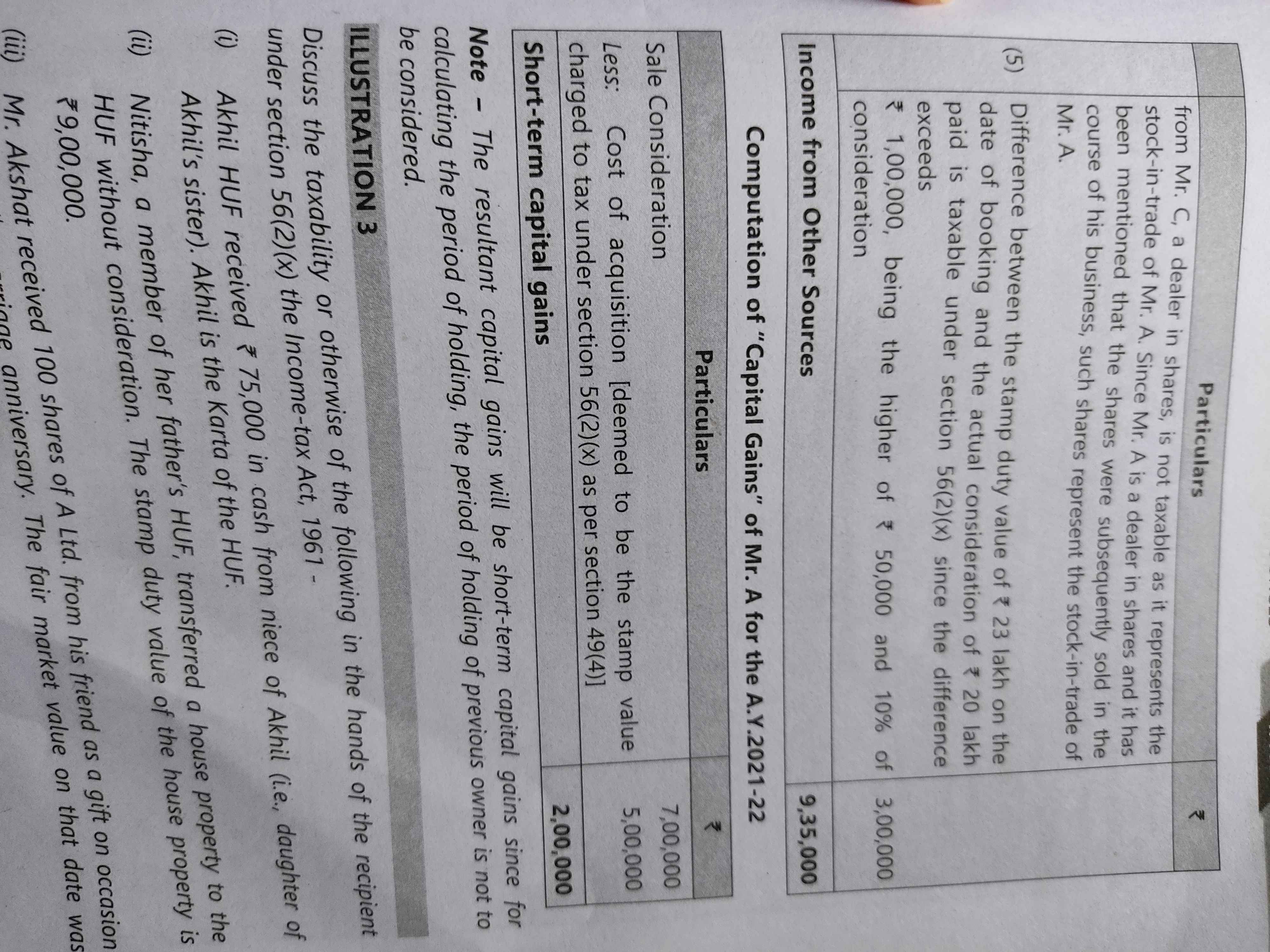

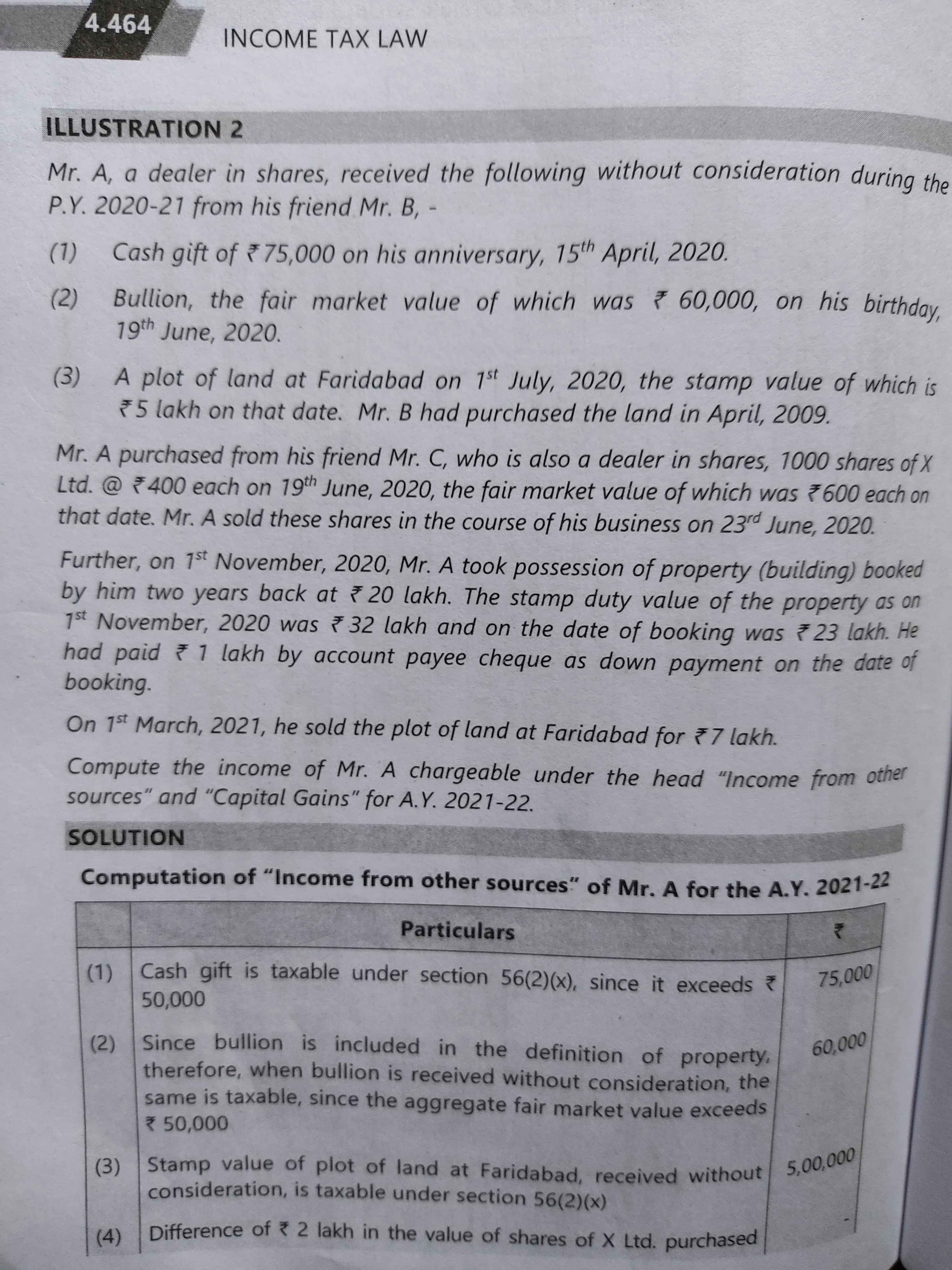

Check the note mentioned here,,here they have not considered period of holding of previous owner

Thread Starter

Nagesh S HegdeCheck the note mentioned here,,here they have not considered period of holding of previous owner

Can you give us the illustration

Sudha Reddy

Can you give us the illustration

My query is particularly whether to consider the period of holding of previous owner While determining whether the capital gain is long term or short term.

Sudha Reddy

Yes. Many court verdicts and tax tribunals have held that for gifted or inherited property (capital asset), the period of holding should be considered from the time the previous owner acquired it. Based on such period of holding, an asset would be classified as short term or long term.

I had attached a icai study mat illustration in this chat earlier where for determining transferred asset as short term or long term they haven't considered period of holding of previous owner..can I conclude that as a error?

Thread Starter

Nagesh S HegdeI had attached a icai study mat illustration in this chat earlier where for determining transferred asset as short term or long term they haven't considered period of holding of previous owner..can I conclude that as a error?

Only when it is a gift/ inheritance then period of holding of previous owner considered. In the given illustration, cash received is specifically given as gift. but Property is not mentioned as gift it is given as received without consideration, so if the assumption is gift then it will include the previous owner holding period to determine the capital gain, if it is not assumed to be a proper gift then previous owner's holding period will not be considered.