Forums

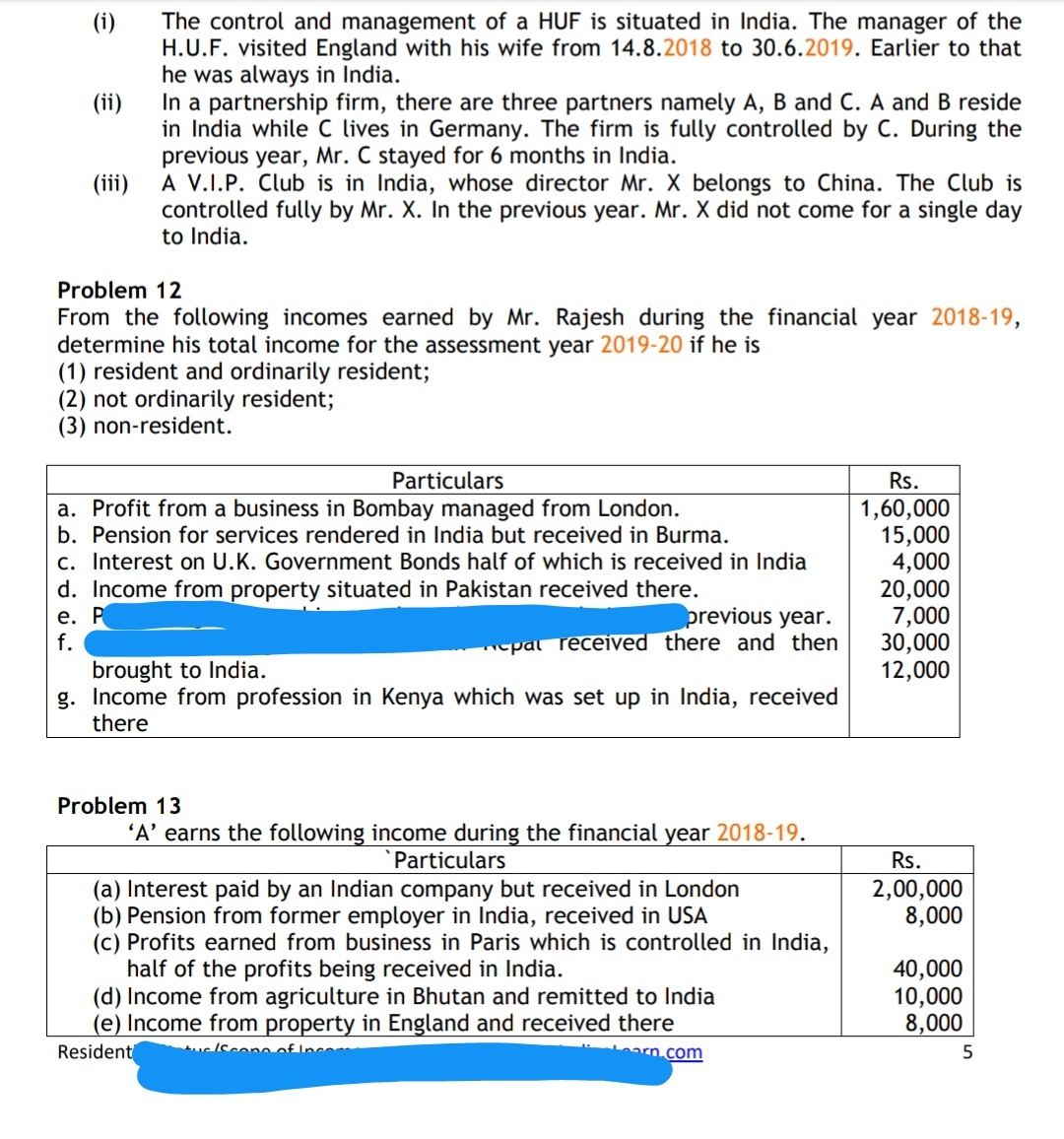

Residential Status

Direct Taxation

Sir in case of problems having Rent from Properties no deduction of 30% is taken for rent in the lecture while in icai module illustration 30% deduction has been made upfront So what do we have to do exactly sir?

Answers (4)

Thread Starter

Priyanka UdeshiBoth of these sir

Our questions have Income. ICAI questions have rent. You will understand about income from house property in a separate chapter i.e. how to derive income if rent is given