Forums

AS-22

Accountancy

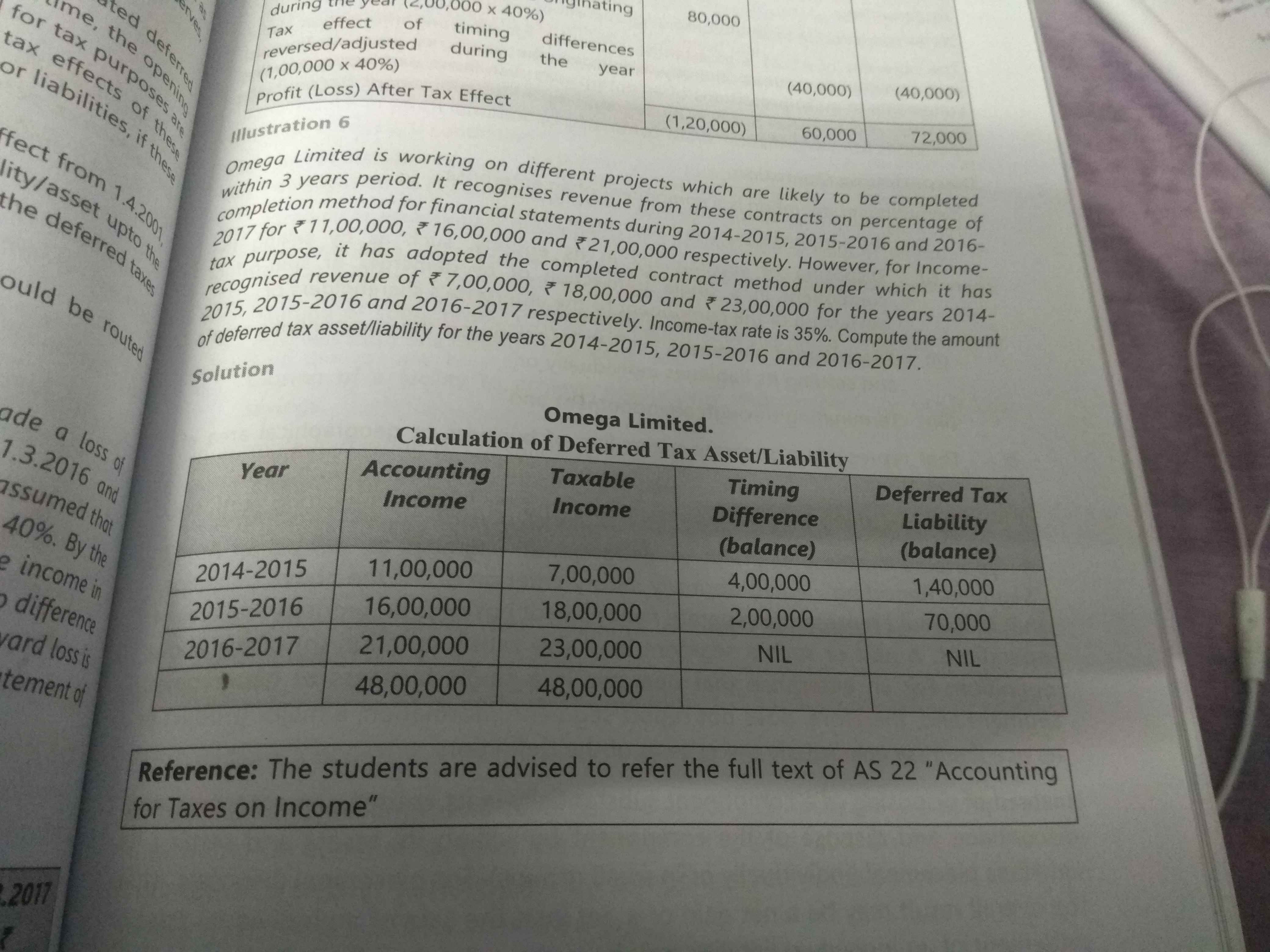

How will the second yr be deferred tax liability it's asset only know sir

Answers (1)

The amounts shown are cumulative figures - timing diff is + 4 lacs in year 1 and -2 lacs in year 2 = so cumulatively for year 2 the difference i + 2 lacs. Second year it will become an asset if there is opening liability . If opening liability is there it is first adjusted against it