Forums

Treatment of goodwill in partnership accounts

Accountancy

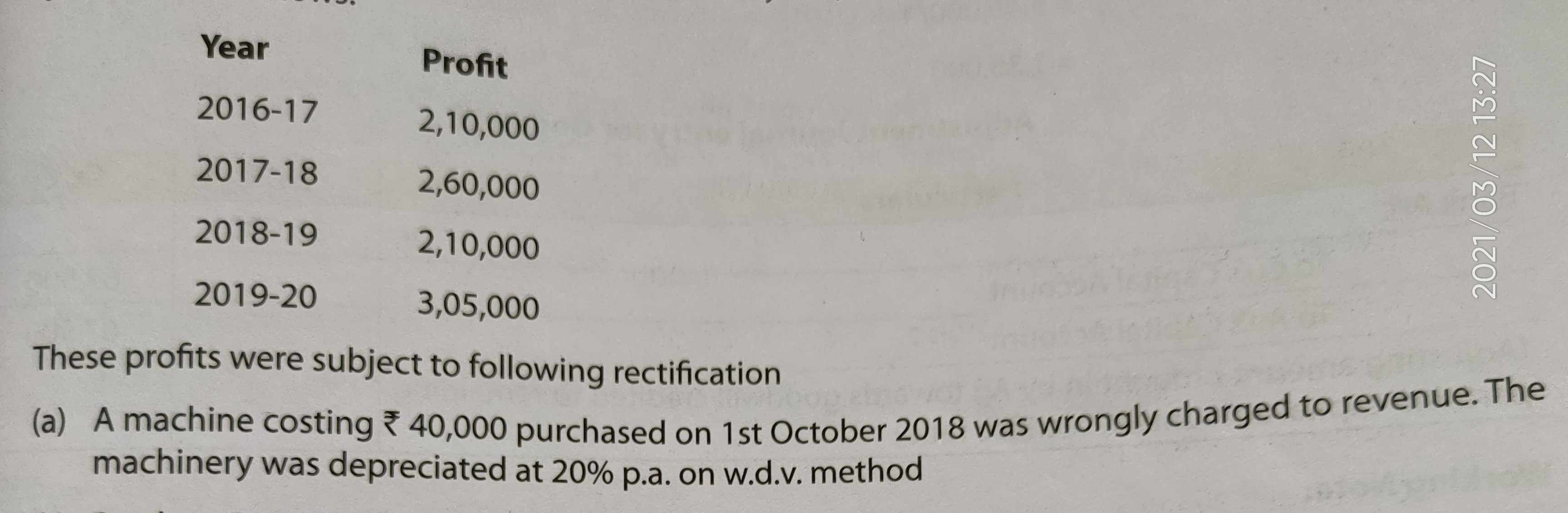

This is illustration 11 sir. Can u explain (a) adjustment point

Answers (12)

ruchi lahoti

Adjust the profits of 2018-19 by adding back the cost of machinery and reducing the depreciation on such machinery. By charging it as revenue, our profit was understated. By adding back we can arrive at the correct profit.

Mam, in adjustment they have already given that machine was depreciated. Then y we need to again reduce the profit ?

Thread Starter

siva chaitanyabut purchase of machine is added as revenue it increases profit but purchase of machine is capital expenditure so for rectifying it we should decrease profit know?

Bro can you tell the page number of that illustration?

Thread Starter

siva chaitanyabut purchase of machine is added as revenue it increases profit but purchase of machine is capital expenditure so for rectifying it we should decrease profit know?

Nhi bro dekho hmne isey revenue expenditure mana h yani p&l reduce hua h na to profit yani kam h so we will add this to ascertain the correct profit

ruchi lahoti

Adjust the profits of 2018-19 by adding back the cost of machinery and reducing the depreciation on such machinery. By charging it as revenue, our profit was understated. By adding back we can arrive at the correct profit.

Mam but by charging it as revenue, profit will increase know mam

Sushma Verma

Nhi bro dekho hmne isey revenue expenditure mana h yani p&l reduce hua h na to profit yani kam h so we will add this to ascertain the correct profit

Ok we treated as revenue expenditure ok thanks ð???

Meda Jeevansai

Plz reply sir/mam

This depreciation is for the machine we had charged as revenue instead of capital expenditure