Forums

Inventory chapter 4

Accountancy

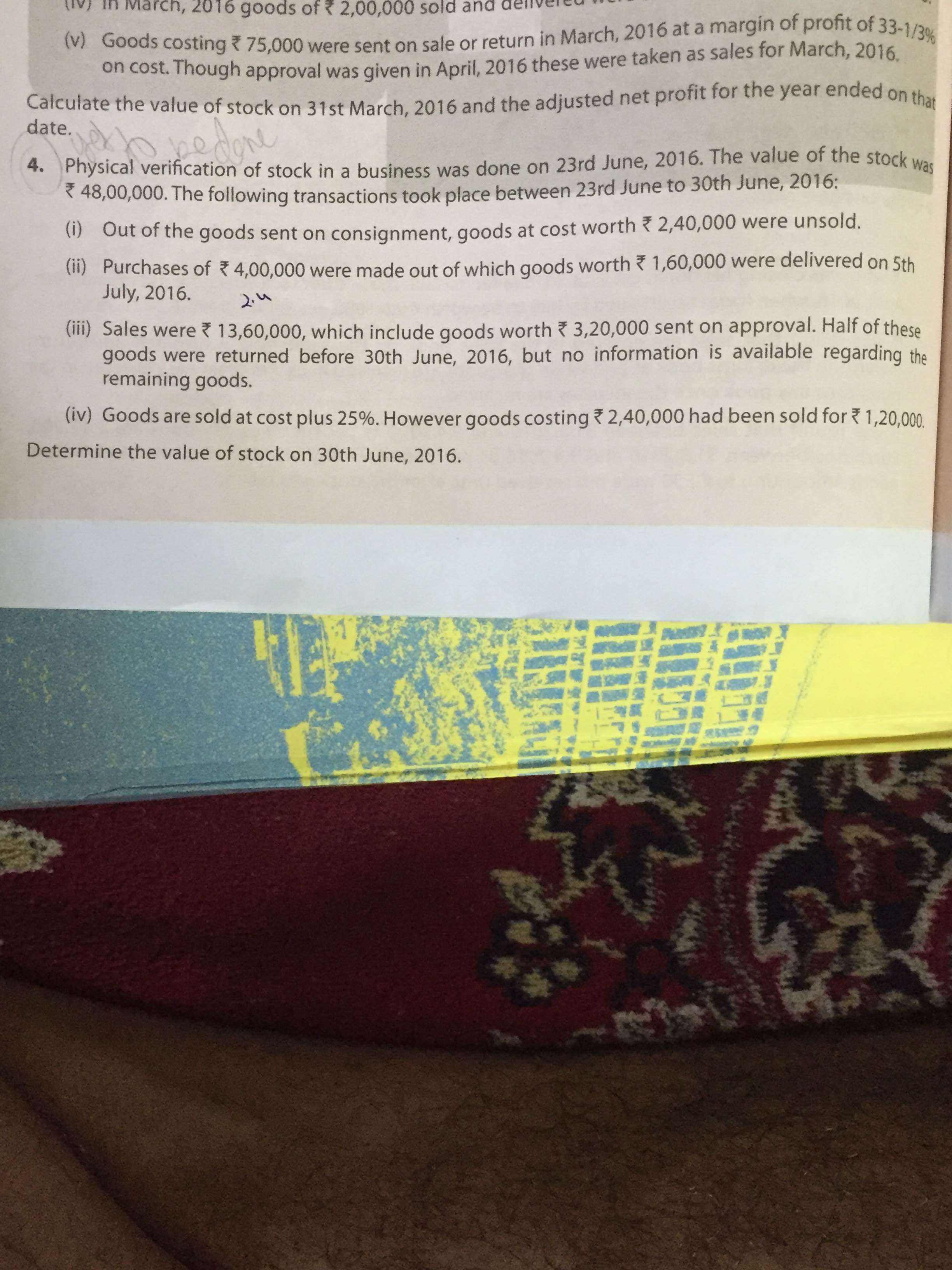

Sir in case the purchase is made in the current year for eg march 2019 and the good are recieved on next year , Now Whether the inventory for the year ended 2019 will include that purchased inventory or not? And one more doubt ie is there a difference between physical inventory and closing stock? If yes then what it is?

Answers (9)

Best Answer

Closing stock means stock that your recognize in your books as your own on which you have owner ship and control. All the risks and rewards on such stock belong to you. w.r.t goods in transit, if the ownership is transferred to you then stock is your yours, if not then stock does not belong to you. Eg: Say you send a truck to pick up material from your supplier on Marc 31st and assume that inventory has been loaded on to your truck is in transit on March 31st then you show that Goods in transit ( GIT) as your closing stock. In same case if delivery terms say that inventory has to be delivered by supplier to your door step and on 31st march supplier has dispatched and goods have not yet reached you but are on highway, then risk and rewards have not been transferred to you and hence you cannot include the goods in your closing stock. Physical stock means all inventory that is physically available.

Thread Starter

Abhishek PurohitSo sir what does valuation of stock means , physical stock or closing stock?

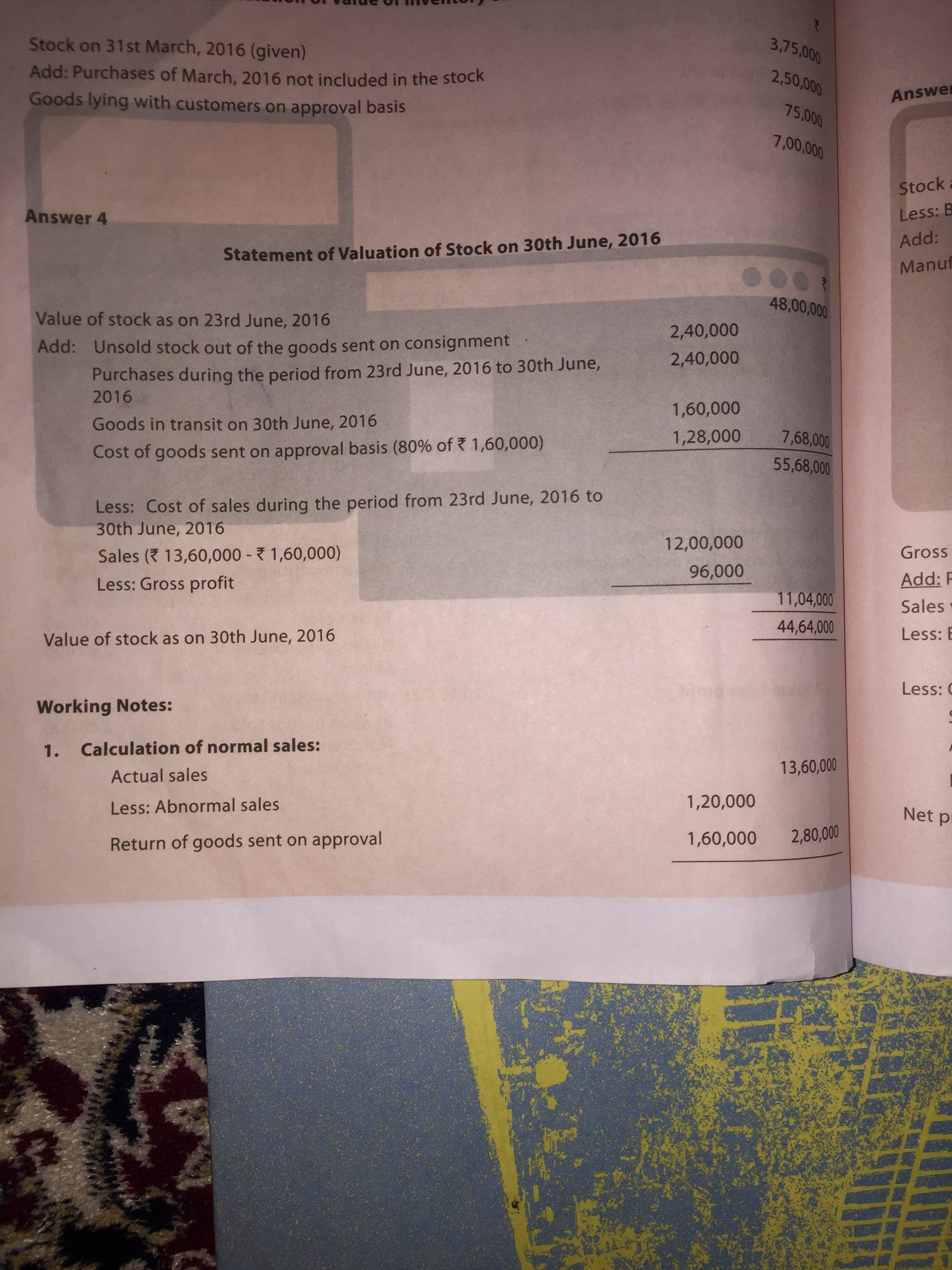

AScertaining value of closing physical stock based on cost incurred and realisable value

Sudha Reddy

AScertaining value of closing physical stock based on cost incurred and realisable value

3rd adjustment in the question i didnt understand

Thread Starter

Abhishek Purohit3rd adjustment in the question i didnt understand

Third adjustment has two aspects (i) Sales 13,60,000 & (ii) Goods sent on approval & returned 50% of 3,20,000 i.e. 1,60,000 Goods returned have to be added to the stock after adjusting profit to the stock on 23rd Jun i.e. 160,000 /125 x 100 = 1,28,000 Sales have to be adjusted from stock at cost , for that arrive at sales removing abnormal sales & goods returned at sale value and then adjust for gross profit