Forums

State person liable to gst

Indirect Taxation

I attach the file. Pls see the question and explain the answer. Pls

Answers (6)

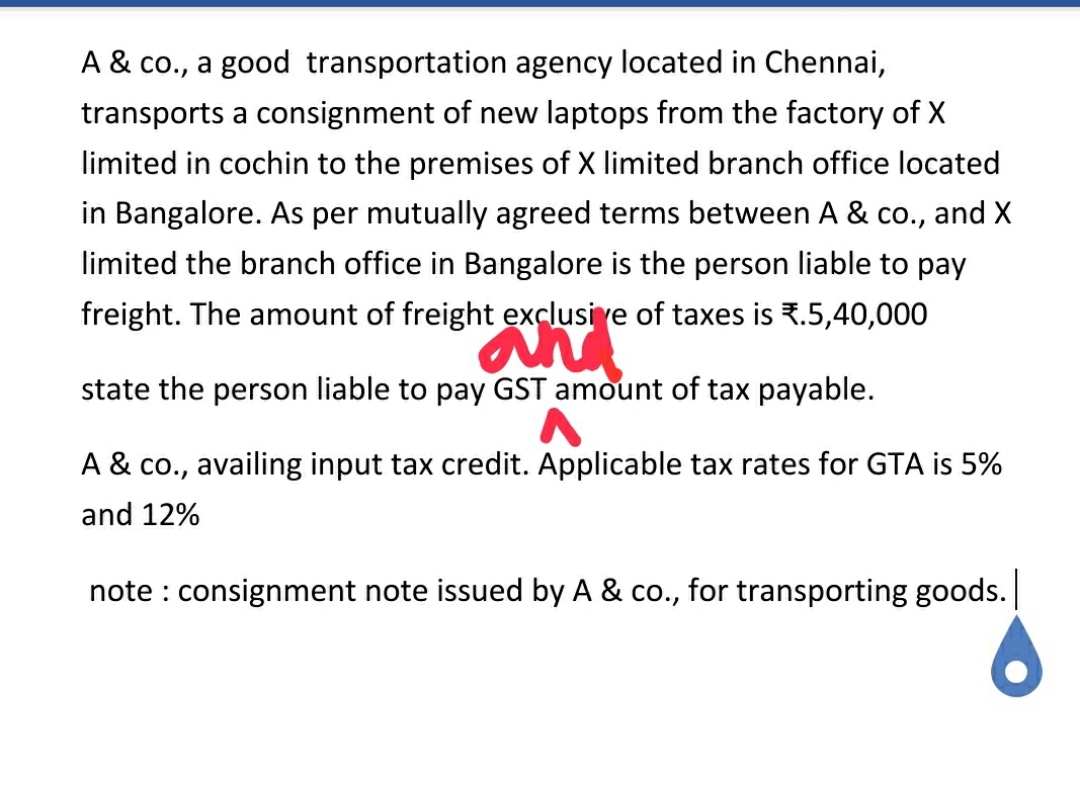

Since A&C0., issued a consignment note, it will be considered as GTA for GST purpose. If a consignment note is issued, the transporter is responsible for the goods till its safe delivery to the consignee. A GTA does not have to register under GST if he is exclusively transporting goods where GST is paid under RCM (even if the turnover exceeds 20 lakhs). And if a GTA provides the services to the certain businesses, recipient of services is required to pay GST under RCM. If the supplier of goods (consignor) pays the GTA, then the sender will be treated as the recipient. Since X Ltd is a body corporate established by or under any law, X Ltd will pay the GST. And since Bangalore branch (distinct person) is paying freight, Bangalore branch will pay the GST