Forums

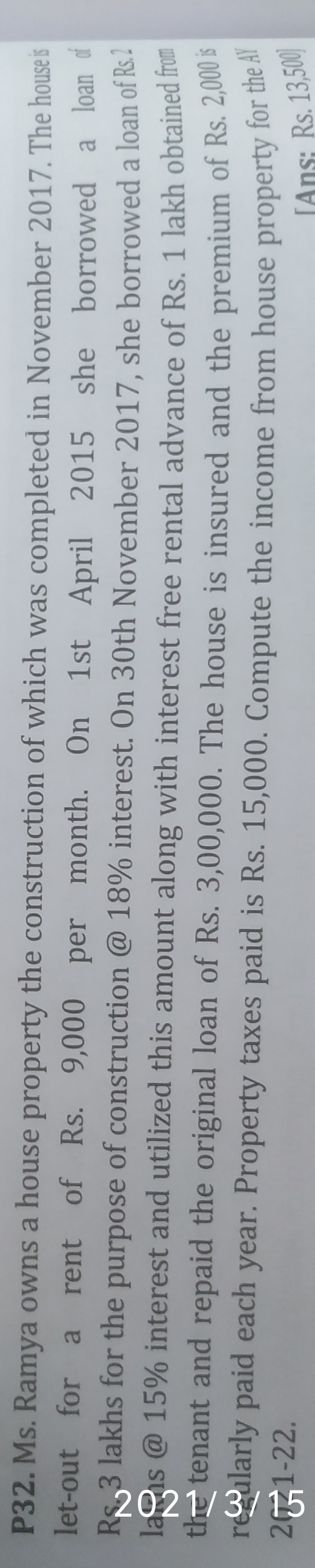

Income from house property

Direct Taxation

Treatment of interest

Answers (5)

CA Suraj Lakhotia Admin

Can you elaborate your query?

Regarding Amount to be deducted as interest u/s 24(b)

Thread Starter

G. @95148Regarding Amount to be deducted as interest u/s 24(b)

Interest on home loan is allowed as deduction u/s 24(b) and not the interest on interest. Self occupied - Rs.2,00,000 (max) but Rs.30000 if loan is prior to 1/4/99. Let - out or deemed let out - the entire interest on the home loan is allowed as a deduction. The interest limit is applicable per assessee i.e. in case of joint owners both the home loan bearers are entitled to claim the interest separately in their income tax returns provided both of them are legal owners of the property.