Forums

Mcq

Direct Taxation

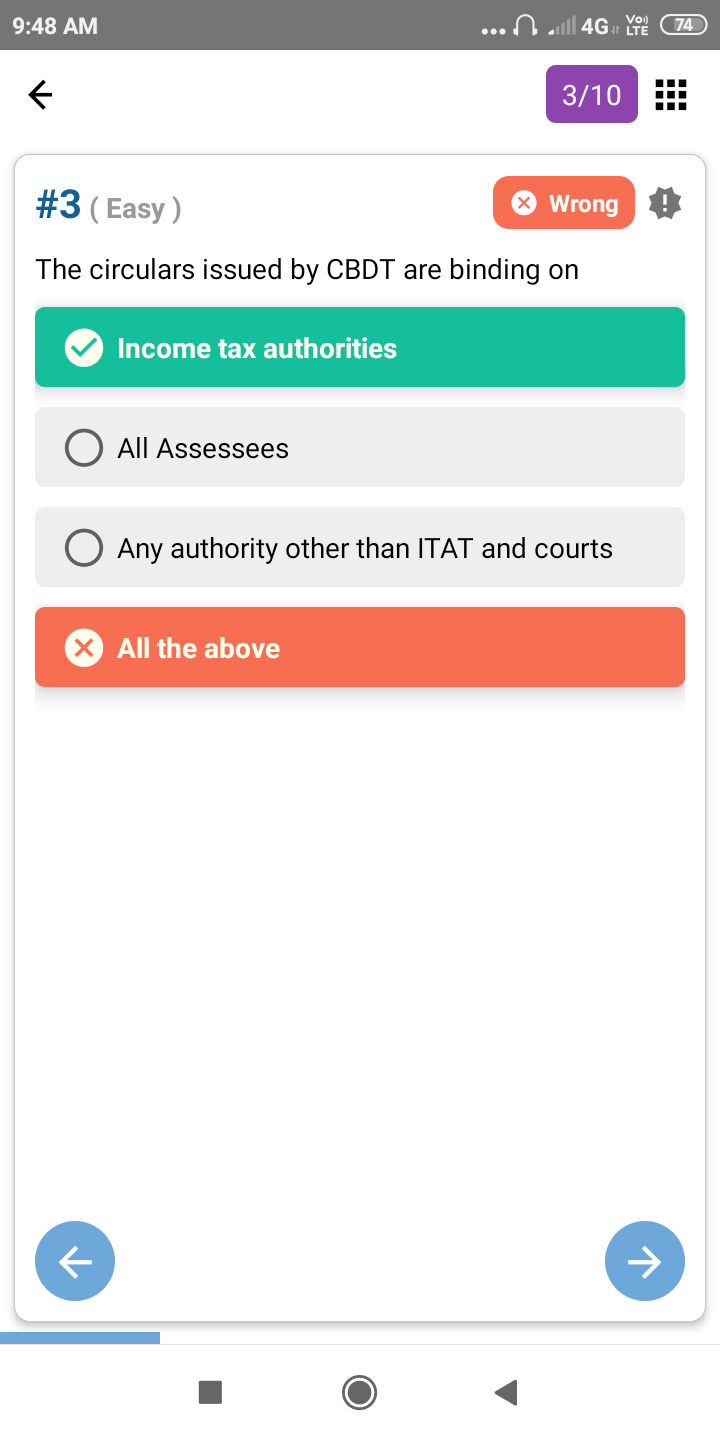

Pls explain how CBDT is not binding generally on taxpayers.without binding only , taxpayers are paying taxes

Answers (2)

Income tax is collected under the Income Tax Act. Circulars are issued by CBDT which is an administrative body. Circulars help in a better understanding of the law or provide clarification on provisions of law. Because tax authorities work under CBDT, the circulars of CBDT are binding on assessee. However, as far as taxpayers are concerned, they can ignore the circulars and have their own interpretation of tax laws.