Forums

Not able to understand certain points in solution

Accountancy

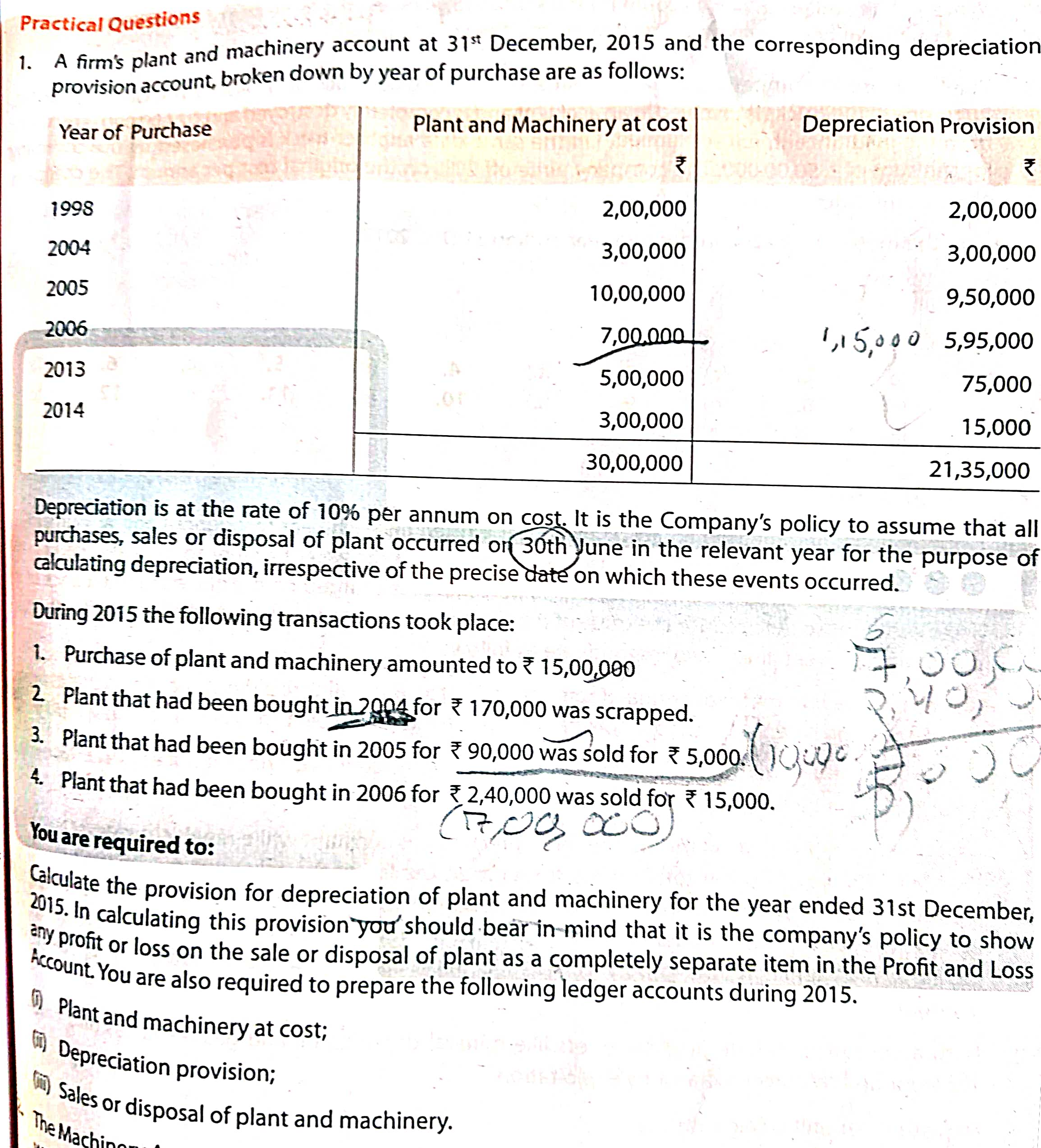

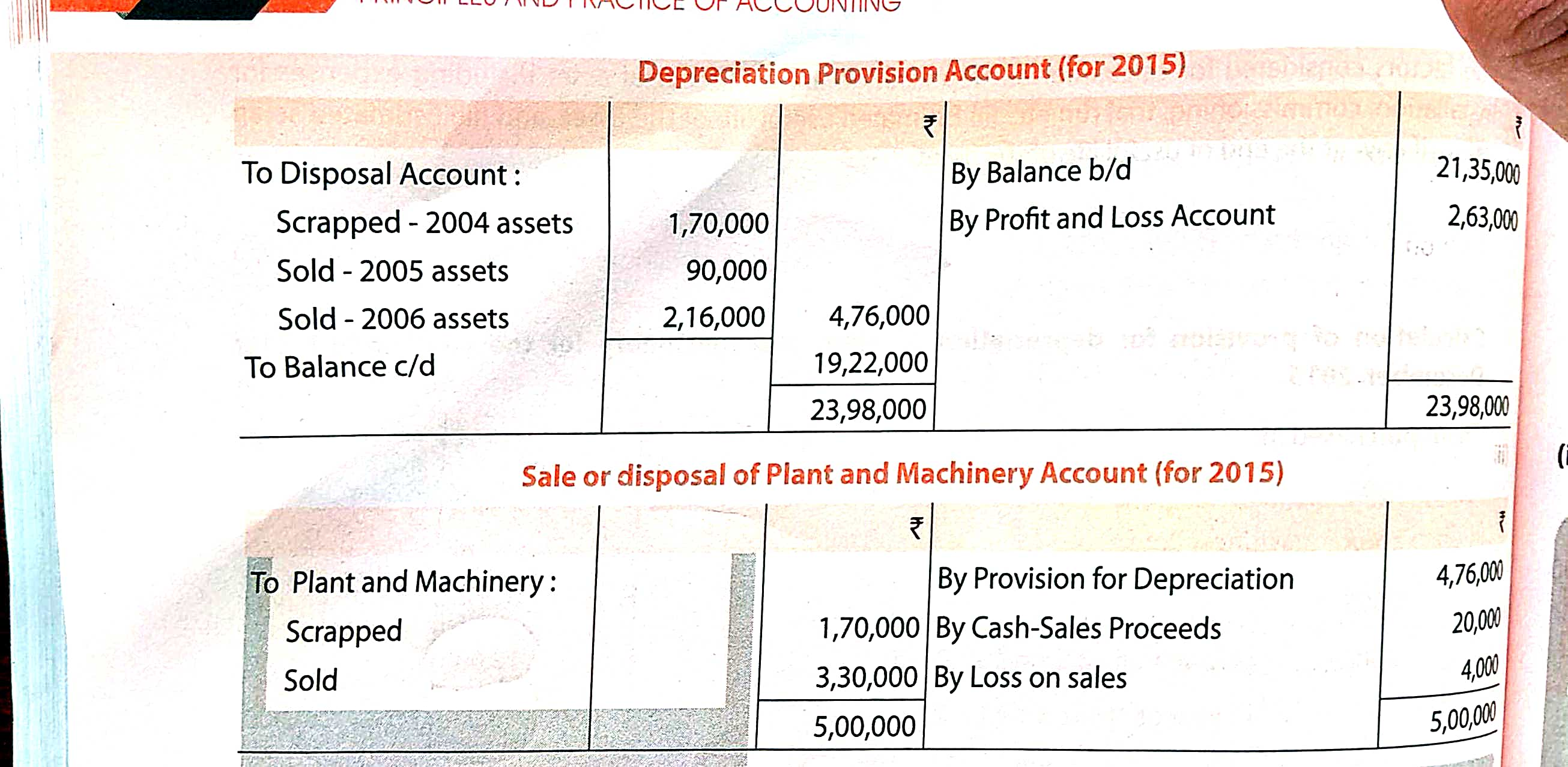

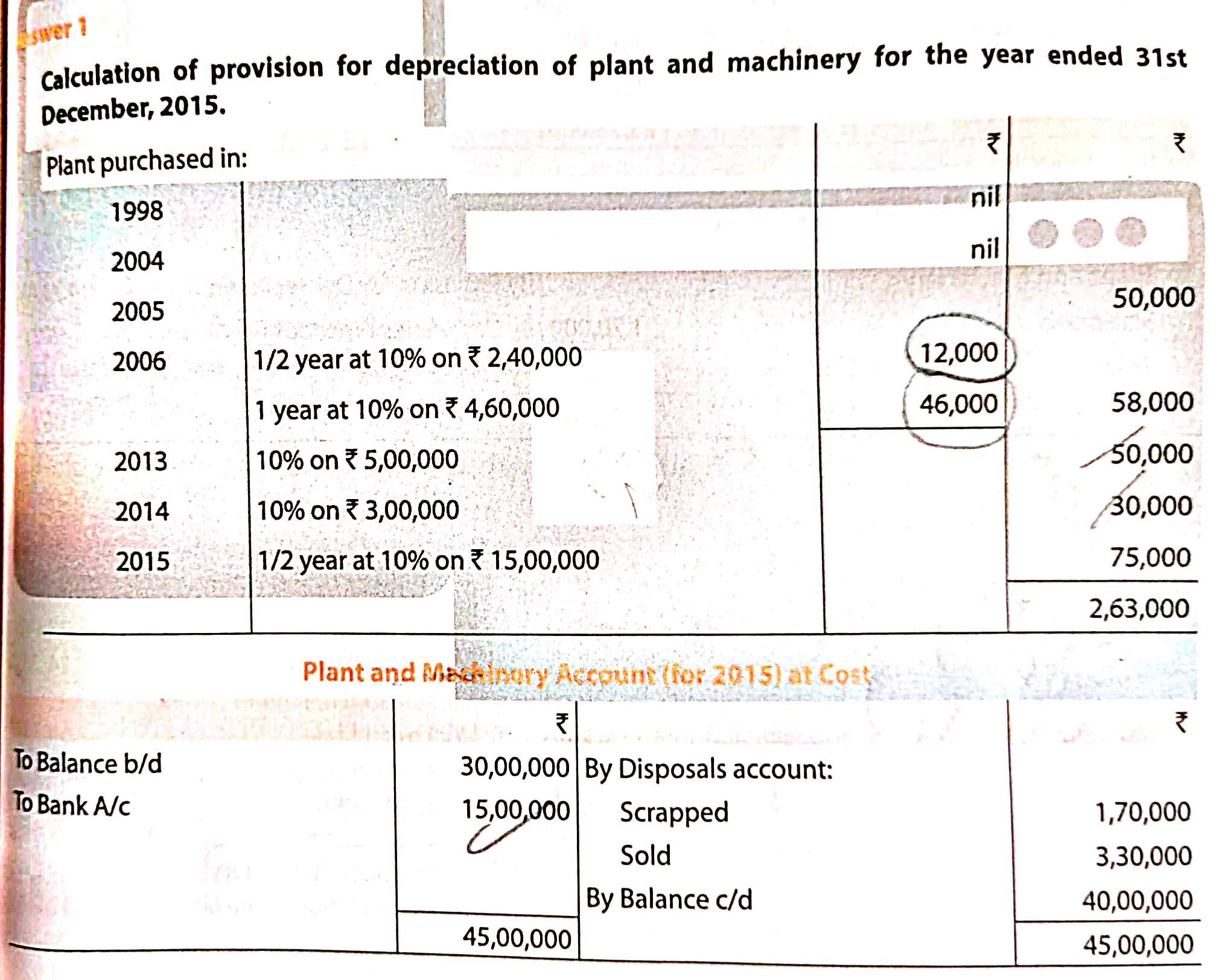

I am attaching question as well as solutions Following are the points I need to understand from you 1.in 2005 in plant purchased we wrote difference of 50,000 and then charged 10 percent dep And in 2006 what was the point of separating 240k and 460k 2.do we always write full value in depreciation provison account like in to disposal account we wrote the cost 3.in sale or disposal account how did we get loss of 4000 4.i need journal entries of all the transaction to understand more clearly Pls give solution as soon as possible

Answers (1)

1. For plant purchase in 2005 - depreciation of 50K was charged ie half year dep - nothing else was done. It is diff between Cost and accumulated depreciation so far - it is fully depreciated by this year 2. We are separating 7 lacs into 240 k & 460K because there is a sale of assets worth 240K. For assets of 2004 / 2005 the P&M is fully depreciated and hence we need not separate them. 3. Yes Depreciation & provision for Dep are always maintained 4. 4K loss computation . on 2004 assets fully depreciated so no loss on scrapping. 2005 asset fully depreciated and hence 5k is fully profit. 2006 asset 90% depreciated so book value is 24K less: amount realised is 15K i.e loss of 9K. total loss i.e 9K loss + 5K profit