Forums

Redemption of preference shares

Accountancy

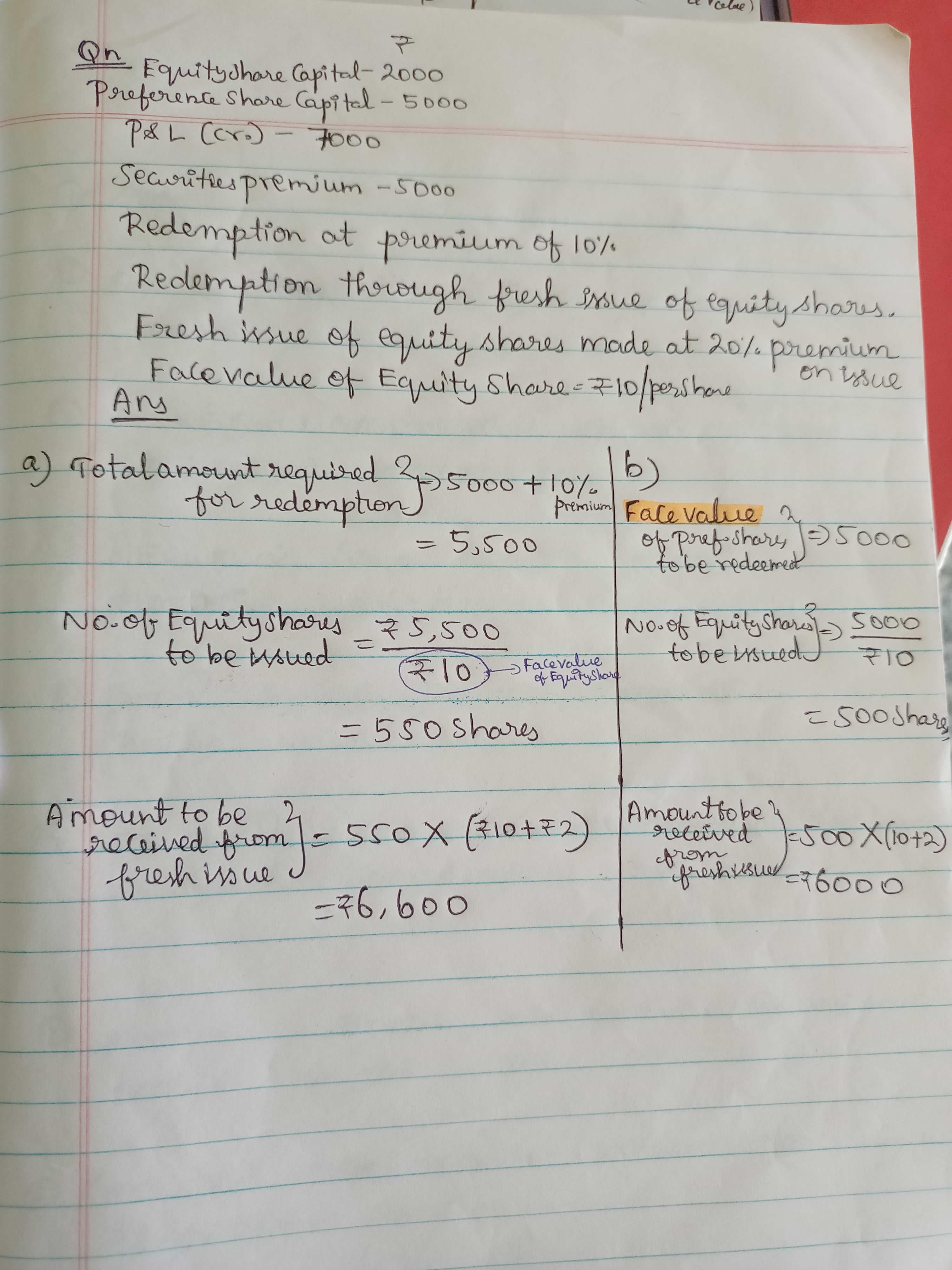

Please tell whether option(a) or (b) .which is correct and why?

Answers (11)

Option (b) is correct. As per provisions of section 55 of Companies Act, 2013 in relation to redemption of preference shares, the NOMINAL VALUE of preference shares to be redeemed must be out of fresh issue. Premium payable on redemption will be provided out of free reserves or Securities Premium A/c (SPA cannot be used if company is S. 133 compliant). Hence, nominal value = 5000 will be out of proceeds of fresh issue. No. of equity shares = 5000/10 = 500. Premium payable on redemption of Rs. 500 will be provided out of credit balance in Profit and Loss A/c.

Kartik Iyer

Option (b) is correct. As per provisions of section 55 of Companies Act, 2013 in relation to redemption of preference shares, the NOMINAL VALUE of preference shares to be redeemed must be out of fresh issue. Premium payable on redemption will be provided out of free reserves or Securities Premium A/c (SPA cannot be used if company is S. 133 compliant). Hence, nominal value = 5000 will be out of proceeds of fresh issue. No. of equity shares = 5000/10 = 500. Premium payable on redemption of Rs. 500 will be provided out of credit balance in Profit and Loss A/c.

Can I provide that 500( premium on redemption) through any free reserves or only P&l

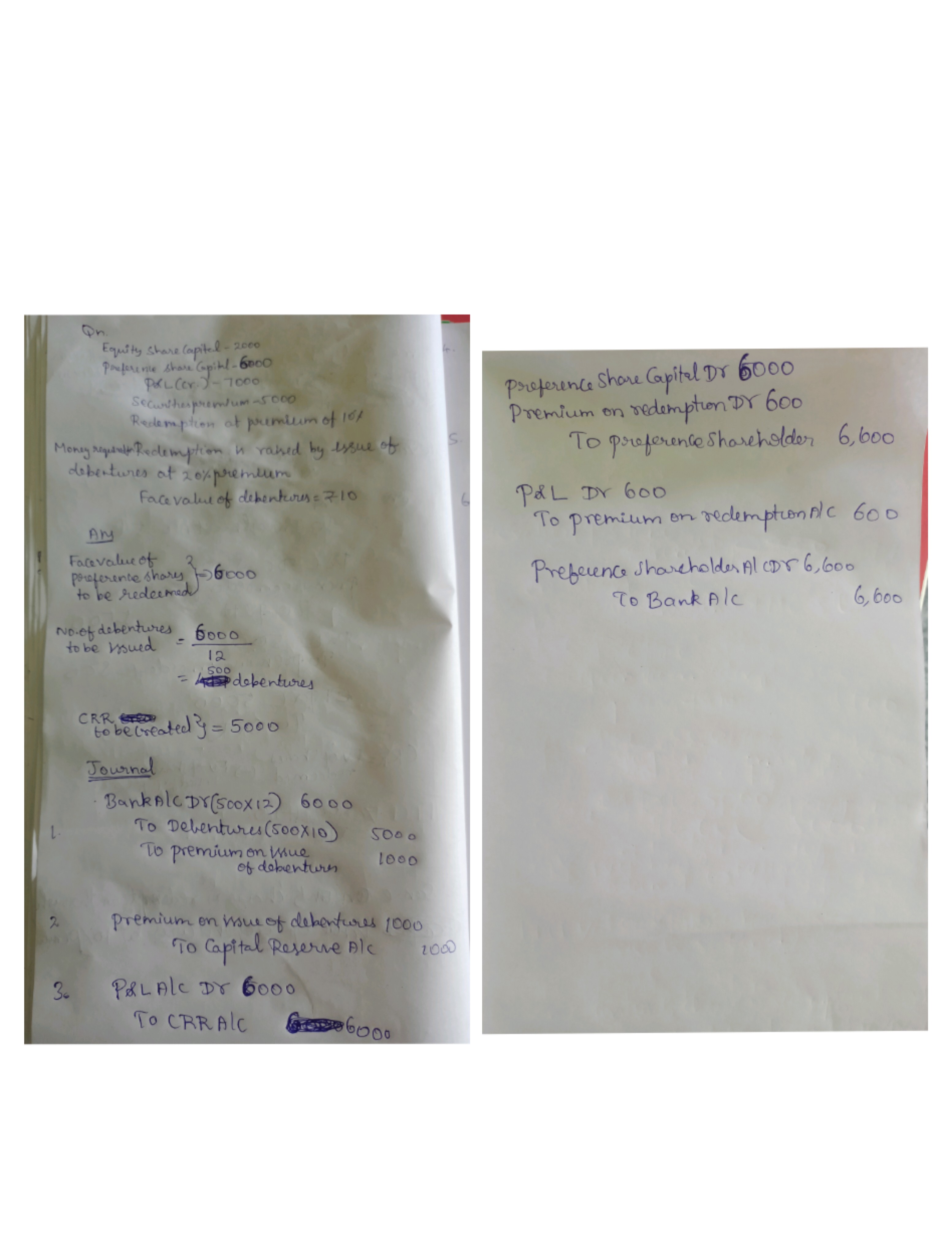

Here please tell whether to use 12 or 10 for dividing 6000 I think 12 because Securities premium only cannot be used for redemption of preference shares but premium on issue of debentures is a capital profit and credited to capital reserve a.c and Capital reserve can be used for redemption of preference shares and hence I used 12 Am I correct ??

Thread Starter

Krishnan K..

No of equity shares to be issued = 5,000/10 = 500 Amount collected on issue of shares = 500 x 12 = 6000 Premium on redemption to be provided out of P&L