Back

Oil below Zero!! Really?

Sriram Somayajula, CFA

April 20, 2020, is truly an unforgettable date in the History of US & international crude Oil trading. The Futures contract for WTI Crude for May 2020 Delivery that was set to expire on 21 April 2020, traded on 20 April 2020 at US$ -37.63 a barrel. WTI index is a US benchmark for crude oil prices. Brent price which is more than the international benchmark is hovering close to US$ 20-25 per barrel.

In this article, I shall try to explore various potential implications on stock/commodity markets, and other derivate products for a student of finance.

Before we move ahead, let us first refresh the meanings of some key yet basic terms:

- A spot contract is a contract for delivery of a share of company/Commodity/currency for a price (called spot price). The settlement i.e exchange of money and the asset (i.e share/commodity/currency) happens on a pre-agreed date. In India’s case all our shares and currency markets operate on T+2 settlement, i.e if you buy something today in the stock exchange or currency market, money will have to be paid by you the day after tomorrow

- A futures contract is a standardized contract between 2 parties to exchange an asset for pre-agreed money at a future date. These contracts are traded on an exchange and used both by speculators as well as hedgers.

- Futures Contracts for currencies and stocks are typically non-deliverable and are net settled by cash on the exchange. Commodity exchanges in addition to allowing net settlement also has a delivery period before which if the contracts are not settled, delivery will have to be made/taken. The WTI futures, whose price has moved to the negative zone were due to move into the delivery period on April 21, 2020, if they were not settled before that date. Check the contract specifications for WTI futures here.

- Brent Crude: Brent Crude is a trading classification of sweet light crude oil, Crude Oil i.e low in density and called sweet because of lower sulfur content. Brent Crude is extracted from the North Sea (Near Europe) and comprises Brent Blend, Forties Blend, Oseberg & Ekofisk crudes. Brent is the leading global price benchmark for Atlantic basin crude oils. It is used to set the price of two-thirds of the world's internationally traded crude oil supplies. The Brent crude can be delivered at multiple offshore locations.

- WTI Crude: West Texas Intermediate (WTI) is the main oil benchmark for North America as it is sourced from the United States, primarily from the Permian Basin. The oil comes mainly from Texas. It then travels through pipelines where it is refined in the Midwest and the Gulf of Mexico. The main delivery and price settlement point for WTI is Cushing, Oklahoma.

- Indian Crude basket: The Indian basket of crude oil ( the index based on which the import price of crude into India is determined) represents a blend of Oman, Dubai, and Brent Crude. The price of the Indian crude basket is influenced more by the decisions of OPEC than WTI. While all crude indices are linked in one way to each other over a longer period of time in a directional sense, a reduction in the level of one such index does not always mean an automatic and immediate reduction in the level of the other.

COVID 19 & International Markets

Covid-19 is leaving a long trail of human, physical, and economic destruction. This is what most of the international markets including Indian NIFTY / Sensex, Indian Rupee, etc., are pricing in (to some extent at least!!).

With large parts of the world in lockdown and curfew, flight travel has come down and so has the passenger and commuter movement within a country and across several countries. This along with the shutdown of several industries and factories (and also the expectation of their continuing shutdown) has led to a substantial reduction in demand for Petrol, Diesel & other crude derivatives that are used by consumers.

Indices classes across the world have fallen in the last 2 months following the outbreak of COVID-19. Given below is a comparison of price levels of various indices/assets across the world:

Why did WTI go sub-zero? Will this continue?

WTI as mentioned earlier is a contract specific to the US. Deliveries of contracts for WTI crude are to be made at Cushing Oklahoma. The futures price of May contracts which will expire on April 21, 2020, traded at negative US$37.63 on April 20, 2020. This was far more driven by the contract-specific issues of the buyer having to take delivery at Cushing, Oklahoma if they did not settle the contracts before April 21, 2020, than anything else.

What does that mean? For a buyer who had purchased May WTI futures, for contract expiry on April 21, 2020, he had to take delivery of the crude oil at Cushing, Oklahoma in the coming few days. However, unfortunately, due to a situation of oversupply and a sharp reduction in demand across the US, most of the storage points in and around Cushing are already filled or have been contracted to be filled shortly and the pipelines in that location do not have enough immediate capacity to divert all the new oil. So, if the buyer takes delivery, where will he/she store the oil? There are no warehouses (oil tankers) to store the huge quantity of the oil that was to be delivered.

Another reason for this crack in price is also the role of The United States Oil (USO) ETF. Of all the outstanding crude contracts in WTI, 25% were owned by USO. But ETF's are not designed to take physical delivery. So just like a short squeeze of short-sellers, who push up prices to buy an asset that they have short sold, the opposite happened with WTI Futures held by the USO. USO started unwinding its long positions in futures, which resulted in a massive selloff in WTI crude futures contracts.

Simplistically speaking, instead of selling this oil to someone else for a price after taking delivery as per the futures contract, the buyers of the futures contracts were ready to reduce the sale price of their crude to zero and in addition, also were willing to pay extra money to anyone willing to take delivery of their oil and store it. This reflected in the pricing for these futures contracts.

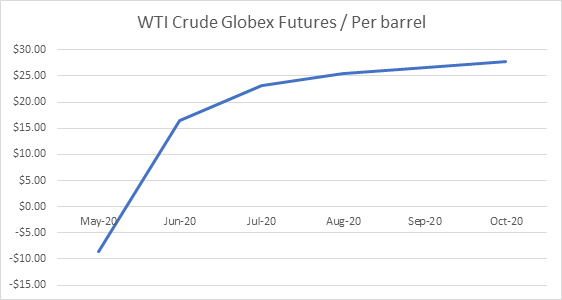

June futures are trading at close to US$20 (+ve number !!) in normal ranges. This indicates that the future supply is expected to get adjusted to the reduction in future demand in June & no scenario like April 20, 2020, is expected to repeat immediately; consequently, the WTI crude contracts for far months are trading in positive territory, though at much lower levels (Refer table 2 below)

Is this the first time any asset price has gone negative? - No

Post the reduction of FED rates to zero on 15th March 2020, the possibility or a -ve interest rate scenario in the US is now no more unlikely. We have seen Japan work with negative interest rates from 2016 (Check this link); the same was the case with German electricity markets which have been seeing negative electricity prices since 2017 (Check this link). All these scenarios are a result of a lack of demand for the said asset/commodity ( in Japan’s case, the currency being the asset class and massive deflation and an aged economy have been pushing down the interest rates for decades now) or a reduction in economic activity.

What related concepts can young students of Finance think of in this scenario?

Is this backwardation or contango?

When a market is in contango, the forward price of a futures contract is higher than the spot price. when a market is in backwardation, the forward price of the futures contract is lower than the spot price. If you look at the chart below, prices for contracts to be settled in far months are all higher than near-month contracts. The market is definitely in contango as it usually is.

https://www.cmegroup.com/trading/energy/crude-oil/light-sweet-crude.html; snapshot at 3.36 PM IST on April 21, 2020

What would have happened to holders of Futures/options?

Futures – Anyone who is a bought May-end delivery futures anytime in the last couple of months or even 2 days ago would have lost out big time yesterday. Conversely, sellers of futures would have made big money.

Options – Call option buyers – they would have let the options lapse as the market is way below any strike they would have imagined. Put option buyers made money with never imagined upside. Typically one would compute upside to put buyers as Strike price – Market Price with MP>= 0 ( usual computation); While the price of WTI crude May futures dropped to negative, we will know the spot price only on April 22nd once all the derivative contracts are settled. We expect it to be close to Zero on either side and not the bizarre minus US$37.63. You can check historical spot prices at this link. Put option holders will make gains beyond the usual computations if the spot closes <Zero.

Well strange times, strange outcomes!!!

Sources:

https://en.wikipedia.org/wiki/Brent_Crude

Share

Course Guides

Courses

CA Final Group I - All Subjects (FR + AFM + Audit)

FR + AFM Combo

Financial Reporting (FR) - CA Final

Advanced Financial Management - AFM - CA Final

AFM Additional (Incremental) Topics for Nov'24 Exams for SFM Students

Advanced Auditing & Professional Ethics - CA Final

Economic Laws - CA Final- (New)

Indirect Tax Laws (IDT) : GST, Customs & FTP - CA Final - (New)

Integrated Business Solution (IBS) - CA Final Paper 6

Financial Modelling

Microsoft Excel - Beginners & Working Professionals

Fundamentals of Blockchain

Tally ERP 9.0 & Tally Prime

1-1 Mentorship Program for Students - 1 Month

1-1 Mentorship Program for Students - 3 Months

Books

News & Updates

CA Foundation June 24 Results Date Announced

23 hrs ago

YT Live! Career Opportunities for CAs & Tips & Strategies for CA Final Students! 🎉

18-Jul-24 15:00

CA Final Examination Nov-24 Schedule Announced

18-Jul-24 12:15

It is "THAT" Season of the year! Surprise Awaiting! 🎁

05-Jul-24 19:00

CA Inter & Final Results Date - May 2024 Exams

04-Jul-24 13:14

🎉AFM Classroom Revision Session in Coimbatore! 📚

27-Jun-24 17:40

Cash Awards for 1FIN Students! Fill form now!🤩

26-Jun-24 16:05

Turn Your CFA Dream to Reality🚀 Free Webinar Register Now

24-Jun-24 17:00

CA Scholarships Open Now🚀Fuel Your Prep with best learning platform!

10-Jun-24 15:30

CA Students barred for 5 years from appearing in Exams!

04-Jun-24 12:22

More