Forums

Mcq

Direct Taxation

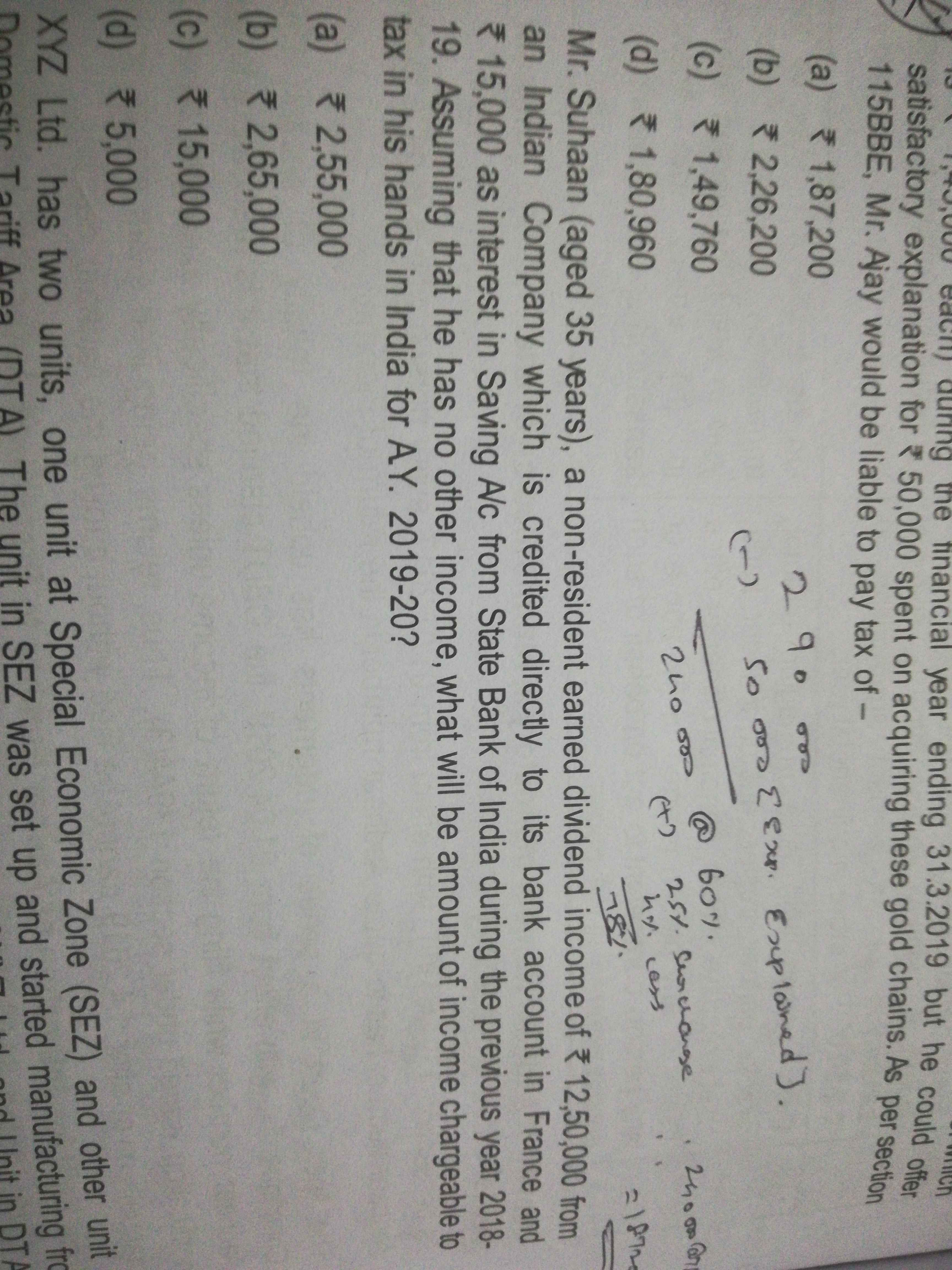

Sir , in this sum , his Taxable income is 255000 but they ask for chargeable income . So , we deduct basic exemption limit . Is it correct sir ?

Answers (17)

Thread Starter

Srini SriramDividend income sir .

Did he's a non resident and received outside , so it's not taxable ? Sir

Thread Starter

Srini SriramDid he's a non resident and received outside , so it's not taxable ? Sir

Dividend income is exempt.

Thread Starter

Srini SriramWhy sir ?

Read 10(34) any income by way of dividends referred to in section 115-O 115-O talks about DDT.

CA Suraj Lakhotia Admin

Sorry my bad. for resident - above 10 lakhs is taxable.

No problem sir . Thank you sir .