Forums

LLP - Financial year

Corporate & Other Laws

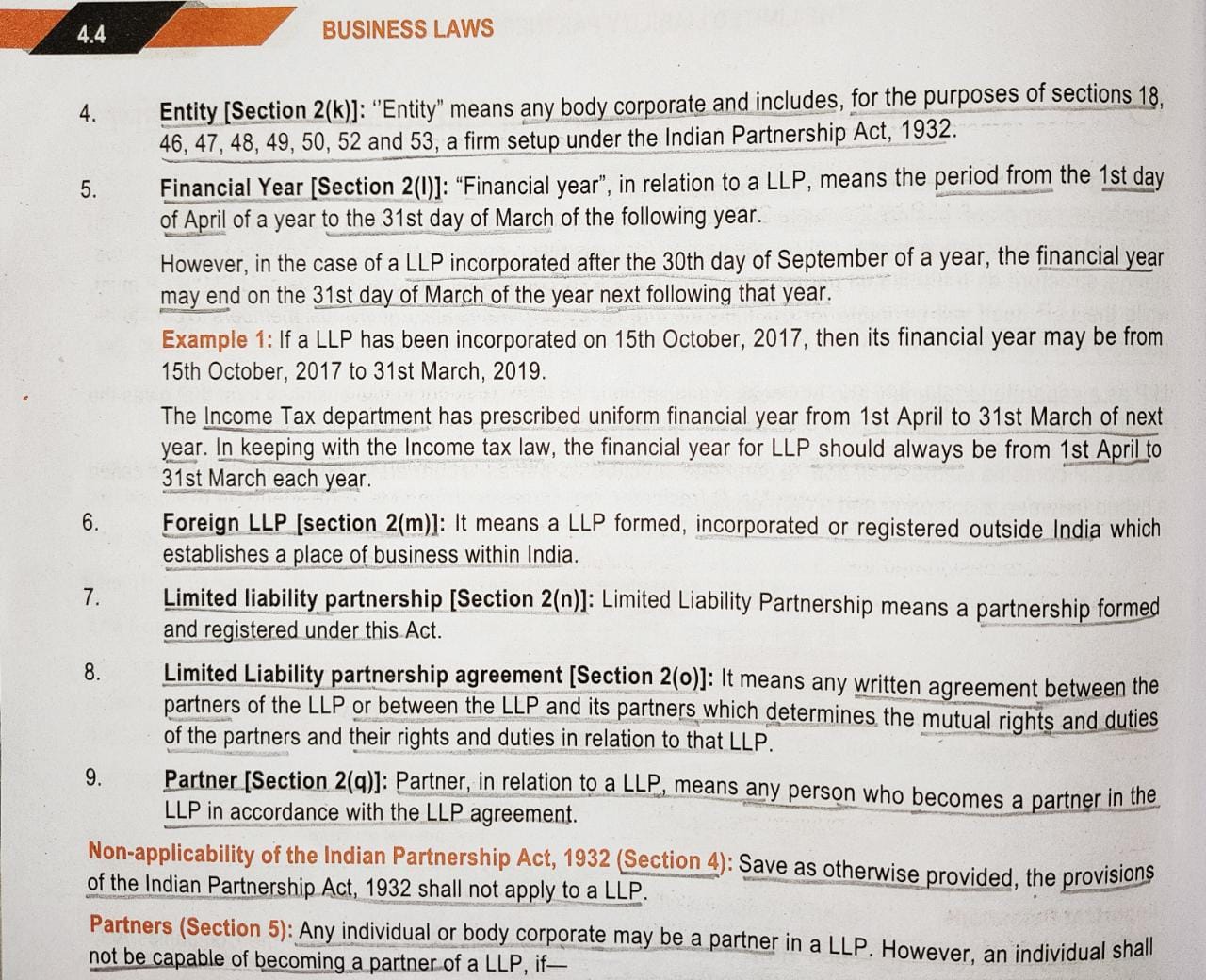

Hello, Kindly explain the financial year of a LLP incorporated after 30th of September. Will the Income tax departments guidance supercede LLP Act's provision to consider 31st March of year next following that year. PFA SM Pic. Thank you.

Answers (3)

Ashlesha Atal Faculty

In case LLP is incorporated on or after 1st October of the financial year, then LLP can close its first financial year either on the immediate or next 31st March, i.e LLP will file details of the first financial year for 18 months.

The LLP is required to file some documents other than the income tax return as well, so for the purpose of those documents the first financial year may end on the 31st March of the next year.

Ashlesha Atal Faculty

The LLP is required to file some documents other than the income tax return as well, so for the purpose of those documents the first financial year may end on the 31st March of the next year.

Ok mam so that means whatever case may be IT should be filled for less than one year(12 months) but other documents can be filled for 12-18 months based on date of incorporation.