Forums

Income frm other persons included in assessee total i come

Direct Taxation

Y hv dey bifurcated house property?

Answers (5)

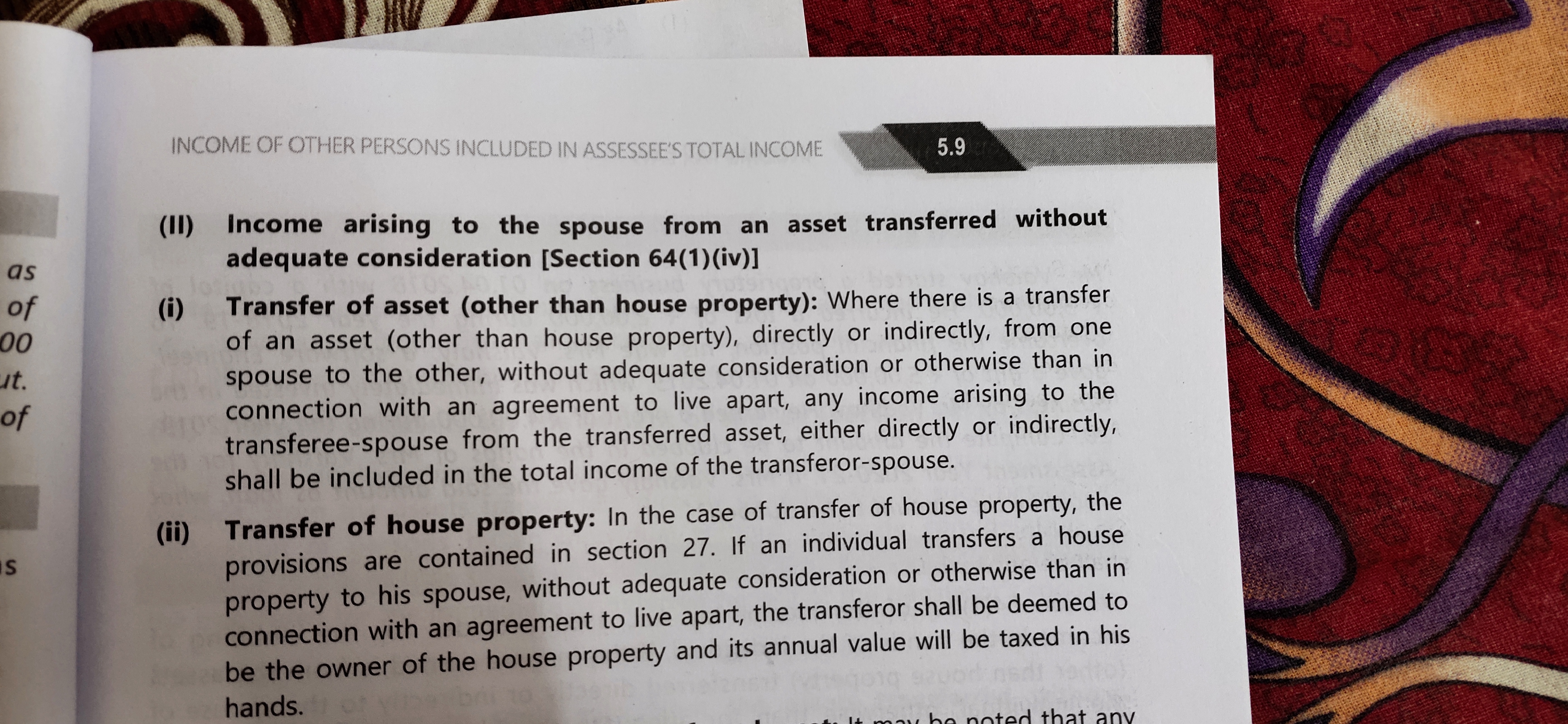

27. For the purposes of sections 22 to 26â?? (i) an individual who transfers otherwise than for adequate consideration any house property to his or her spouse, not being a transfer in connection with an agreement to live apart, or to a minor child not being a married daughter, shall be deemed to be the owner of the house property so transferred; This is covered specifically by above section. So the transferor will be deemed owner and the income will be taxed in hands of the deemed owner and hence no need to club again.

1.And now fr example the transferror has 2 self occupied house and this transferee property is also self occupied then will the provisiom apply i.e oly 2 is self occupied and other is deemed let out... 2.and in case of interest of loan aggregate of 2lakhs inclusive of the transfered property. Or the limit will b separate fr it sir

Thread Starter

Shru Kanda1.And now fr example the transferror has 2 self occupied house and this transferee property is also self occupied then will the provisiom apply i.e oly 2 is self occupied and other is deemed let out... 2.and in case of interest of loan aggregate of 2lakhs inclusive of the transfered property. Or the limit will b separate fr it sir

2 self occupied and one deemed let out. The aggregate limit is 2 lakhs.