Forums

Recognized Provident Fund

Direct Taxation

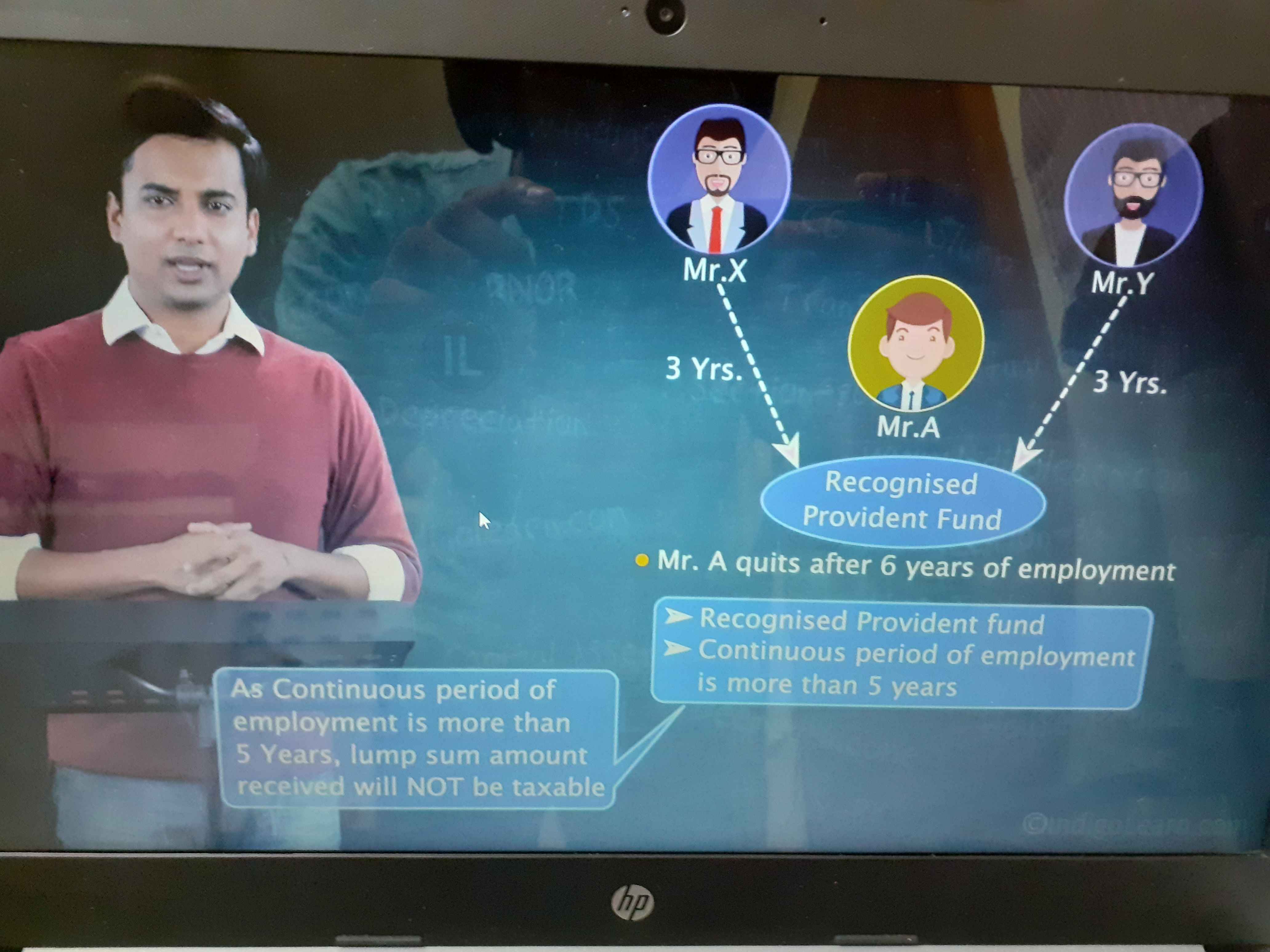

1. What do you mean by recognized by Income Tax act ? 2. Sir in this example , the recognized fund will be different from company to company. So how did it form part as continuous period ?

Answers (7)

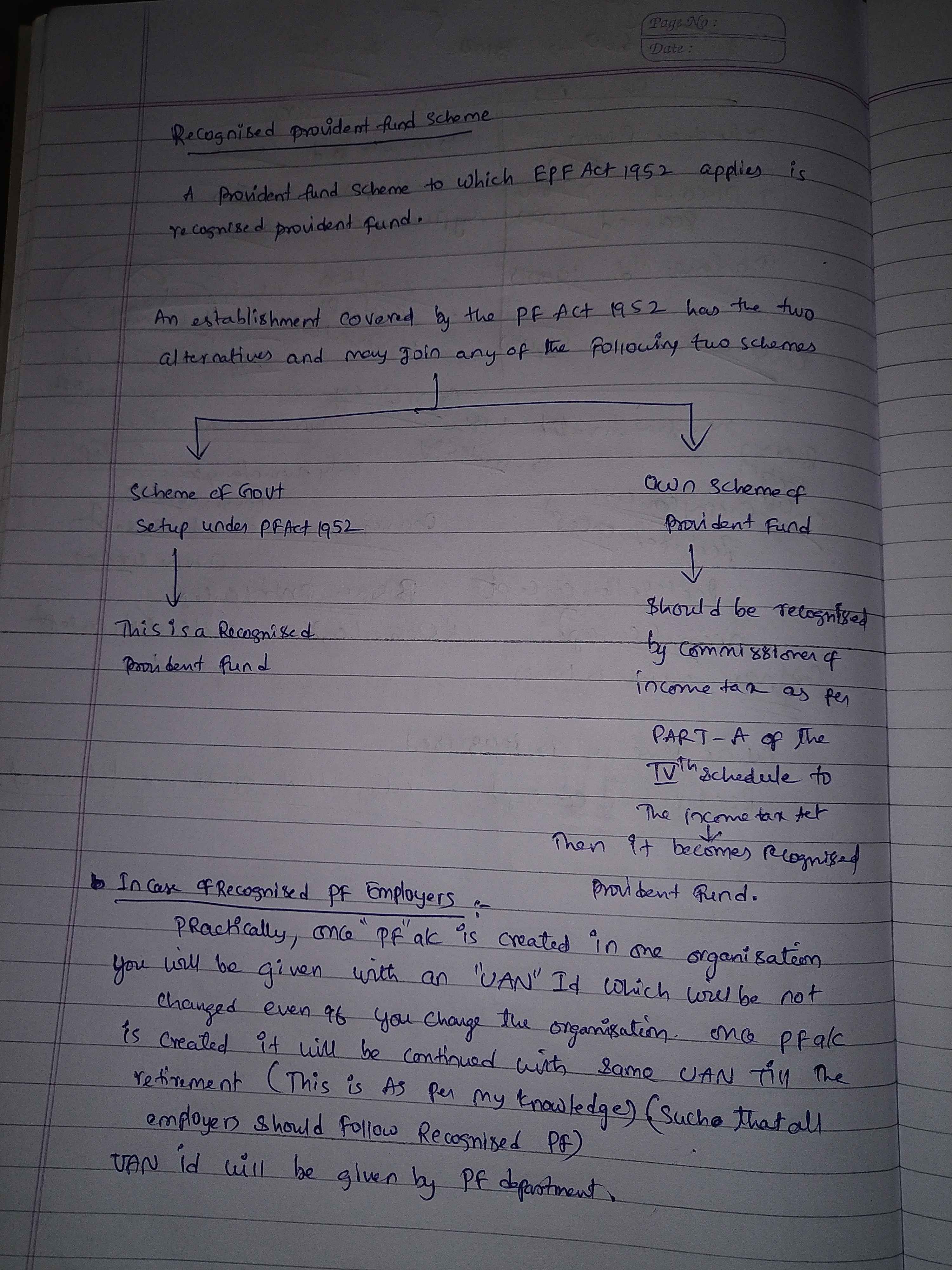

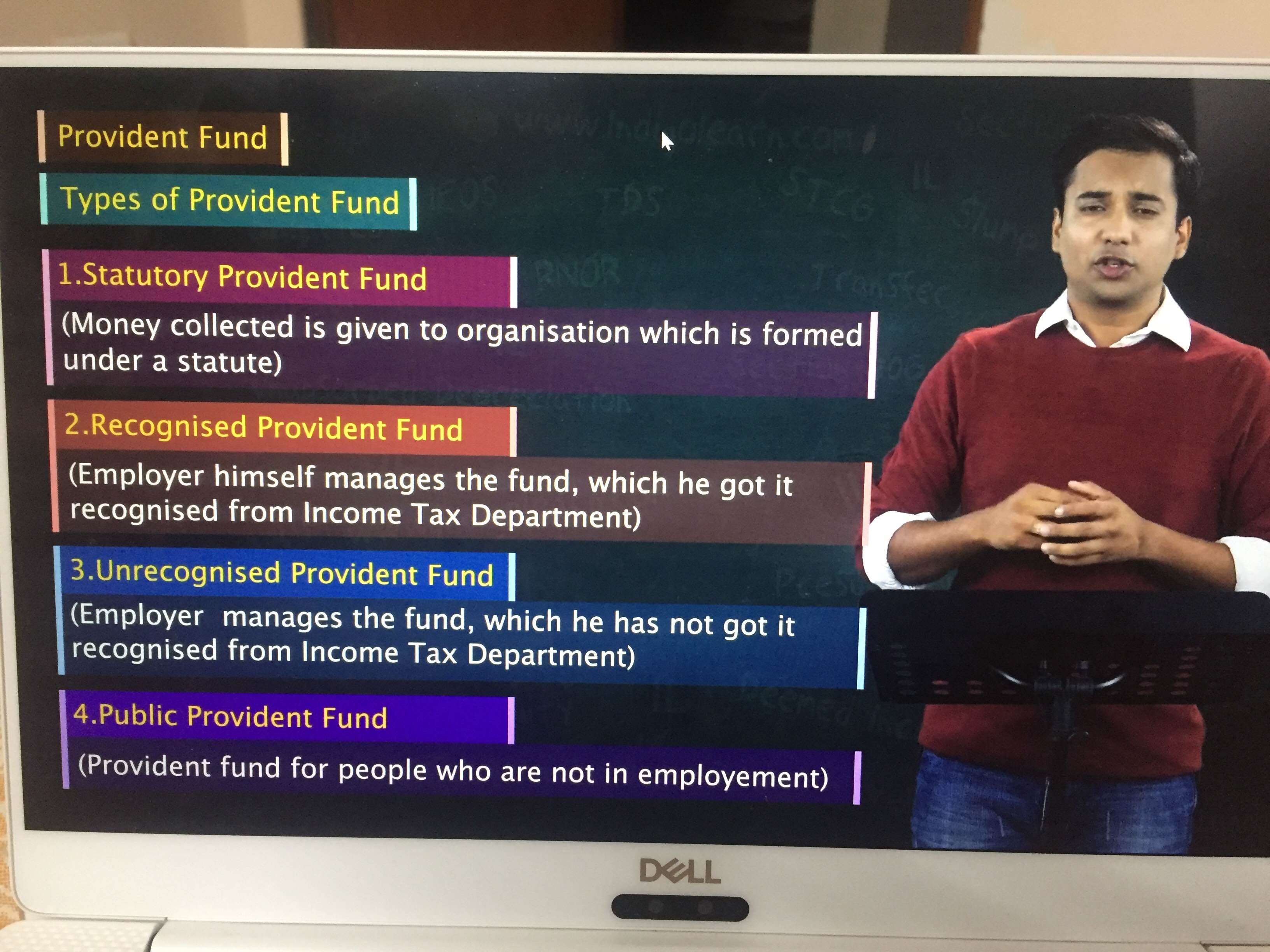

Companies can create a provident fund and apply for recognition from the IT department. These funds are managed by the trustees of the fund who are usually employees / ex employees - such funds are called as recognized provident funds - RPF. Statutory provident fund - SPF is a fund maintained by the government. An organization may choose to pool the PF contribution of all its employees along with its contribution in the SPF in which case its only responsibility is to pay monies on due dates to the SPF and update employee information ( resignation / addition withdrawal etc) with the PF department. In case of an RPF, in addition to the above work of maintaining records of contributions , o investment of money , withdrawals etc is done by the PF trust which is managed by the trustees

VIJAYA SARADHI MAGANTI

Statutory pf is governed by provisions of pf act 1925 But RPF is governed by provisions of pf act 1952

Both are maintained by govt organisations,local authorities, railways, universities and recognised educational institutions.

VIJAYA SARADHI MAGANTI

Both are maintained by govt organisations,local authorities, railways, universities and recognised educational institutions.

Statutory is maintained by government, recognised pf is maintained by the employer