Forums

Section 54 income tax

Direct Taxation

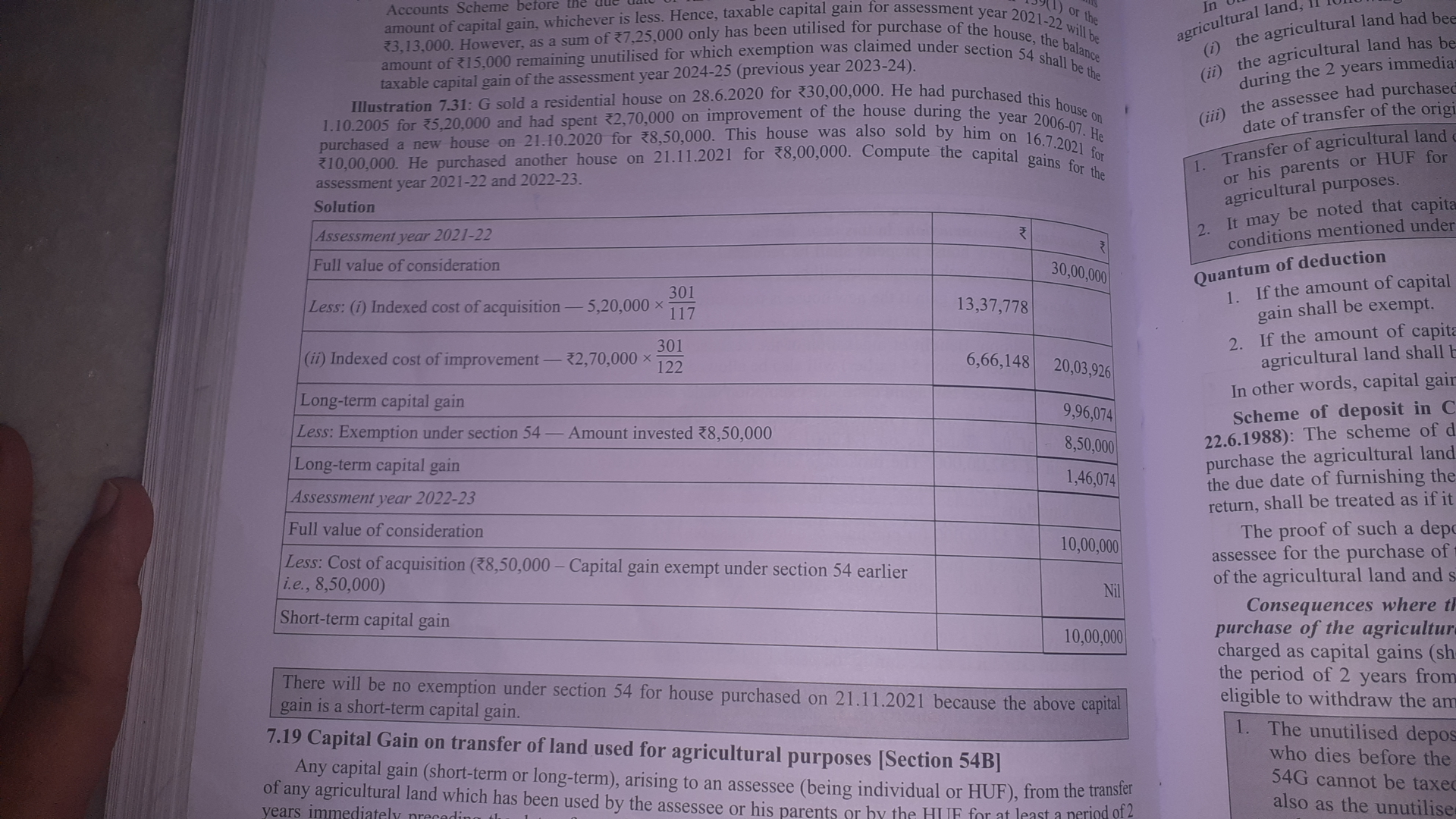

In section 54 if we have utilised long term capital gain to buy a residence house and if that residence house is sold before the lock in period but it is sold after 2 years and before 3 years so it is a long term capital gain so can we get exemption in that long term capital gain which has arrived after the sale of new purchase residence house if we transfer that long term capital gain in CGDA or buy a new house in the same previous year?? Â As in this question the house sold on 16 July 2021 would have been sold on on 24 November 2022 so that will be counted As Long term capital gain so can we get exemption in that???

Answers (1)