Forums

Salaries

Direct Taxation

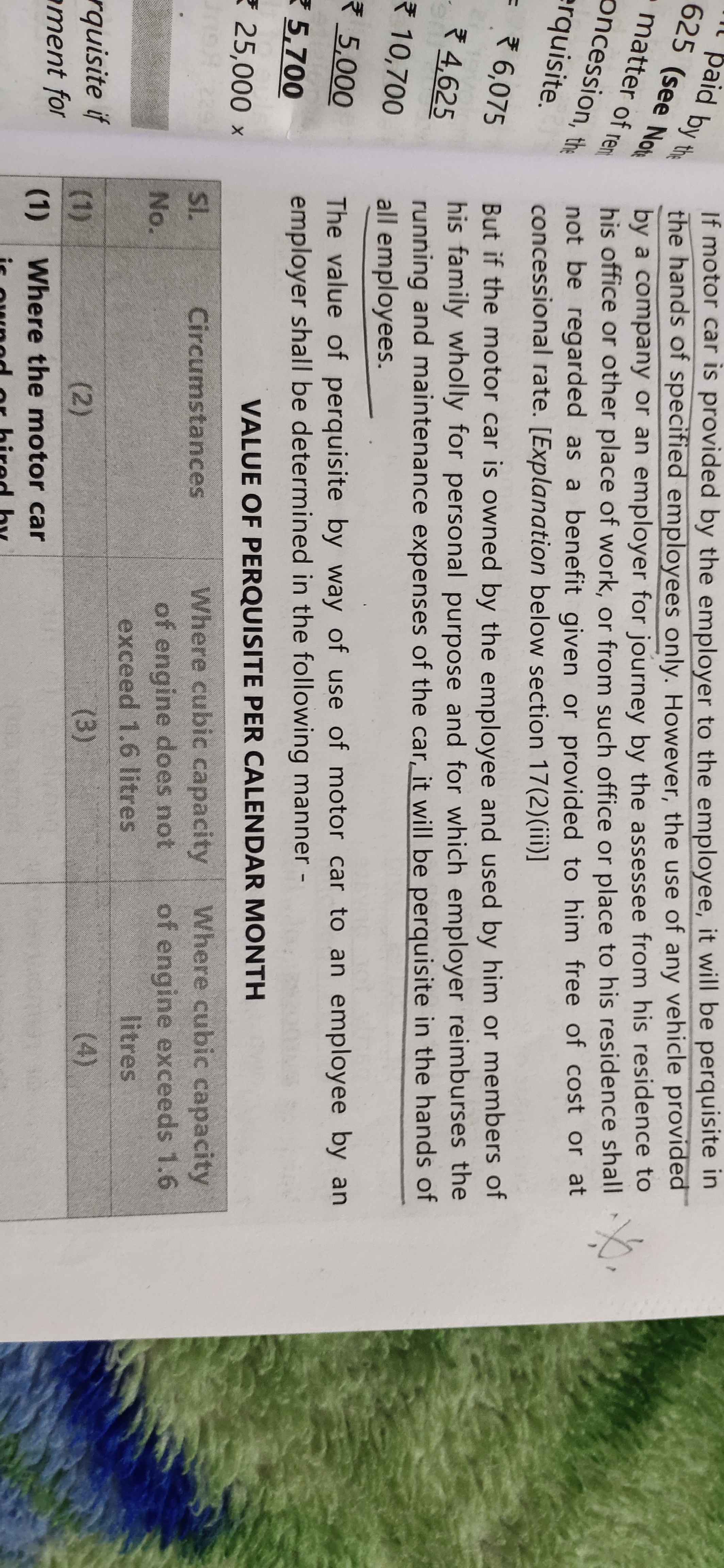

Motor car owned by employee used by him oly fr personal use? Or partly personal use and official use sir is a perquisite fr all employees

Answers (4)

CA Suraj Lakhotia Admin

for partly personal and partly official - you need to look at the amount prescribed.

Ya ok sir.. But wt abt the amount fr personal use oly..

CA Suraj Lakhotia Admin

for partly personal and partly official - you need to look at the amount prescribed.

Wt im asking is in image dey hv mentioned oly fr personal use is taxable in case of all employees.. Wt if its fr partly fr official and personal use sir

Thread Starter

Shru KandaWt im asking is in image dey hv mentioned oly fr personal use is taxable in case of all employees.. Wt if its fr partly fr official and personal use sir

If it is for personal use, it will be taxable in case of all employees (specified + not specified)