Forums

Impact of eligibility of input tax credit on value of supply

Indirect Taxation

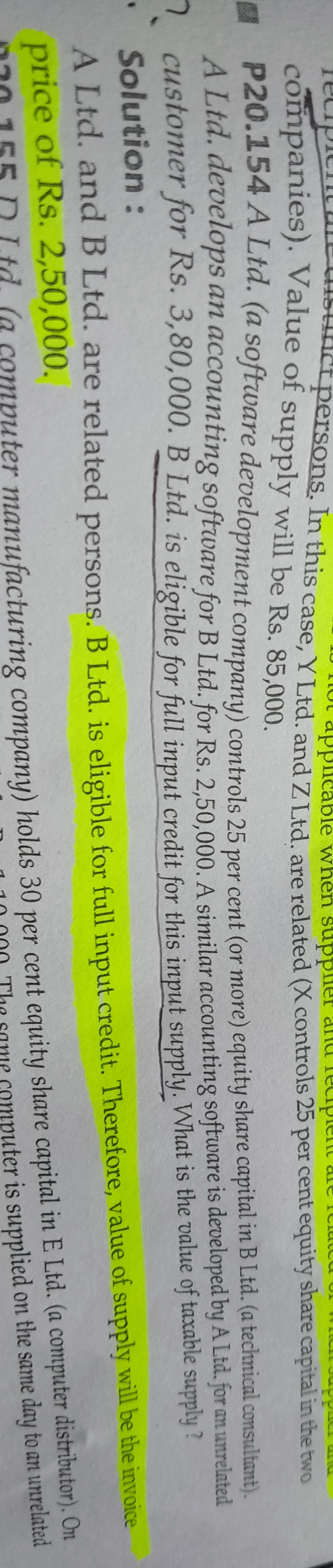

Question : A ltd(software development company) controls 25% equity capital in B Ltd(a technical consultant). A ltd develops a accounting software for B ltd for rs. 2,50,000 . A similar accounting software developed by a ltd for an unrelated person for rs. 3,80,000. B ltd is eligible for full input credit for this input supply .what is the value of taxable supply ? Kindly explain it sir . And also tell me what is the inpact of full eligibility on taxable value of supply ..

Answers (3)