Forums

Sale of goods on approval/ return basis

Accountancy

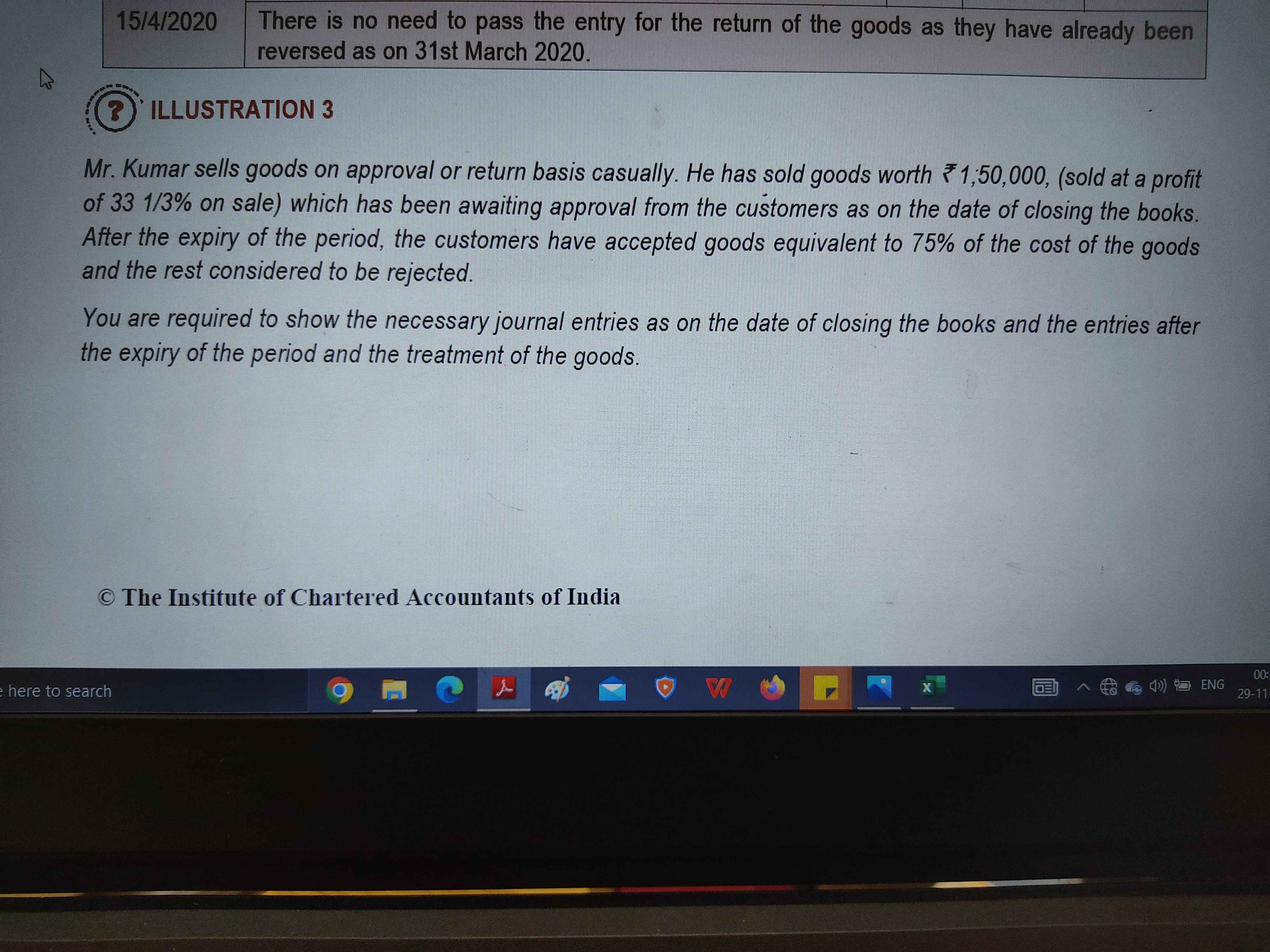

Please explain this sum in detail

Answers (9)

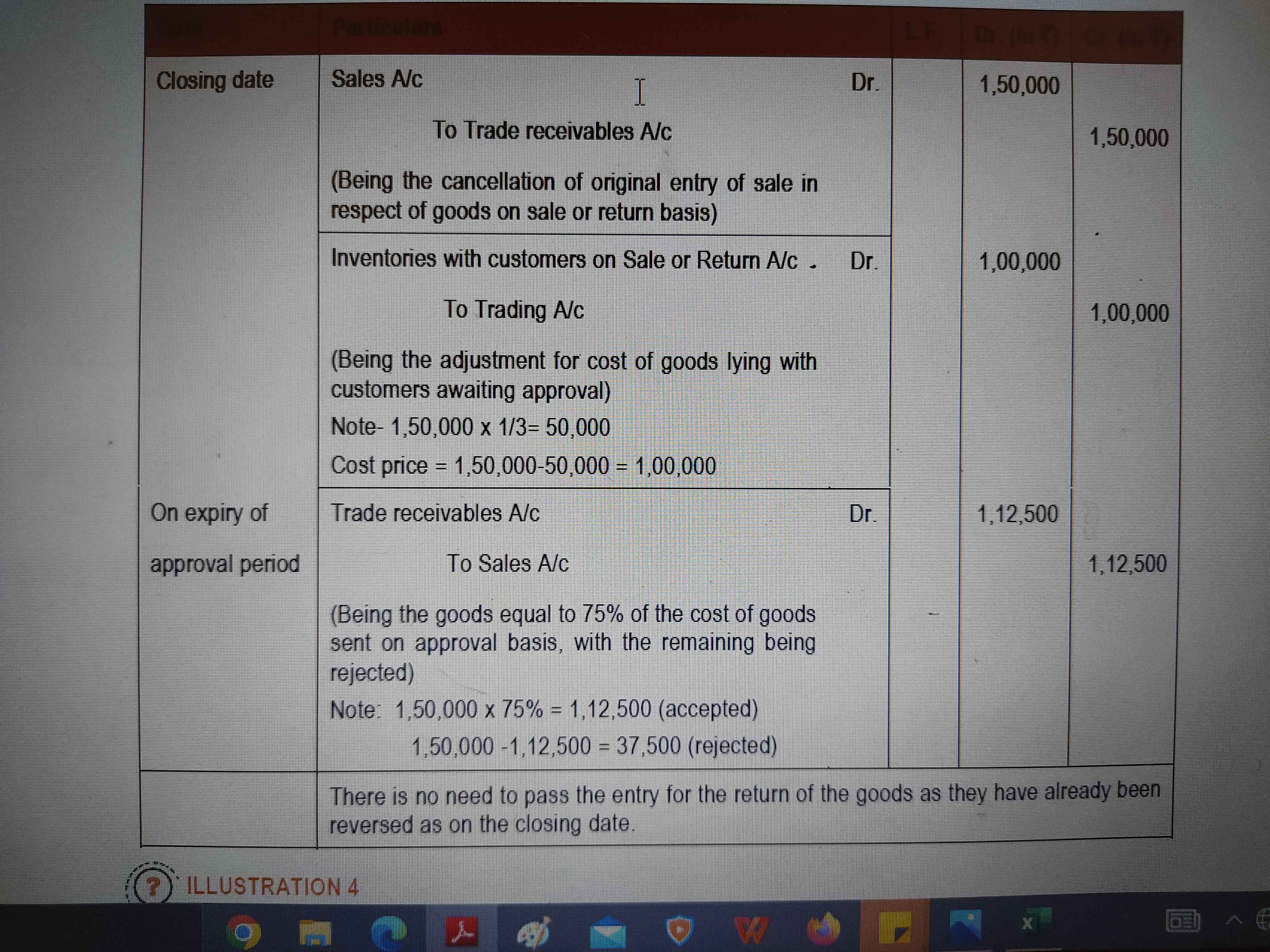

On approval of the 75% of goods sent on approval basis. We have to pass the necessary entry. (i.e). Trade receivevable. Dr. xxx To sales A/c. xxx In this entry, the amount should be 1,12,500 which 75% on 1,50,000. Entry for balance worth goods where already done when we made the reverse entry at the closing date itself.

On the 3rd entry whenever there is acceptance of good it it's not needed to pass entry so on acceptance of goods no entry will be passed and only for the remaining goods of 25% on cost because In question it is mentioned 75% of cost of goods are considered so 25% of goods on cost to be calculated and entered

Thread Starter

Anitha V KOn the 3rd entry whenever there is acceptance of good it it's not needed to pass entry so on acceptance of goods no entry will be passed and only for the remaining goods of 25% on cost because In question it is mentioned 75% of cost of goods are considered so 25% of goods on cost to be calculated and entered

You are right sis. If the approval is made in the same financial year, what you have said takes place. But here it is not applicable because the approval is made in the next financial year. So previously we would reverse the entry made for the sale on approval basis on the last date of financial year. So after that we have to pass the entry for the goods approved by the customer. And not for the rejected or returned goods