Forums

Won't able to understand the equation

Financial Management

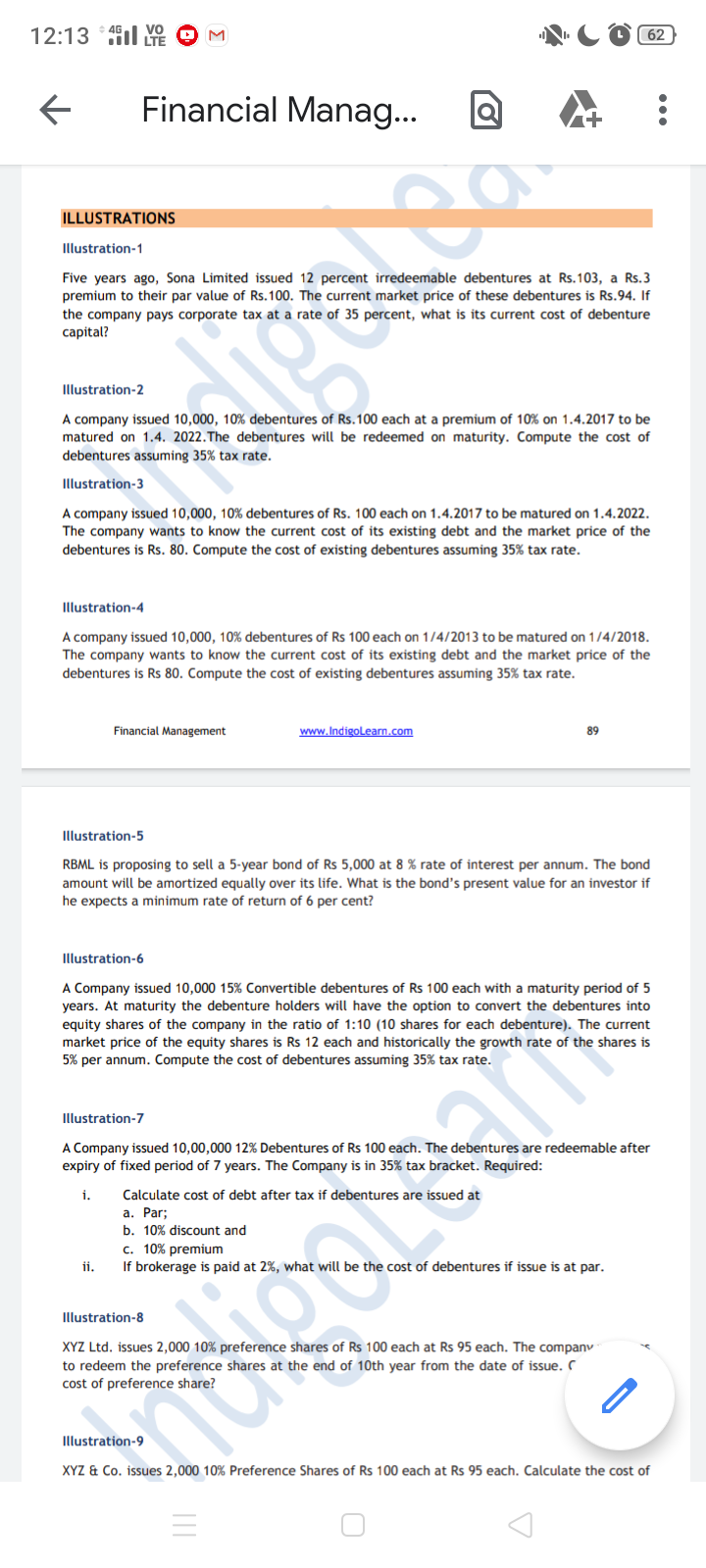

Sir I won't able to understand the calculation of yield to maturity method .. present value of cash inflow at 15 % for 5 years where present value is 10..

Answers (11)

Thread Starter

Sutapa DasI won't able to understand the NPV calculations

Do you mean Net Proceeds? calculation?

Thread Starter

Sutapa DasYea net proceeds valuation

In case a debt is an existing debt then the Net proceeds is taken as the Current Market Price and in case the debt is new, the the Net proceeds is taken as net proceeds from debentures In the present case the debt is an existing debt hence, you must take current market price for Net Proceeds

ruchi lahoti

In case a debt is an existing debt then the Net proceeds is taken as the Current Market Price and in case the debt is new, the the Net proceeds is taken as net proceeds from debentures In the present case the debt is an existing debt hence, you must take current market price for Net Proceeds

But sir told that in case of redeemable deb then we should take book value as net proceeds and in case of irredeemable deb if mp value is provided then we should take market value as net proceeds ... Am not about this. .. I won't able to understand the calculations ..okkkkk !

Thread Starter

Sutapa DasBut sir told that in case of redeemable deb then we should take book value as net proceeds and in case of irredeemable deb if mp value is provided then we should take market value as net proceeds ... Am not about this. .. I won't able to understand the calculations ..okkkkk !

Sir, also told that, book value is the issue price. If the question is silent about issue price of debenture (i.e, whether they are issued at par, premium) then we must check for Market Price. If the Market Price is also missing, then we can take Face value as net proceeds. In this question the issue price is not given and also he Market value for debt is present. Hence we must take Market value

Thread Starter

Sutapa DasYes u r right ..but I won't able to understand the calculation for NPV in yield method refer to lecture no .6

Please try to solve the problem, and come back if you are stuck at any point Send an image pointing out the specific point where you are facing problem