Forums

how to do this question sir can u explain the logic and i have seen the solution not abled to understand , please respond

Accountancy

(a) Physical verification of stock in a business was done on 14th June, 2020. The value of the stock was `96,00,000. The following transactions took place between 14th June to 30th June, 2020: (i) Out of the goods sent on consignment, goods at cost worth ` 4,80,000 were unsold. (ii) Purchases of ` 8,00,000 were made out of which goods worth ` 3,20,000 were delivered on 5 th July, 2020. (iii) Sales were `27,20,000, which include goods worth ` 6,40,000 sent on approval. Half of these goods were returned before 30th June, 2020, but no information is available regarding the remaining goods. (iv) Goods are sold at cost plus 25%. However goods costing ` 4,80,000 had been sold for ` 2,40,000. You are required to determine the value of stock on 30th June, 2020.

Answers (14)

CA Suraj Lakhotia Admin

Which part are you not able to understand?

it will be much helpful if u explain the full question , because answers given mock test paper solution is different from indigo learn methode

CA Suraj Lakhotia Admin

Have you tried? If yes share what you did

My doubt is pretty clear , I have a confusion on how to calculate the sales , purchases and gross profit in this case that's all

Thread Starter

nisam MMy doubt is pretty clear , I have a confusion on how to calculate the sales , purchases and gross profit in this case that's all

If you post a question here, the solution should also be posted here. you cannot send an email without subject or context and then expect us to connect back to your query here. we get 100s of queries. The forum is designed to ensure there is a track to our discussion. Please post your solution here

Sriram Somayajula Admin

If you post a question here, the solution should also be posted here. you cannot send an email without subject or context and then expect us to connect back to your query here. we get 100s of queries. The forum is designed to ensure there is a track to our discussion. Please post your solution here

sir my doubt is pretty clear know , i said i want to know how to calculate the sale and gross profit and purchases of the trading account , so is it required to send the working ?

Thread Starter

nisam MWorking I did , it is wrong , please check

it will be much better if could the solve the numerical questions doubts in live session , rather than in written form , in live faculty could explain tooo

Thread Starter

nisam MWorking I did , it is wrong , please check

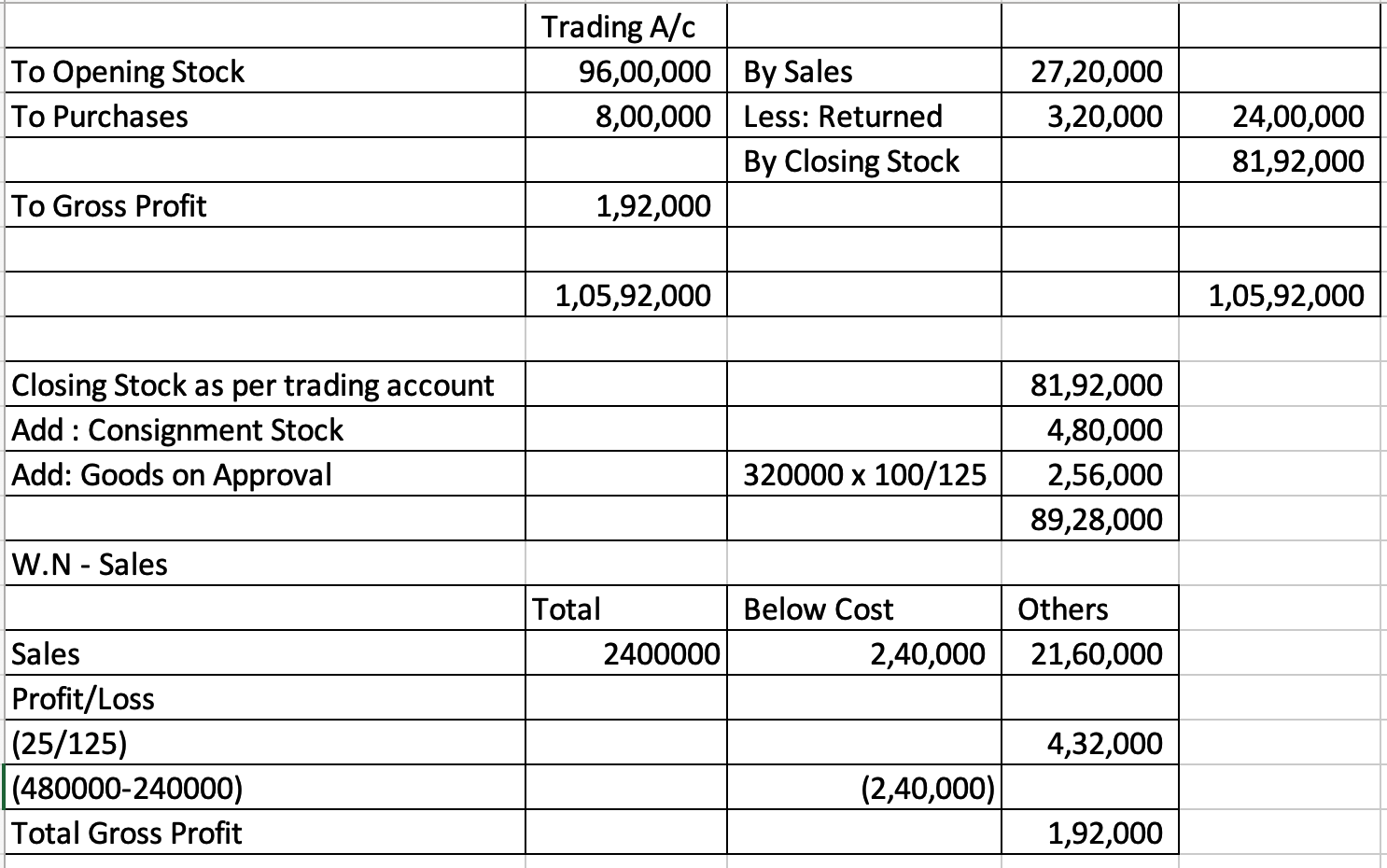

The stock of 96 lakhs given in question is as on 14th June and hence is opening stock. Sales amount is 27.2 lacs less 50% goods returned. You have deducted 100%. Have attached solutions in Trading Account format.

CA Suraj Lakhotia Admin

The stock of 96 lakhs given in question is as on 14th June and hence is opening stock. Sales amount is 27.2 lacs less 50% goods returned. You have deducted 100%. Have attached solutions in Trading Account format.

sir not getting logic , sir can u please explain gross profit calculation ,

Thread Starter

nisam Msir not getting logic , sir can u please explain gross profit calculation ,

In the total sales made, there are some goods which are sold at loss. This needs to be separated. On remaining goods there is a profit of 25% on cost.