Forums

ITC of Capital Goods

Indirect Taxation

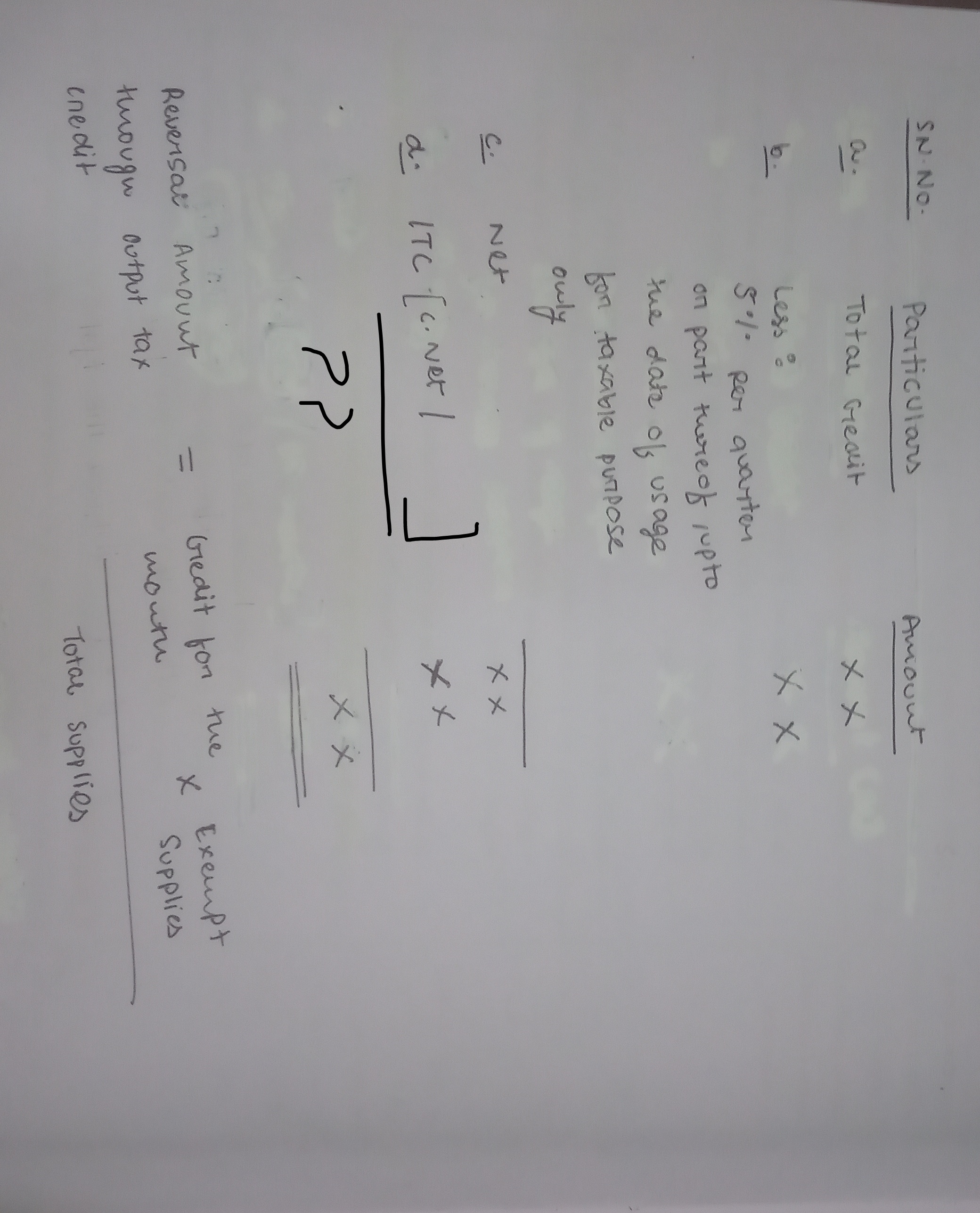

In case the capital asset is used initially for business purposes but later on for both taxable and exempt. The so called amount calculated by Input Tax Credit Availed - (5% per quarter * No. Of Quarter) is done My question is The resultant figure will then be divided by 60 or (60 - no. of months expired)

Answers (1)