Forums

Unrealised Rent - Income from House Property

Direct Taxation

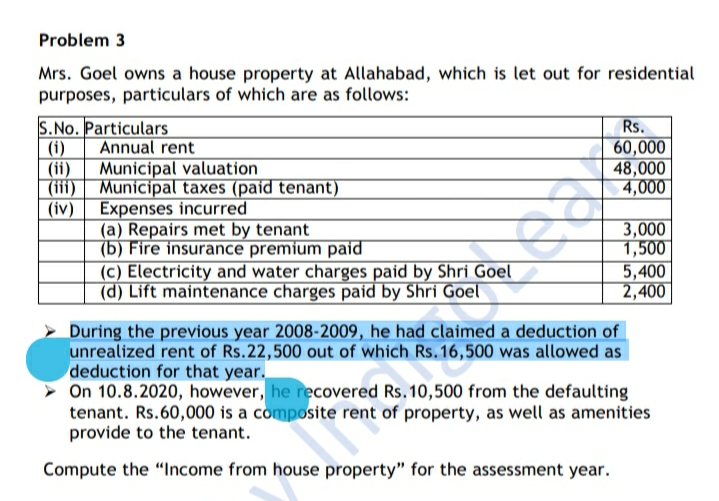

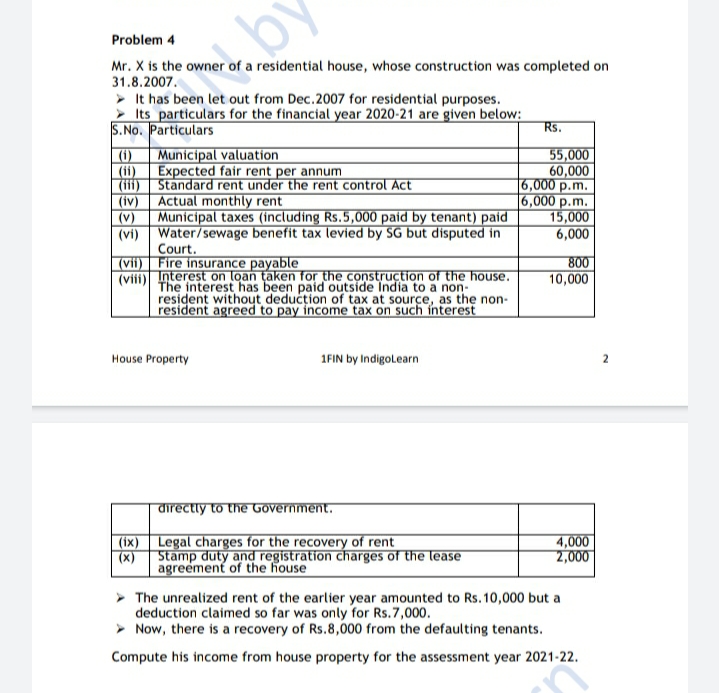

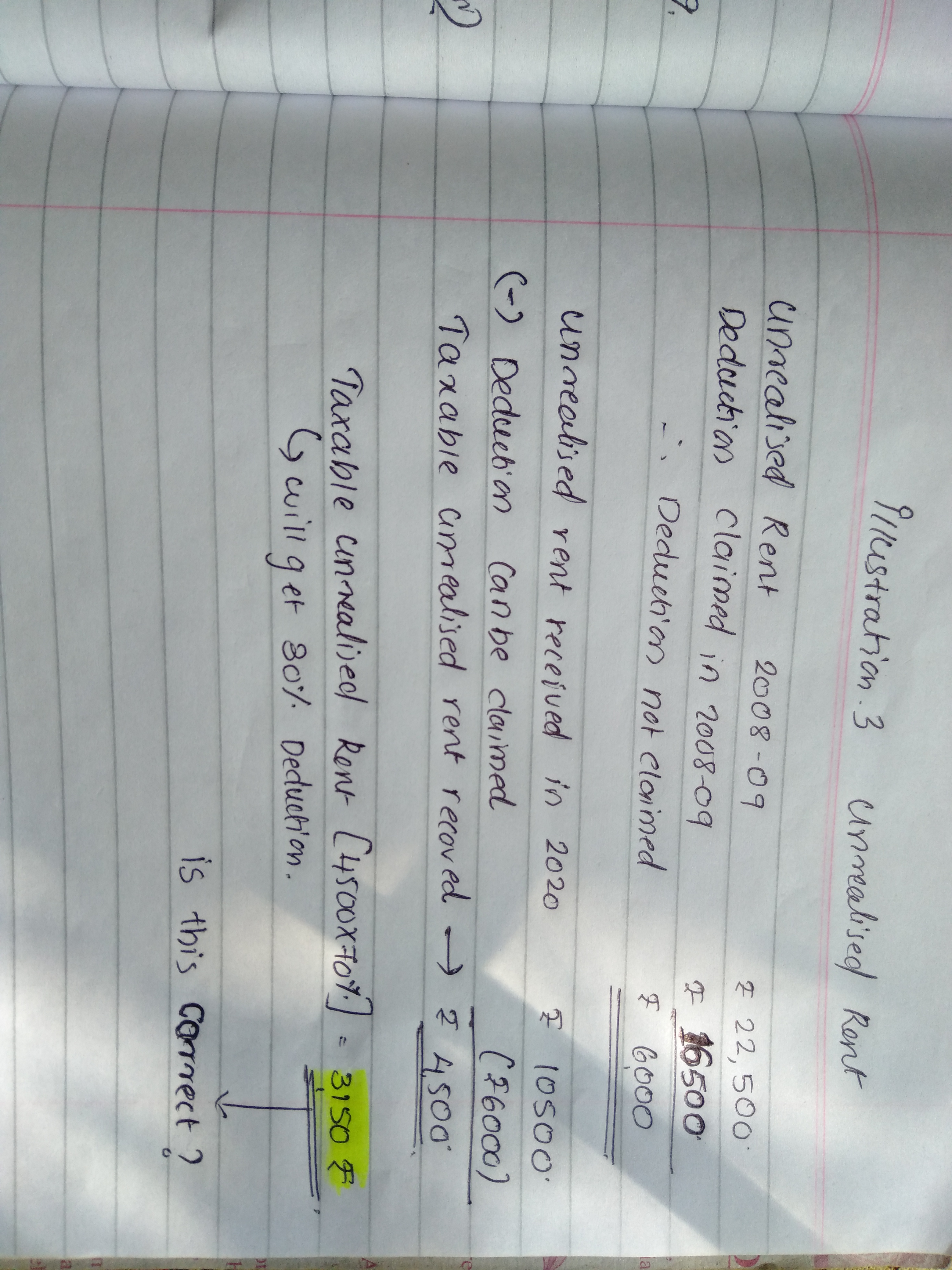

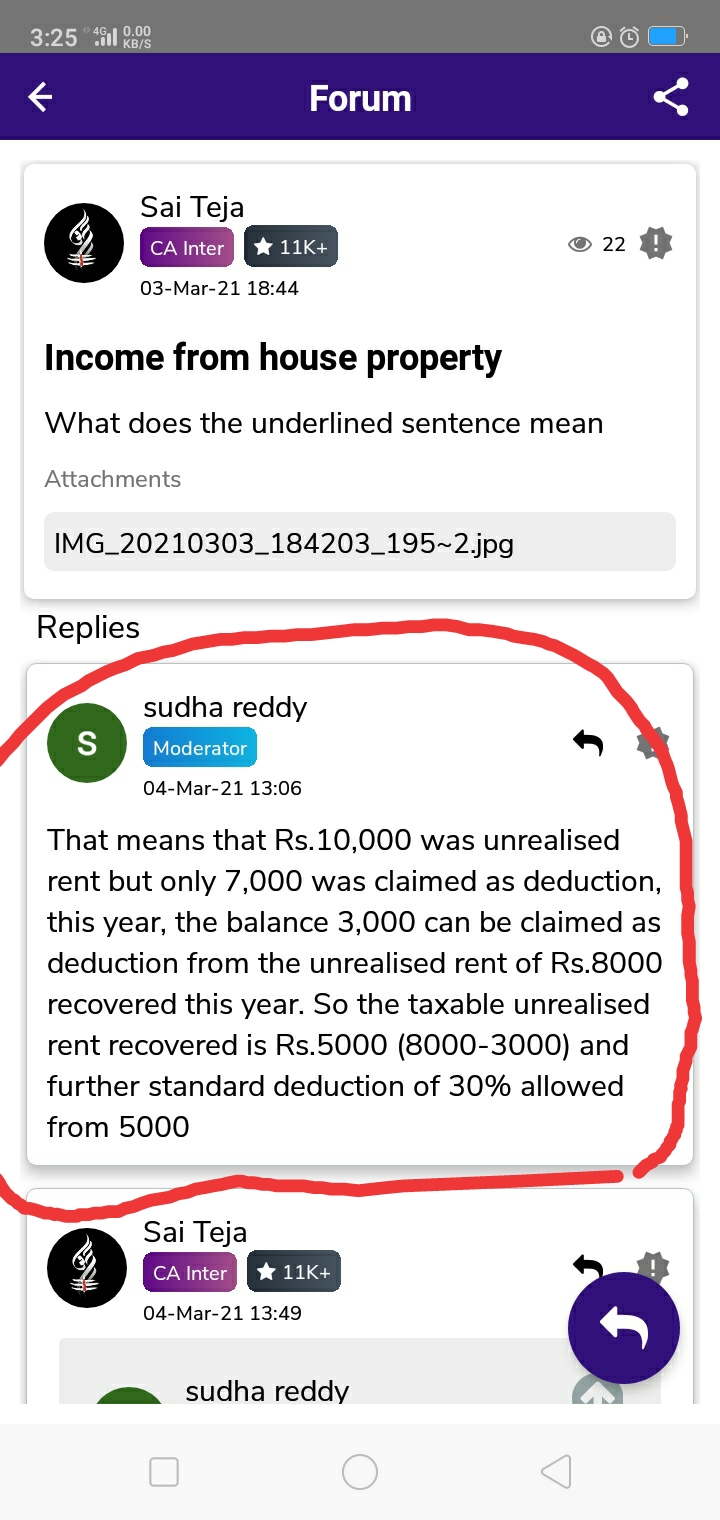

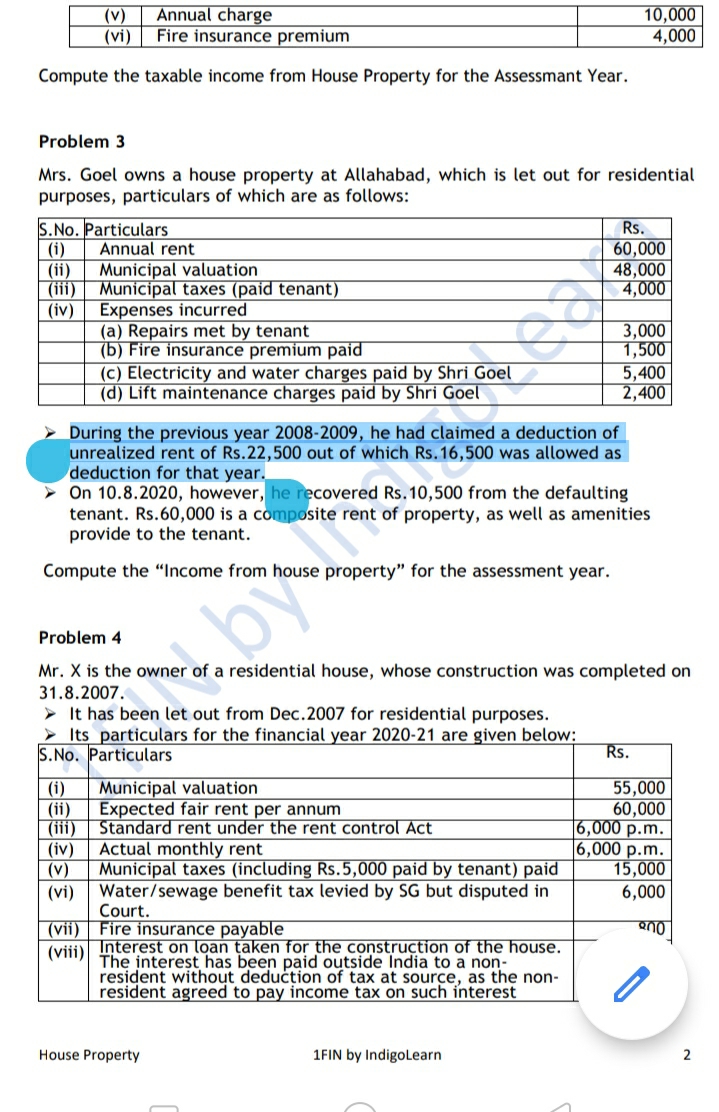

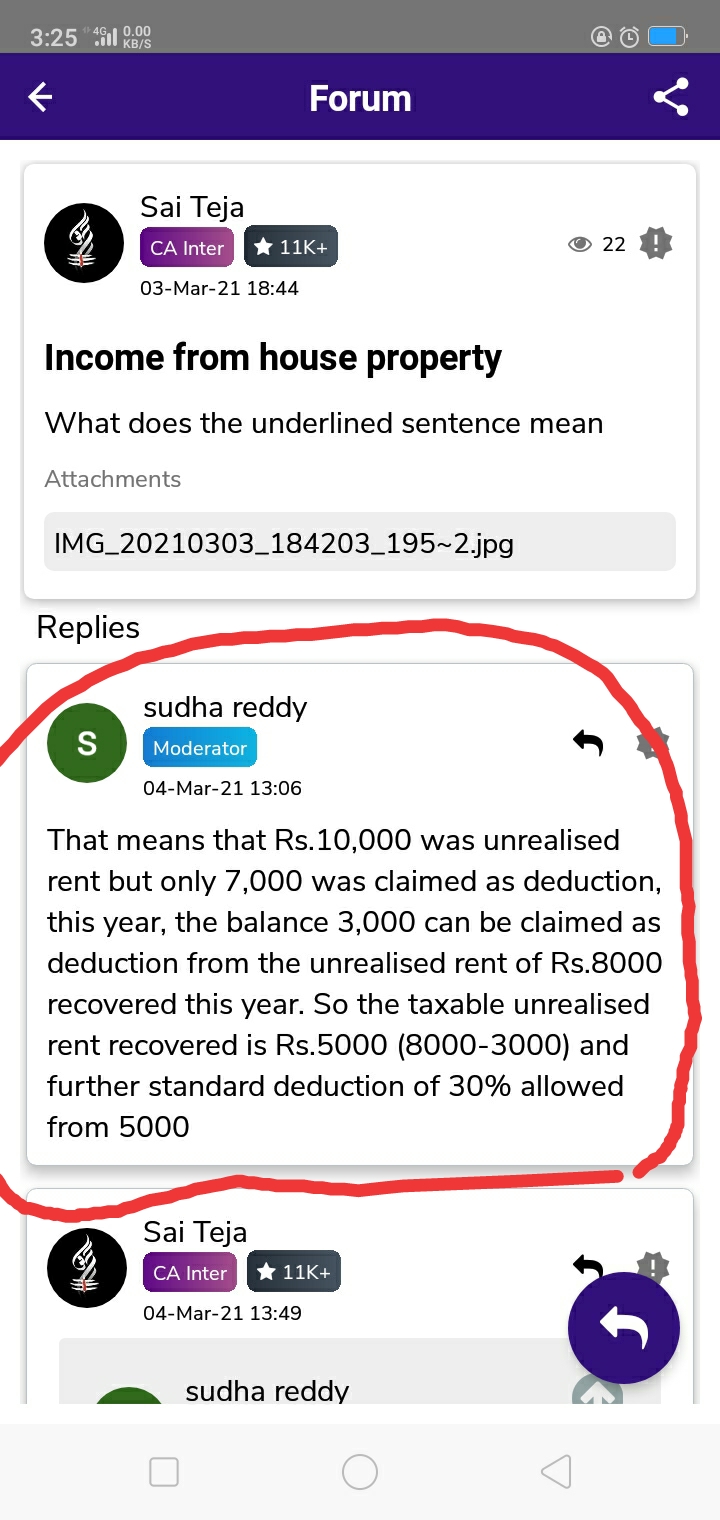

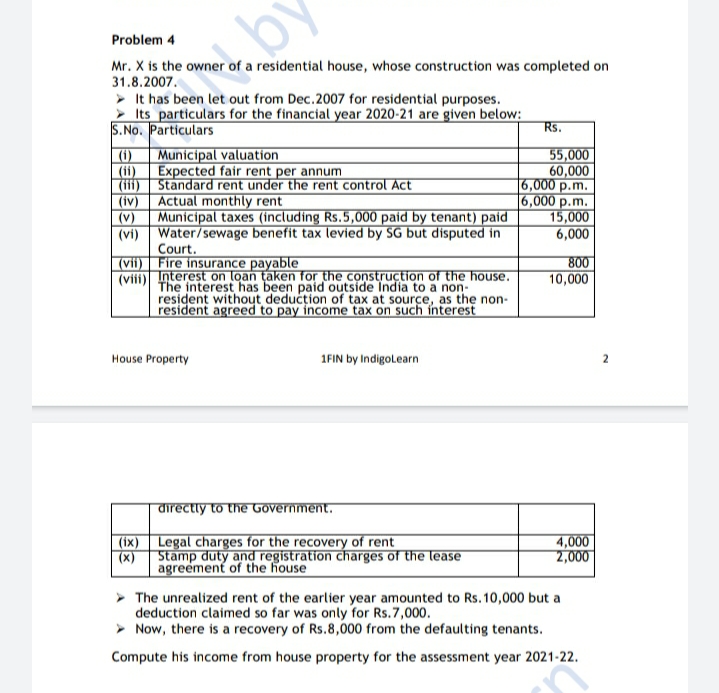

What happened in case of unrealized rent a part deduction is allowed and in the current year got an amount as recovery of unrealized rent. In the illustrations from house property chapter it's just taken as sach amount recovered less 30 % standard deduction . That is 70 percentage of unrealized rent taken for computing house property income. Is the method correct or can we deduct the income which has already paid tax during any of the previous year without getting unrealised rent deduction Illustration 3 In illustration 3 rupees unrealised rent received rupees 10500 fully taken for computing and realise rent and a reduction given the percentage. I.e, 70 % of such amount rupees 7350 added with income from house property for the current year instead of girls can we claim an exemption of rupees 6000 which has already paid in in year Then pay tax on balance 4500 and clean my direction at the rate of 30 % as standard deduction Also Illustration 4 Unrealized rent recovered rupees 8000 (the interior is the rent of real amount to rupees 10,000 but deduction claimed so far was only for rupees 7000) Can we adjust rupees 3000 on 8000 and pay tax on 5000 rupees as unrealized rent for the current year and claim and deduction of 30 % That is 70 percentage of 5000 amounting to 3500

Answers (8)

(1) Arrears of rent received or unrealised rent received subsequently in respect of let out property, if not charged to tax in earlier previous year, is taxable in the year of receipt after deducting 30% irrespective of the assessee is the owner of the property or not in the year of receipt

Sudha Reddy

Illustration 3 - please give your query clearly

Which is correct in case of unrealized rent? 1. Unrealized rent 10500Ã?70%=7350Rs. Or 2.10500-6000=4500 4500*70%=3150 Which among this taken for computing income from house property 3150 got by doing ð???

Thread Starter

Gayathri K VWhat about 4th question Earlier cleared doubt unrealized rent portion

Regret the confusion Explanation to Sec 23 states that unrealised rent is not included in the Annual Value Sec 25A(1) states that unrealised rent subsequently received shall be taxable in the year of receipt Sec 25A (2) allows a deduction of 30% (standard deduction) from unrealised rent received. In the present case, 7000 was claimed and determined as Unrealised rent as per Rule 4 and it was not included in the Annual Value. But 8000 received subsequently will be taxable as unrealised rent in PY 2020-21 and 30% (Rs.2,400) will be allowed as deduction in PY 2020-21