Forums

Risk analysis in capital budgeting

Financial Management

If the cash flows are before tax,we need to add back the depreciation right? But why didn't add that back? And also why they add working capital at end of the life of project as cash inflow?

Answers (6)

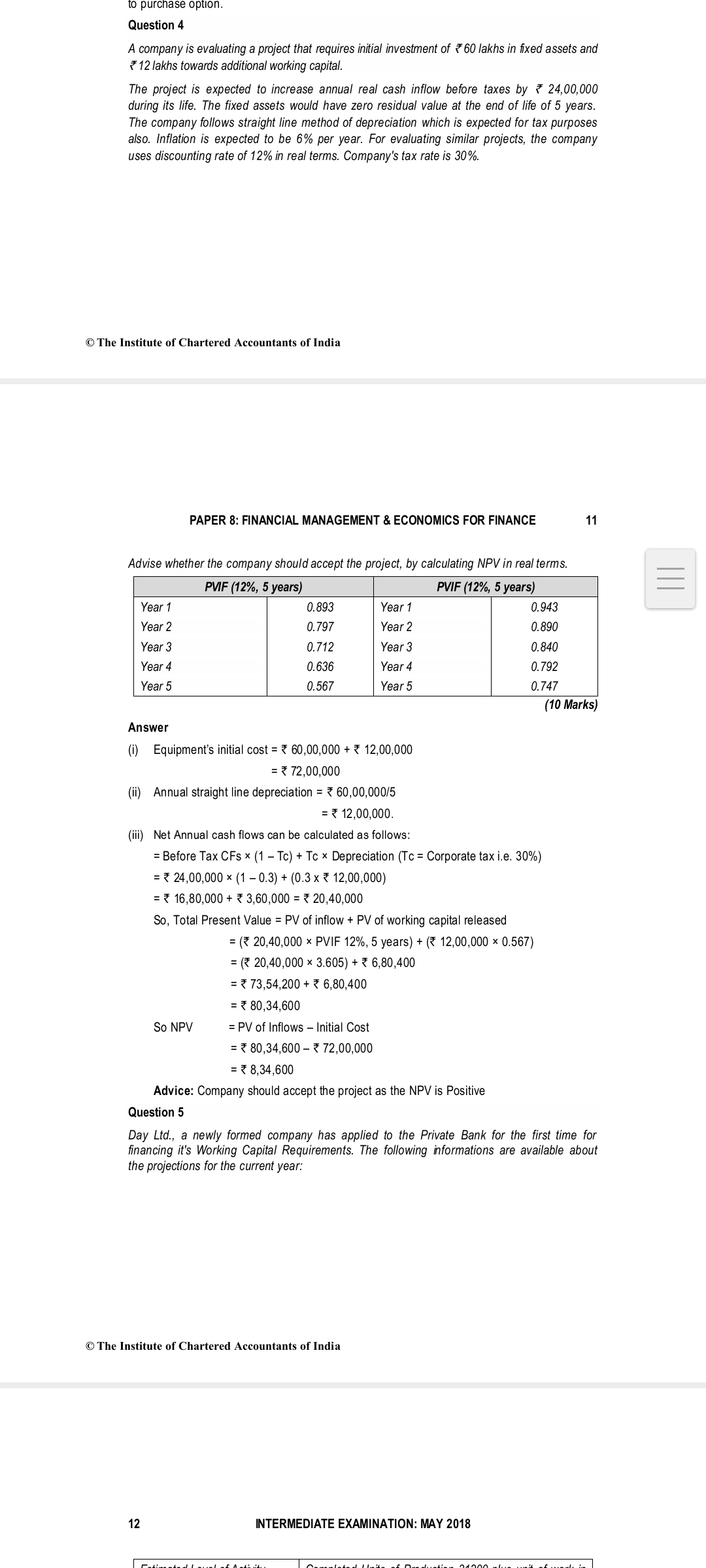

Cash flow before tax - 24,00,000 Less - depreciation (12,00,000) EBT - 12,00,000 Tax - (3,60,000) EAT - 8,40,000 + Depri- 12,00,000 Cash flow - 20,40,000 Answer remains same but method is changed And at the end of project working capital is received that is 12,00,000 Some examples is like cash stock etc.

Divy Degda

Cash flow before tax - 24,00,000 Less - depreciation (12,00,000) EBT - 12,00,000 Tax - (3,60,000) EAT - 8,40,000 + Depri- 12,00,000 Cash flow - 20,40,000 Answer remains same but method is changed And at the end of project working capital is received that is 12,00,000 Some examples is like cash stock etc.

So by selling the stocks produced in the project,we receive cash,is it correct?

Divy Degda

We only sell ? We do purchase so just remember working capital realised at the end of project

Ok,now clear, thank you so much