Forums

subsidy valuation

Indirect Taxation

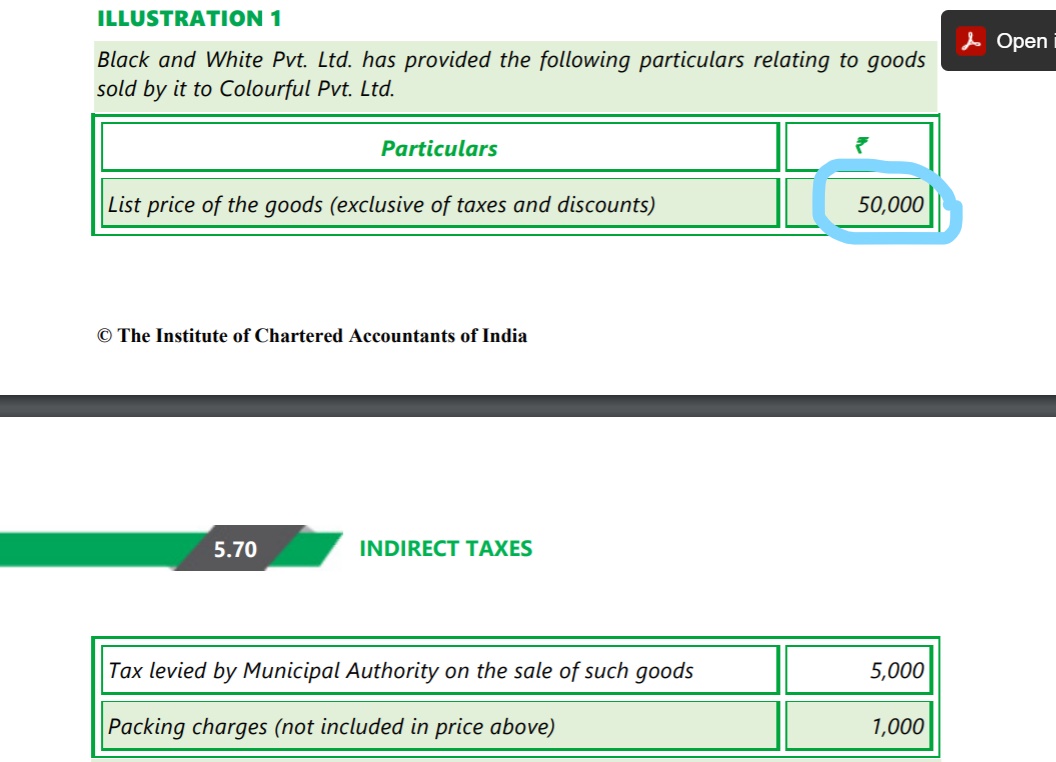

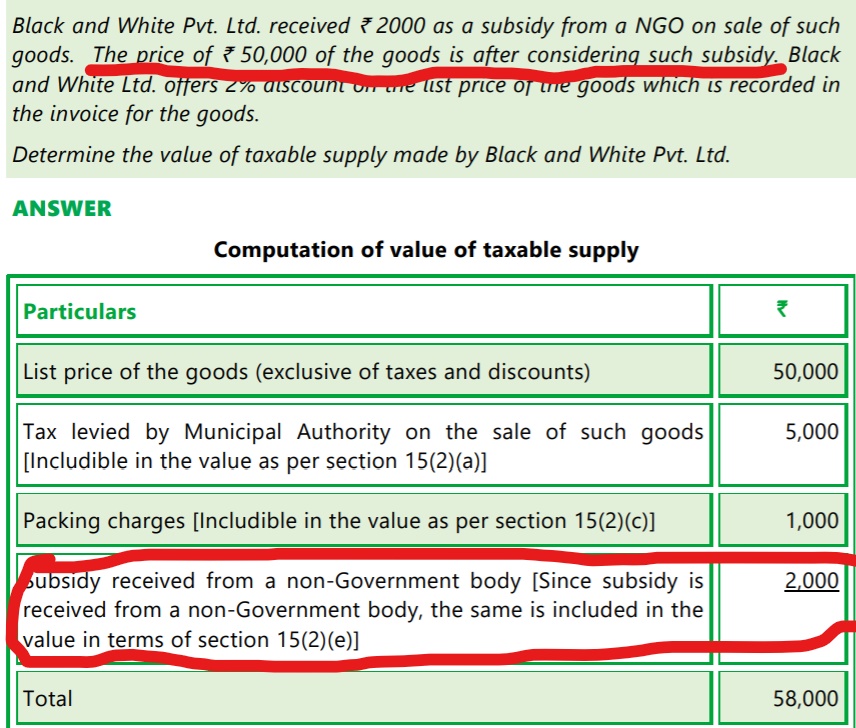

I have attached copies of an illustration from the institute material. The question states that a subsidy from a NGO of rupees 2000 has been received and the price of the goods is after consideration of such subsidy received. As the question has given that it is after considering subsidy, we cannot add it one more time with the price. But in the material, they have added such subsidy to the price. Please clarify it to me if i am wrong.

Answers (1)

Section 15(2)(e) states that Value of Supply shall include subsidies directly linked to the price excluding subsidies provided by the Central Government and State Governments. So subsidy received from NGO in the present illustration is taxable as it is not from Govt.. "Price of the goods is after consideration of such subsidy received" means that 50,000 is net of subsidy received, hence 2000 is added to the value of supply