Forums

ROI

Direct Taxation

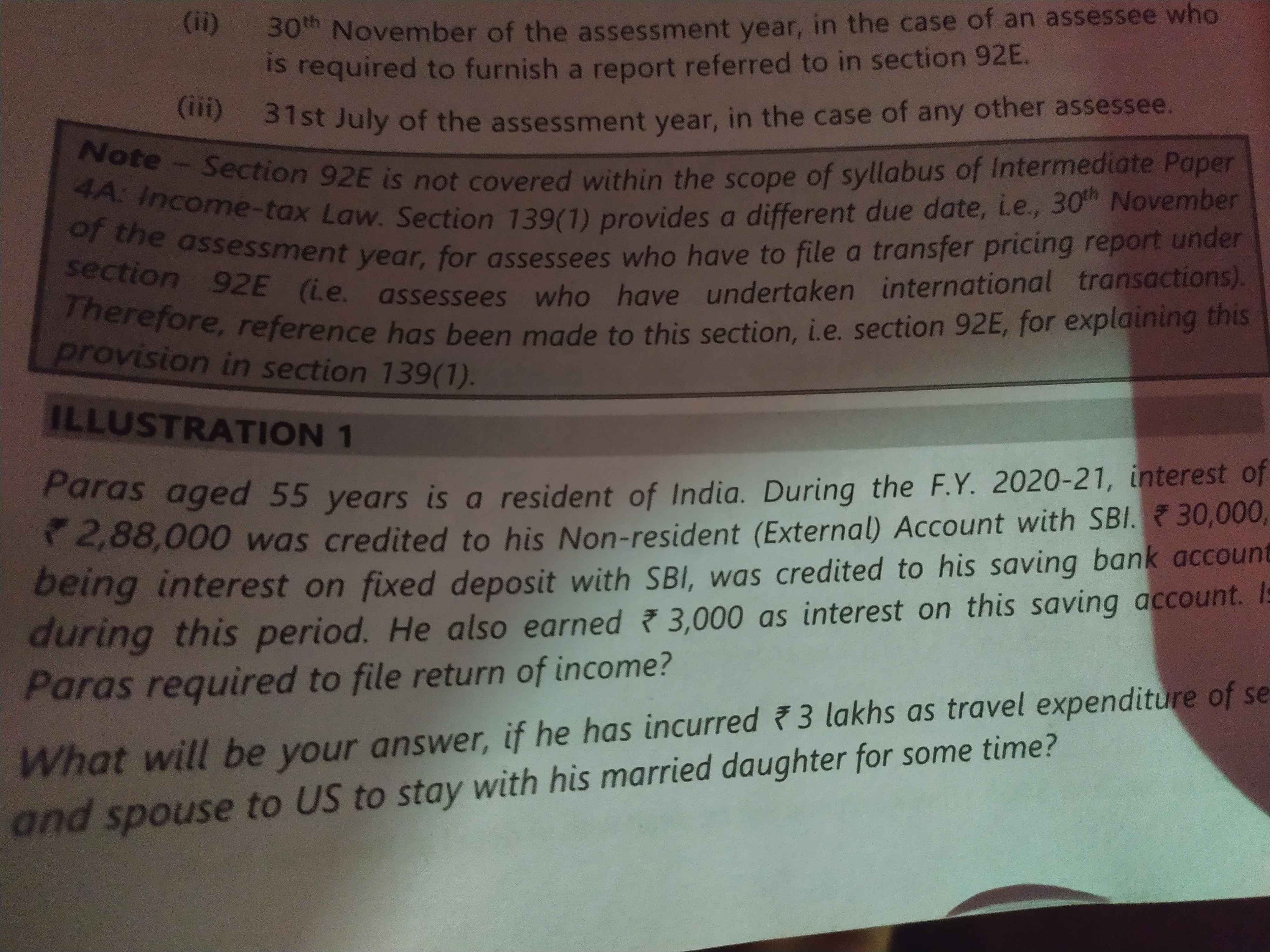

In this example, if mr. Paras has 200,000 as interest of NR a/c and not permitted by RBI then whether it will be liable to file return ?? Plz explain..

Answers (4)

If you are assuming that Mr. Paras has not been permitted by RBI to maintain the account, then it is not exempt. After inclusion, his total income before giving deduction is more than basic exemption limit. Hence he has to file his return. All depends on the assumption.