Forums

Investment Decisions

Financial Management

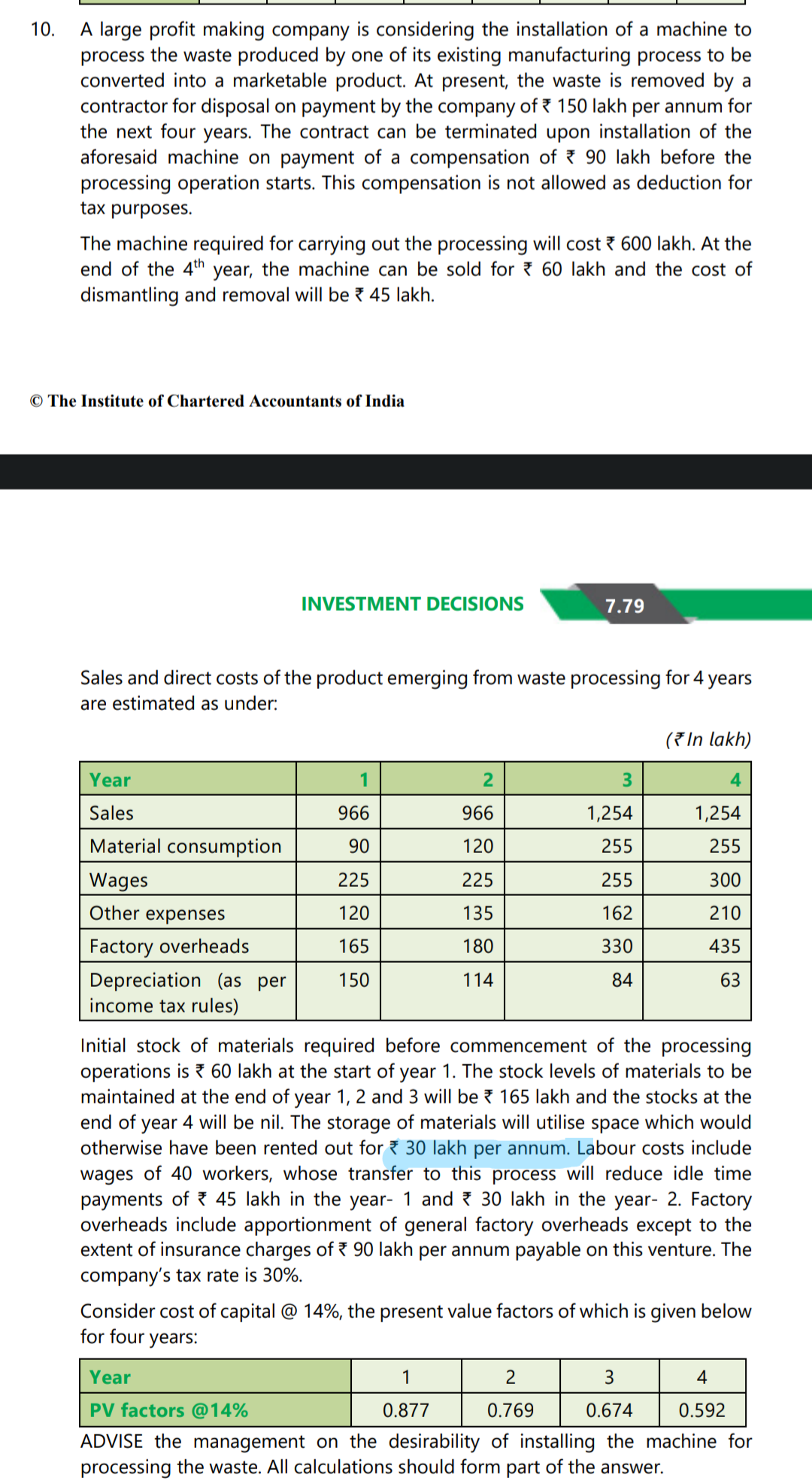

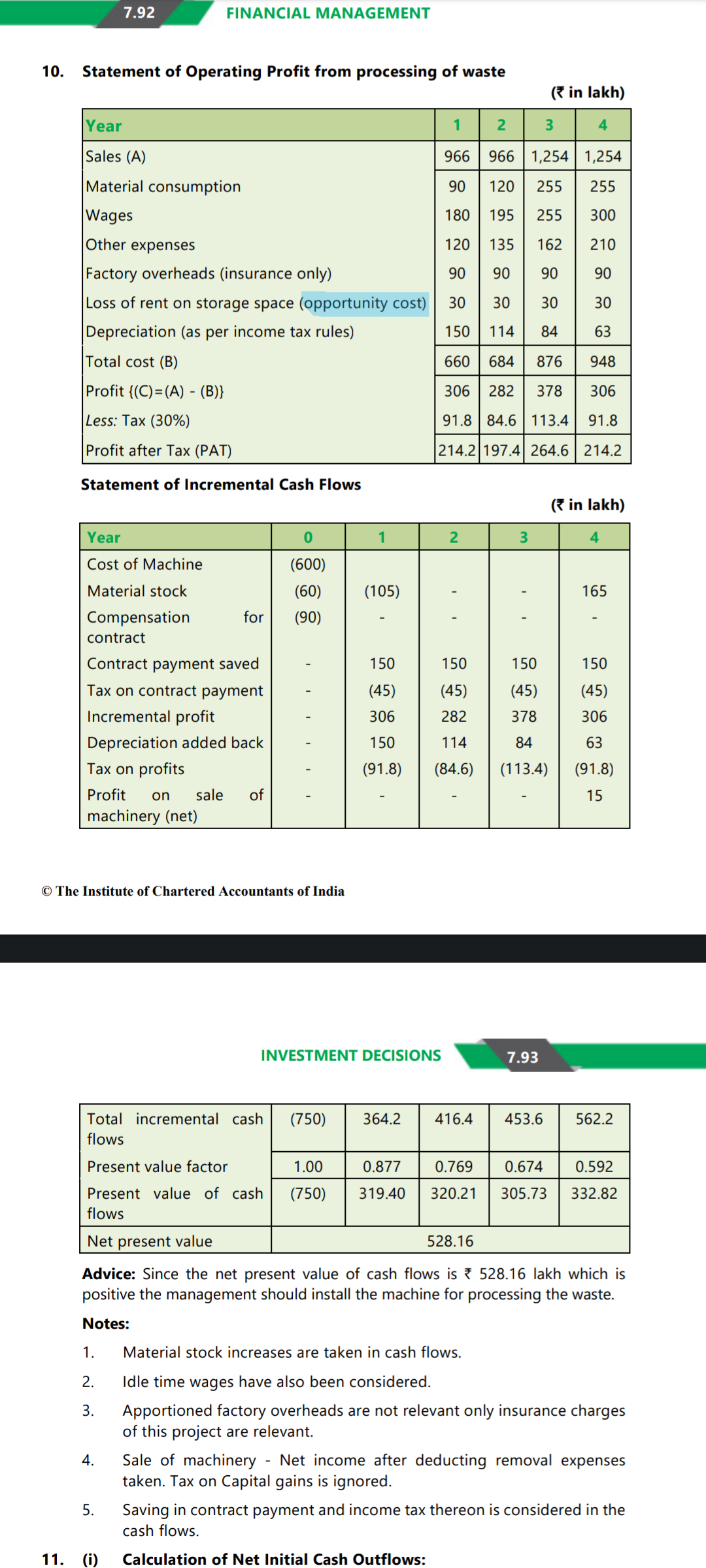

Why opportunity cost considered for tax deduction ?

Answers (3)

Note: It's an investment decision, you are calculating for investment purposes. In simple terms, if opportunity cost is utilised or not, how it affects your decision. If that 30 lakhs is received as income, you have to pay additional tax. But you used it for your productive purpose. So you lose your income, hence you have to deduct it from revenue. Hope it helps you.

Ashik Ahamed

Note: It's an investment decision, you are calculating for investment purposes. In simple terms, if opportunity cost is utilised or not, how it affects your decision. If that 30 lakhs is received as income, you have to pay additional tax. But you used it for your productive purpose. So you lose your income, hence you have to deduct it from revenue. Hope it helps you.

Thanks Ashik for ur reply , the opportunity of 30 lakhs forgone , that should be appropriated for tax rate (1-t) , in these case 30% , so 30(1-3) = 21 lakhs only , that's the opportunity we missing out if we choose other method. That's clear , do we deducting because assuming it's included in sales ?

Thread Starter

Prethivi RajanThanks Ashik for ur reply , the opportunity of 30 lakhs forgone , that should be appropriated for tax rate (1-t) , in these case 30% , so 30(1-3) = 21 lakhs only , that's the opportunity we missing out if we choose other method. That's clear , do we deducting because assuming it's included in sales ?

No, it's not included in Sales, it's an additional income we received from our investment (Land(Fixed Assets)). Now you use it as your PPE (Land(Fixed Assets)).